Fidelity is one of the largest trading platforms in the world. This Fidelity review looks at the company’s history, the types of investments it supports, different account types, trading fees, pros & cons, and more.

Welcome to our updated 2022 Fidelity review. Fidelity Investments is one of the outright largest asset managers in the world. Their extensive trading platform not only delivers much in the way of investment opportunities and research with zero commission, but also offers you a couple of powerful benefits which you might not find on other trading platforms.

Established just after World War II in Boston, Fidelity today manages about $5 trillion dollars worth of assets plus another nearly $8 trillion in customer accounts.

The firm was the first big American finance company to advertise mutual funds to everyday investors. The renowned fund manager, Peter Lynch, was their Magellan fund manager between for more than a decade and averaged a 29% average annual return — an outstanding performance which remains one of the best in the history of mutual funds.

Fidelity is a huge, multi-faceted organisation which operates not only the brokerage firm and trading platform we’re reviewing here, but also a retirement planning business, a proprietary investing business and other interests alongside its mutual funds operations. They are a giant of modern American personal finance.

Today though, we’re focusing our Fidelity review on the online investing platform. We’re going to dive into what you can expect as a Fidelity customer, the history of the company, the main reasons people invest on this platform, how to open an account and the various account types available.

Our Fidelity review also looks at the top three pros and cons of trading using Fidelity, explains their trading fees model, and explains why trading using Fidelity or any other online broker might not — despite the wealth of third party research and data on display — give you a complete picture of your portfolio performance.

What is Fidelity And What Does It Offer Its Customers

Fidelity is many things. While we’re just looking at the group’s trading platform and brokerage account in this Fidelity review, it’s important to note that Fidelity is a multinational financial services corporation with many different interests.

Fidelity operates:

- A brokerage firm

- Several mutual funds

- An investment advisory service

- Retirement planning services

- Index funds

- A wealth management business

- Life insurance

- Securities execution and clearance

- Custodial services

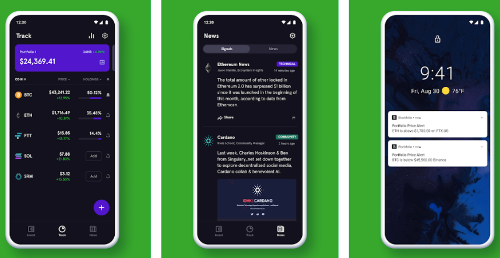

Fidelity has also been one of the first major brokers to move into cryptocurrency investing.

On the brokerage front, Fidelity supports nearly 30 million brokerage accounts and approximately 600,000 trades a day. This includes the Active Trader Pro platform.

Its trading clients hold about $8 trillion in their Fidelity accounts.

And with the range and quality of the tools and features with a Fidelity trading account, you’ll soon see why they’re one of the biggest in the world.

Before we get into opening an account with Fidelity or looking at the pros and cons, let’s explain some of the company’s history so you can see how it became what it is today.

The History of Fidelity

Fidelity’s history goes back nearly a century, when a lawyer and businessman named Edward Crosby Johnson II applied for his ‘Fidelity Fund’ approved by the Massachusetts Securities Director.

The Fidelity Fund was the only fund to gain approval in the state during the Great Depression. This fund became Fidelity Investments. Johnson later founded Fidelity Management & Research in 1946, right after World War II.

From there, Fidelity continued to expand and break new ground in the investment landscape.

In the 1960s, they became the first big finance company to make mutual funds investing available to everyday people. Up until then, mutual funds had only been advertised to high income, wealthy people. Fidelity sent direct mail and went door to door to bring a huge new group of investors into the market.

At the end of the 60s, Fidelity started serving customers outside the U.S. with the newly formed Fidelity International Limited. In 1982, they began offering 401(k) products. In 1984, they were one of the first to offer computerized trading.

More recently, Fidelity has continued to pioneer new areas for its business and clients. In 2018, they set up Fidelity Digital Assets so cater to institutional crypto asset custodial services and trading. In March 2021, Fidelity again made a bold move by filing for a Bitcoin ETF with the SEC.

