Why earning dividend income from your shares — and tracking it effectively — is vital to portfolio performance reporting.

If I told you that you could make back your entire initial investment in a stock without enjoying a single dollar of capital gains…

Would you want to know how that’s possible?

I know I would.

The fact is this is entirely possible.

I’m actually well on my way to this being a reality with one of my investments right now.

How does this work?

Dividend income.

Dividends are, in many ways, the unsung heroes of long-term wealth building.

Not only do dividend-paying stocks allow you to earn money simply for owning shares…

They allow you to harness the power of compounding (something Einstein referred to as the eighth wonder of the world) to take a modest investment and potentially turn it into a fortune decades down the track.

Understanding the power of dividend yield is vital to a successful long-term investment strategy.

Properly tracking the income you earn from dividends is vital to:

- Understanding the true performance of your entire investment portfolio.

- Ensuring you crush your annual investment tax returns with full confidence and minimal stress.

In this post, we’re talking dividends and investment income.

If you want to grasp their true power — and learn a smart way to save time tracking and reporting on your dividend income — then read on.

Dividend Income:

Getting Paid To Own Stocks

The only thing that gives me pleasure? It’s to see my dividends coming in.

— John D. Rockefeller

There are some inspiring stories out there of big time investors who’ve built huge fortunes by hanging on to stocks and living purely off the dividends, without ever having to sell to make money.

Let me start with my own experience.

A few years ago, I bought shares in NAB.

I bought the stock with the intention of holding it for a long time.

My research showed it was going to go up in value over the long term — and that the current market price was fair value.

But more importantly, it told me NAB would pay me cash dividends to hold these shares.

In the four years I’ve owned the stock, I’ve earned enough dividend income from it that I’ve been repaid 40% of my initial investment thanks to the company’s profits.

All I’ve had to do is sit tight and not sell. Which was always my plan.

So $100,000 worth of shares would have made me $40,000.

This is the essence of dividend investing.

It’s the closest thing to free money you can get, short of winning lotto.

Put enough time into it, and dividend investing can help you build substantial streams of extra income for relatively little effort.

Bear in mind this leaves capital gains aside.

In a perfect world, you would buy $100,000 worth of Stock X, collect $40,000 in income over the course of a few years and enjoy a capital gain on top of that when you do eventually sell your shares.

You can see how, deployed across a large and diversified portfolio, over a long time period, dividend investing can be very powerful.

How And Why To Track

Your Dividend Income

Time is the friend of the wonderful company.

— John D. Rockefeller

There’s two reasons why you should track your dividend income.

First, you’ll want to know how much your investments are earning for you — and how much time it could take for your stocks to eventually ‘pay for themselves’.

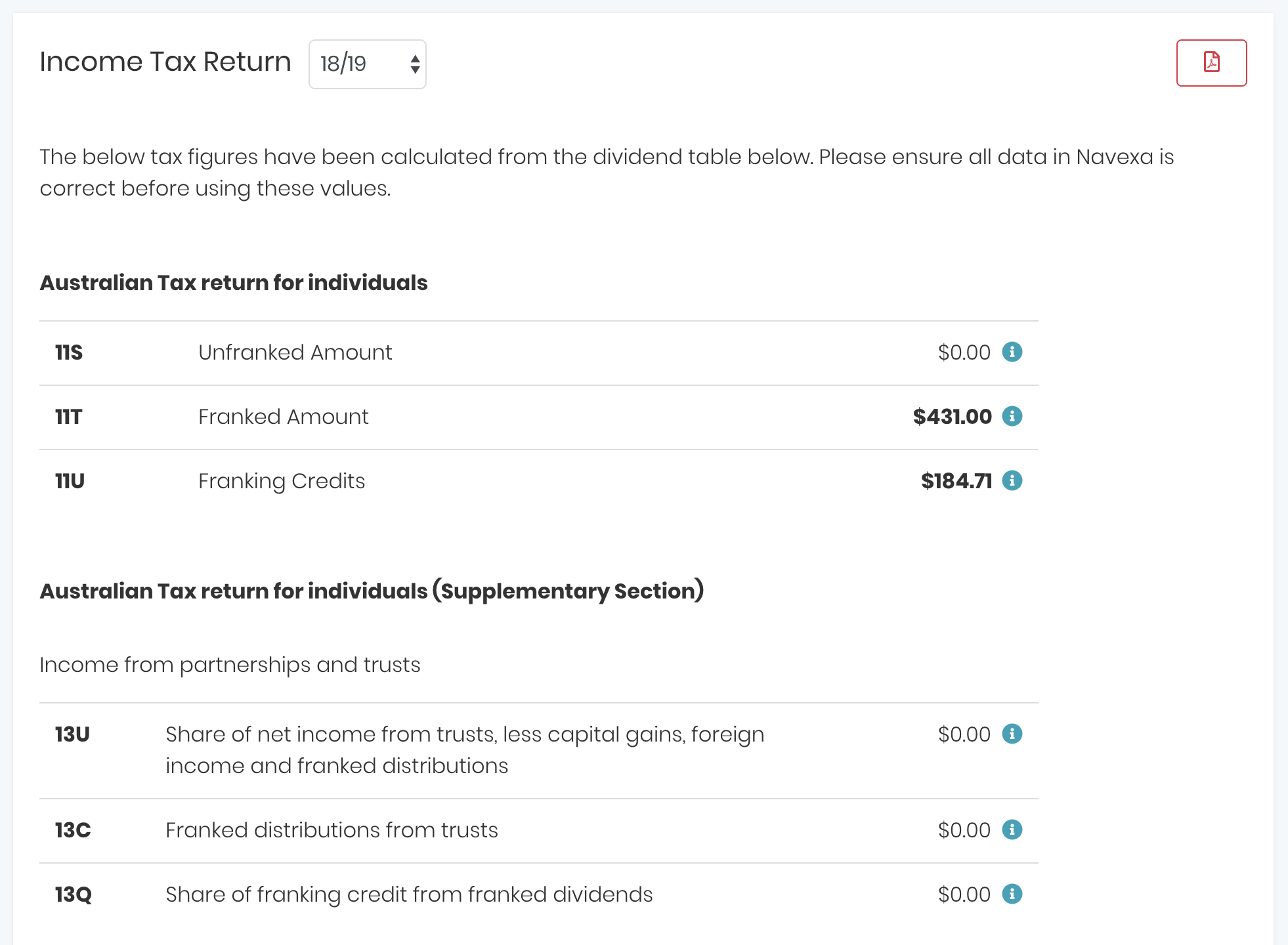

Second — and this is important — you must report your dividend income in your tax return.

The tax man will generally tax your dividend income in the same way as personal income.

For those using spreadsheets to track multiple stocks that pay dividends in various ways (electronically, via brokers, using cheques in the mail and so on), this can quickly become a burden.

You may find yourself rummaging in drawers, trawling through bank statements and trying to get access to registries in order to properly collate all the information you need to satisfy the taxman.

Headache.

This is a big reason we’ve built a dividend income reporting tool into Navexa.