Why Do People Invest With Fidelity?

When you consider that Fidelity has somewhere in the region of 30 million individual clients — about 10% of the U.S. population — you’d have to say there are a lot of reasons why people choose to invest and trade with them.

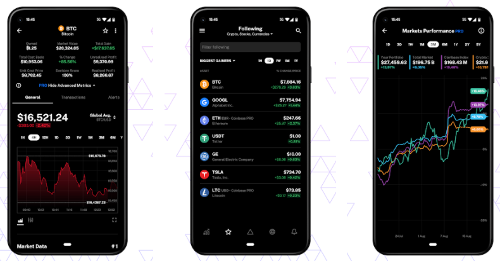

Fidelity has a huge range of products and solutions for investors and traders of nearly every size and experience level. They offer mutual funds, stocks and ETFs, options and more. Their trading platform comprises stock screening and research tools, portfolio advisory and wealth management services, and the separate Active Trader Pro — a completely customizable desktop application aimed at active day traders. They also offer the Fidelity mobile app.

Beyond that, Fidelity offers a robo advisor service. And outside of its platforms, also offers extensive mutual funds and retirement planning services.

So across its massive customer base, there are loads of different reasons why people sign up with Fidelity. In the U.S., these customers can visit 140 physical branches, which for some is an important benefit they can’t get at newer, digital-only brokerages and trading platforms.

One particular attraction, for some, is that Fidelity allows customers to elect to manage part of their portfolio, while they allow a professional manager handle the rest. This hybrid management approach offers more flexibility than other players in the market.

Of course, another major reason to trade with Fidelity is their trading fees.

Like many other major North American trading platforms, Fidelity has moved to a low, or no, transaction fee structure. For some of its offerings, the group claims to offer the lowest fees in the industry.

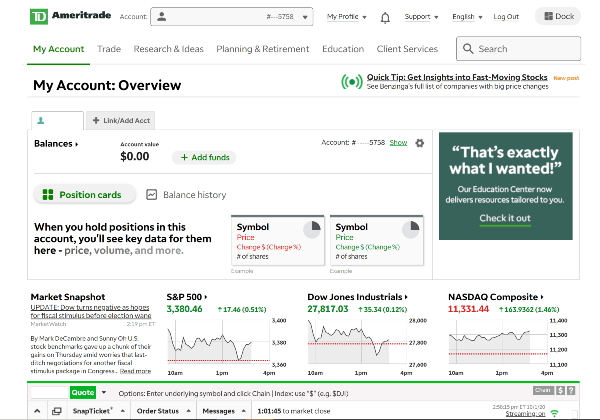

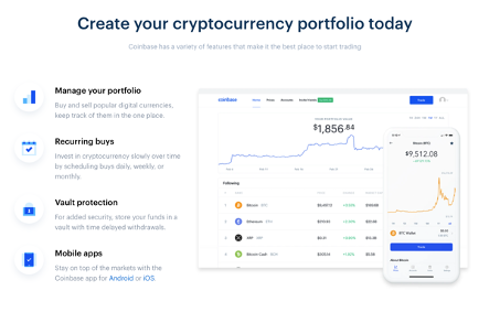

Many stock and ETF trades incur no transaction fee. There’s also no account service fees, late settlement fees or account minimum. Also, unlike other platforms, such as TD Ameritrade, Fidelity sweeps any unused cash in your account into a cash management account with FDIC insurance. This account charges no fees and pays interest.

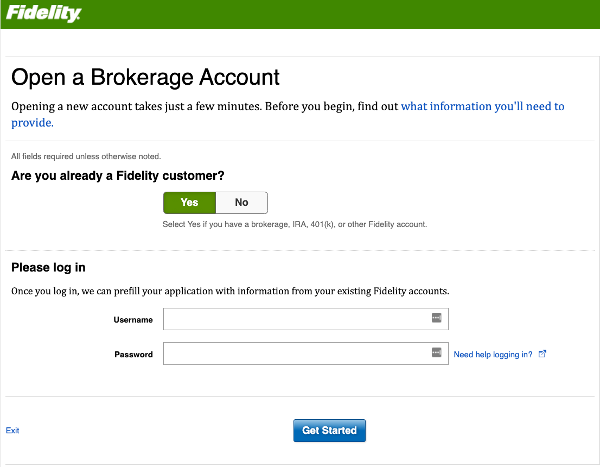

How To Open An Account With Fidelity

Opening a trading account with Fidelity is pretty straightforward, as you’d expect of any major online trading platform these days.

While they let you open an account the old fashioned way, by printing and mailing a form, you can of course create an account online.

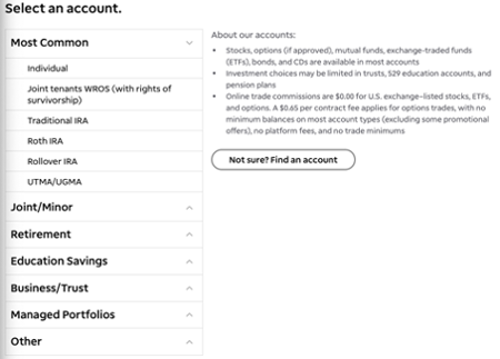

First, you’ll need to select your account type. We’ll explain those below.

Once you’ve done this, it’s a case of standard investment service KYC (know your customer). So have your social security number, residential details and details about your employment handy.

From there, you just need to complete a few fields with your personal information, and choose your investing and trading preferences.

Fidelity begins tailoring your experience during the registration process by asking you to make selections around your goals and interests — the articles, videos and third party research they’ll direct you to in your account will reflect your choices here, so be sure to take your time with this step.

Then, you can review the information you’ve entered, check everything is correct, go through the terms and conditions — which are all pretty standard for the industry, and which you’ll need to spend a long time on if you want to read them to the letter (full T’s & C’s here).

Once you’ve done all this, you’re good to go. All up, applying online should only take about 20 minutes. If you go old school and lodge your application by mail, you’ll need to wait a few days, possibly longer.

Additionally, if you want to register for international trading once you’ve created your account, you can expect to spend about another five minutes getting your account verified.

Once you’re up and running with your account, you can use the mobile app to trade and receive alerts while away from your desktop.

What Are The Different Investment Accounts Fidelity Offers?

As we’ve mentioned already, Fidelity is huge. As a pioneering brokerage with nearly 100 years of history, today they have a huge number of products and services on offer for a wide range of customers.

The same goes for the types of accounts you can open with them. As you’ll see, whatever your goals or life stage, chances are Fidelity has an account type for you.

Fidelity’s investment account types fall into seven categories. They are:

- Investing and trading

- Saving for retirement

- Managed accounts

- Saving for education/medical expenses

- Charitable giving

- Estate planning

- Annuities

- Life insurance

Within investing and trading, you have:

Brokerage accounts: Standard trading and brokerage.

Cash management accounts: Fidelity’s FDIC-insured cash accounts carry no transaction fee and pay a small amount of interest on your balance.

Brokerage and cash management accounts: A hybrid that combines the previous two.

Business accounts: A business level account for trading and holding cash.

Fidelity’s saving for retirement account category comprises no fewer than eight different types of account, including simple, traditional and rollover IRA, 401(k) for individuals and businesses, and more.

If you register for a managed account, Fidelity’s professional advisors and robo-advisors will handle your investment portfolio for you, in line with parameters and preferences you set as the account owner.

The education and medical expenses savings accounts include 529 accounts, custodial accounts for investing on behalf of children, health savings and an account designed to help disabled customers and their families plan and save for disability-related expenses.

Other account types include Fidelity Charitable, which lets you claim tax deductions for supporting charity, Trust and Estate accounts in which you can manage trading for these entities, life insurance coverage accounts and a selection of annuity accounts, ranging from retirement saving to immediate and deferred income accounts.

All up, Fidelity offers pretty much every kind of investing account you could imagine ever needing, from trading online virtually right away to planning years and decades into the future using insurance and income services. And don’t forget their more advanced trading offering, Active Trader Pro.

Now, let’s talk fees.

Fidelity Trading & Account Fees: Generally Very Low, But With A Couple Of Exceptions

Like so many large brokers in this ever more competitive digital age, Fidelity has in recent years adopted a low/no fee/commission model. Mostly, anyway.

Across Fidelity’s huge range of platforms and account types, they’ve essentially set up their fee structure to offer little to no barrier to entry for those wanting to get started trading stocks.

While US stock and ETF trades are commission free, you will pay to trade international shares on the Fidelity platform.

On the mutual funds front, Fidelity offers nearly 4,000 ‘free’ mutual funds, which you can trade without paying fees or commissions. On the other hand, many of the mutual funds you can trade with them do incur a fee — up to $75 in some cases. You should also note that despite offering so many free funds (including, of course, Fidelity’s own), you may be charged a sale fee of $49.95 if you sell your shares in that fund within 60 days of buying them.

If you’re trading with leverage, or margin, it means you’re borrowing cash from your broker in order to (hopefully) multiply your potential gains.

If you’re borrowing to invest with Fidelity, you can expect to pay a relatively high interest rate on margin lending — 8.3% for a balance less than $25,000.

The more you borrow, the better that rate gets. If you borrowed more than a million dollars for a trade, for instance, you’d pay 4% interest on that balance.

Of course, with any trading account, there’s potentially a whole host of other fees you’ll need to be aware of. These are called non-trading fees. This is where Fidelity is quite generous.

You’ll pay nothing to open your account, deposit or withdraw money. And they won’t charge you a penalty fee for leaving your account inactive for any period of time, either. There are currency conversion fees if you choose to trade international stocks through the platform, however.

Here’s an in-depth, detailed breakdown of all Fidelity’s fees.

Fidelity Pros: Huge Variety, Low Fees, Quality Research

There’s a lot to like about a Fidelity account. While we’ve outlined the different types of account you can sign up for above, we’re just going to look at the individual investment account here as we cover a few pros and cons.

Pro #1: Access to a huge selection of stock and ETF investments, mutual funds and more

With a Fidelity account, there’s not much you can’t invest in. Across US-listed stocks, you can buy and sell free from fees and commissions. The same goes for almost 4,000 mutual funds — and, of course, Fidelity’s own mutual funds. You could, if you were happy to stick just to these investments, create a considerably diverse portfolio in your account via these fee- and commission-free investments alone.

Then, of course, there’s the rest; International stocks (Fidelity gives you access to more than 20 markets all up), bonds, options and their other mutual funds and ETFs not covered by their fee-free structure.

Pro #2: Low fees and commissions across much of the range + zero non-trading fees

As we just mentioned, it’s possible to trade on Fidelity and pay zero fees of commissions if you stick to certain products and markets. Not only that, but you won’t pay a cent for opening, closing or leaving your account unfunded or inactive. There’s no account minimum balance. Plus, cash not invested is automatically placed into a FDIC-insured account where it will accrue interest — not a huge amount, but a trading platform that pays anything on your cash account is still a win, especially if you’re holding large amounts of cash for a long period.

Pro #3: A wealth of top-quality research and education resources

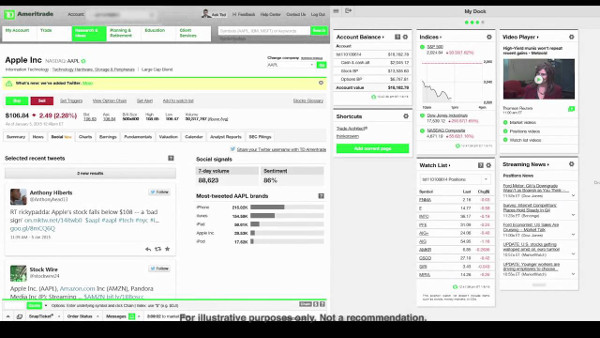

Whether you’re working towards making your first ever investment, or you’ve been in the markets for decades already and are well into your investing journey, Fidelity, like its competitor TD Ameritrade, packs a mind-boggling amount of educational and research resources into your account.

If you’re looking for tools to help you analyze stocks and markets, you’ll be pleased to know Fidelity provides:

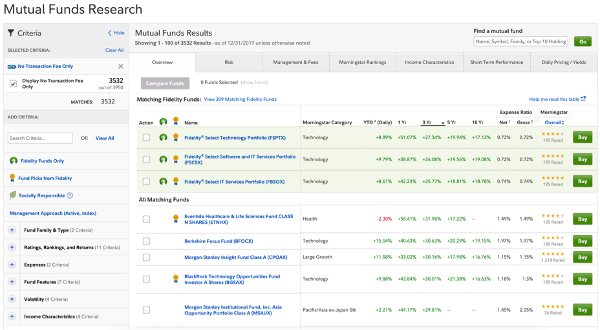

Stock, Options & Fixed Income Screeners: In your account, you’ll find a host of screening tools for stocks, funds, options, bonds and more. You can use these screeners to filter through the wide range of investments available and narrow down those you want to look closely at. One of these screeners, the Mutual Fund Evaluator, allows you to examine funds’ characteristics and compare them against each other:

40 Tools & Calculators: Budgeting, strategizing, predicting the impact of a certain trade on your overall portfolio performance and balance… the list of tools and calculators available in your Fidelity account goes on, with about 40 available all up.

Research & News: There’s more research and analysis packed into a Fidelity account than you could probably ever hope to digest. They host stock and market research from about 20 top-tier sources, including Thomson Reuters. You can even sort your news sources based on your holdings and stocks you’re watching in your account.

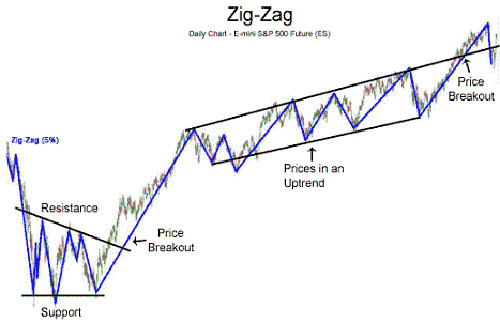

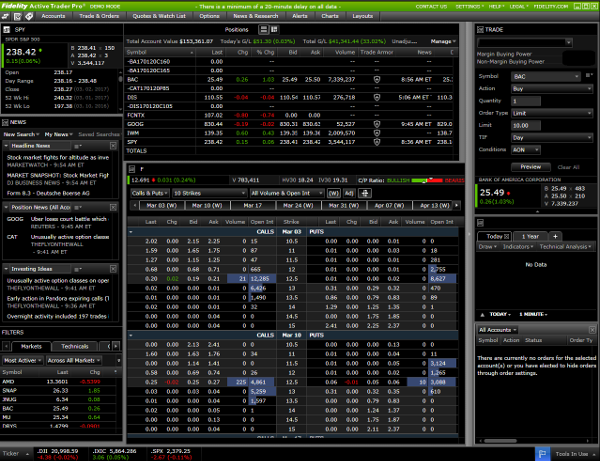

Your account also lets you examine charts using technical patterns, historical and intraday pricing data. Active Trader Pro takes this a step further with more advanced real-time trading data. And, as with most major platforms, Fidelity offers an extensive and quality mobile app experience, too.

Takeaways:

- Free to trade US stocks and nearly 4,000 mutual funds

- You can earn interest on cash accounts

- Packed with research tools

Fidelity Cons: Higher Fees For Certain Services, No Futures, Options

While Fidelity offers a large amount of value across a wide range of products and platforms, there are, of course areas where some customers may find the service lacking.

For the everyday investor — someone looking to research and trade stocks and build up a long-term investment portfolio — Fidelity should deliver more than enough to help you on your way.

But if you’re a more advanced investor or trader who wants access to more complex investment products, you might find you need to look elsewhere for the technology that suits your needs.

Con #1: High Fees In Some Areas May Negate Low Ones Elsewhere

While we consider Fidelity generally a low-fee trading platform, there’s a couple of areas in which they’re not so competitive and, depending on your requirements, this may impact the extent to which the platform could be good value for you.

If you’re wanting to trade beyond Fidelity’s free mutual funds, for example, you’ll pay nearly $50 a trade. Margin interest is also relatively high, if you’re looking to borrow for trading. You’ll need to pay more than $10,000 to borrow $150,000 — which, if your leveraged trade didn’t turn out to be profitable, would negate all the low or no-fee parts of your Fidelity account.

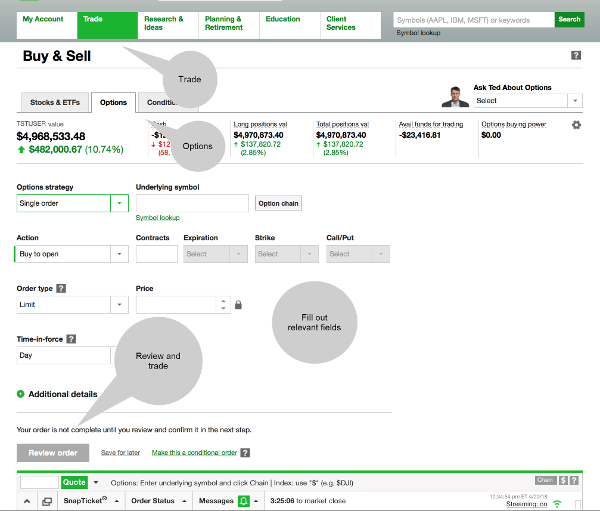

Con #2: No Support For Commodities & Futures Options

Fidelity’s Active Trader Pro provides a powerful service for advanced traders to access the markets with real-time data and an interface they can customize to suit them. However, despite offering this trader-centric part of their service, Fidelity does not currently allow you to use it for trading either commodities or futures options — two investment vehicles commonly used by day traders.

Con #3: Need To Use Different Platforms For Research & Trading

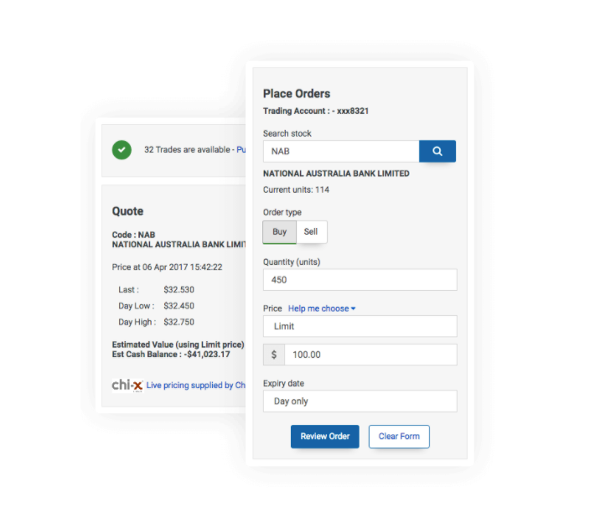

This isn’t strictly a con, given that between the Fidelity trading platform and Active Trader Pro, you can access both large amounts of fundamental data and third-party market and investment research, and an advanced interface through which to make more complex trades.

But, these two sides to the Fidelity platform aren’t integrated. You need to use two different parts of the service to conduct research and carry out trades (this doesn’t apply if you’re happy just using the main platform for stock, ETF and mutual funds investing).

Takeaways:

- Some parts of the platform aren’t free/competitively priced

- You can’t trade commodities or futures options

- Active Trader Pro doesn’t provide fundamentals research

Fidelity Customer Support: Comprehensive & Multi-Level

As you’d expect from a massive, long-established broker like this, Fidelity’s customer support is regarded as pretty good.

Depending on your account type, you can reach them through 24/7 live chat, the customer support hotline (800-343-3548). For the best results, try reaching them between 8am and 10pm Eastern Time, and Saturdays from 9am to 4pm.

More recently, Fidelity has upped its social media presence, which you might find useful in resolving any support requirements, too. You can check out their subreddit, YouTube channel, Twitter account and Facebook page.

Verdict: One Of The Most Powerful Brokers For U.S. Customers Of Nearly Every Experience Level

Fidelity Investments regularly tops various publications’ ‘Broker of the Year’ lists. And while there are a few potential downsides to using the platform in some cases (see above), overall this is an investment research and trading platform that delivers quality and value in spades.

Investopedia rates Fidelity 4.5 out of 5 stars, saying they ‘continued to enhance key pieces of its platform while also committing to lowering the cost of investing for investors’.

Brokerchooser awards them a 4.7 stars — ‘it offers plenty of high-quality research tools, including trading ideas, detailed fundamental data and charting. The web trading platform is easy to use, and offers advanced order types’.

Nerdwallet and Stockbrokers award a full 5 stars out of 5 stars, with the latter commenting: ‘Fidelity is a value-driven online broker offering $0 trades, industry-leading research, excellent trading tools, an easy-to-use mobile app, and comprehensive retirement services.’

You can see then — from our review and from the consensus of these leading sites — that Fidelity is a formidable platform with the history, technology, product range, fees structure and research to make it a brilliant solution for investors and traders of different levels.

They wouldn’t have nearly 10% of the US population as customers were they not a proven, reliable and top-quality broker and trading platform.

Before we wrap up this Fidelity review, though, we should mention that, if you are already, or are looking to become, a Fidelity customer, you should consider adding another piece of financial technology to your investing toolkit.

Don’t Cut Corners On Your Portfolio Tracking

One area in which many brokers — even a best-in-class brokerage account like Fidelity — often lack is in their portfolio tracking and analytics capabilities.

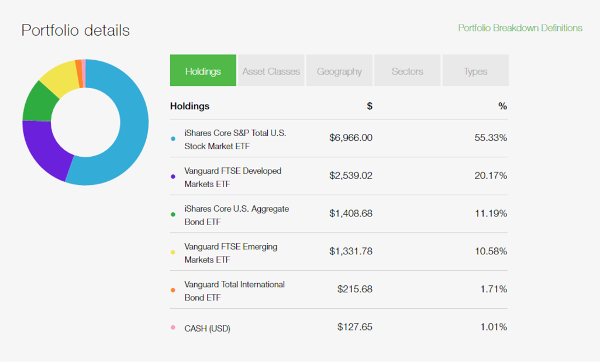

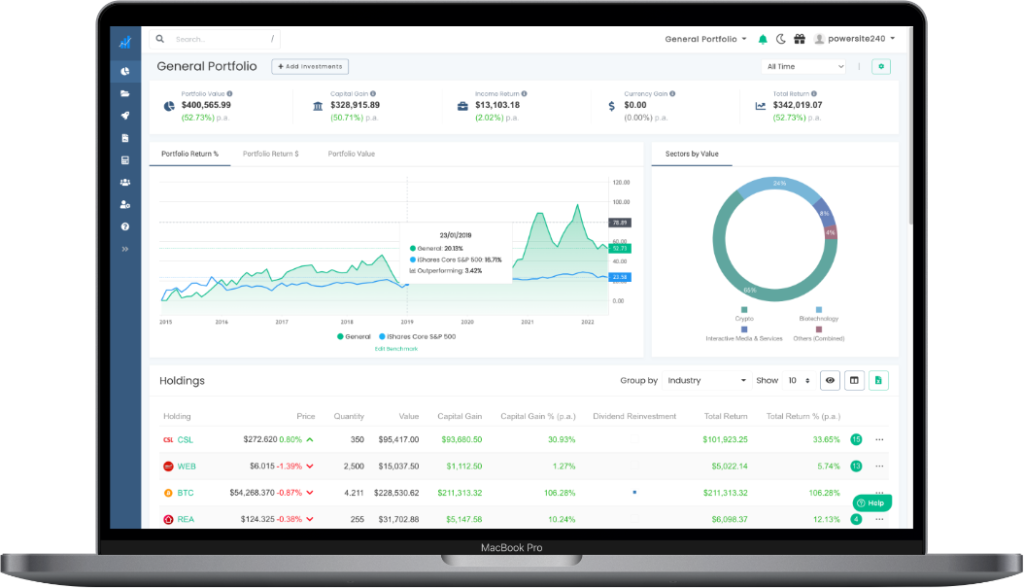

While you can load your Fidelity accounts into FullView (Fidelity’s analytics module) to see your asset allocation and portfolio performance, Investopedia reports that it ‘can be slow to load and a little difficult to customize’.

Here at Navexa, we know that correctly tracking portfolio performance is vital to building and understanding your long-term, true investment returns.

See how true performance differs from the numbers you might be seeing in your brokerage account.

Three Things You Should Know About Your Portfolio Performance

Here are three vital things you need to know in order to fully understand the value and performance of a given investment, and your wider portfolio.

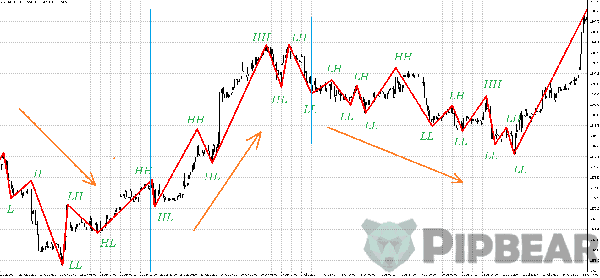

1. How much time have you invested to generate a return? Consider that a 100% gain in a year is far more desirable than a 100% gain in five years.

2. How much income have you earned from dividend payments? One stock our founder owns has paid him back 40% of his investment in dividends. This substantially affects how you should view an investment’s performance.

3. How much have you spent in fees? If you’ve been investing for 20 years, making, say 25 trades a year at $20 a trade, that’s $10,000. However much you spend on fees in the course of your trading, you need to factor that in to fully understand your portfolio performance.

How Tracking Your Portfolio With Navexa Complements Your Trading Platform Experience

Our portfolio tracking platform allows you to see not only your portfolio’s true performance after fees, income, currency gains/losses and annualization, but to drill down deep into all the factors affecting your portfolio and its holdings.

You can run a portfolio contributions report to identify which holdings are contributing the most (and least) to your portfolio performance.

You can run an upcoming dividends report to see which income you have scheduled coming from your investments (thanks to official data from the NYSE, NASDAQ and ASX).

You can view your portfolio performance across any date range you prefer, and factor in closed positions (or not) as you wish.

Try Navexa free for 14 days and see for yourself your portfolio’s true performance.

How Fidelity Customers Can Use Navexa To Optimize Their Investment Journey

Our platform is what we like to call ‘broker agnostic’. That means whether you’re trading stocks, ETFs and mutual funds, crypto or pretty much anything else, you can track it all together in Navexa.

Navexa is one of the few tools that allows investors to bring all their trading platform data into a unified analytics and tracking account where they can see their combined investment performance net of trading fees and currency gain.

I’ve personally experienced the power of tracking dividend income on a stock which made me a 100% return in dividends alone, despite not generating any capital gain. So trust me, it pays to track this stuff properly!

Not only does this allow you to see your true overall performance, but it breaks down your performance by capital gains, investment income and different methods of calculation like simple returns and compound annual growth rate.

For Fidelity customers — or those trading with any major US brokerage account — it’s super easy to get started with Navexa’s automated portfolio performance tracking.

Simply upload your historical trade data using our handy portfolio file uploader tool to see your investment performance clearly and optimize your investment journey!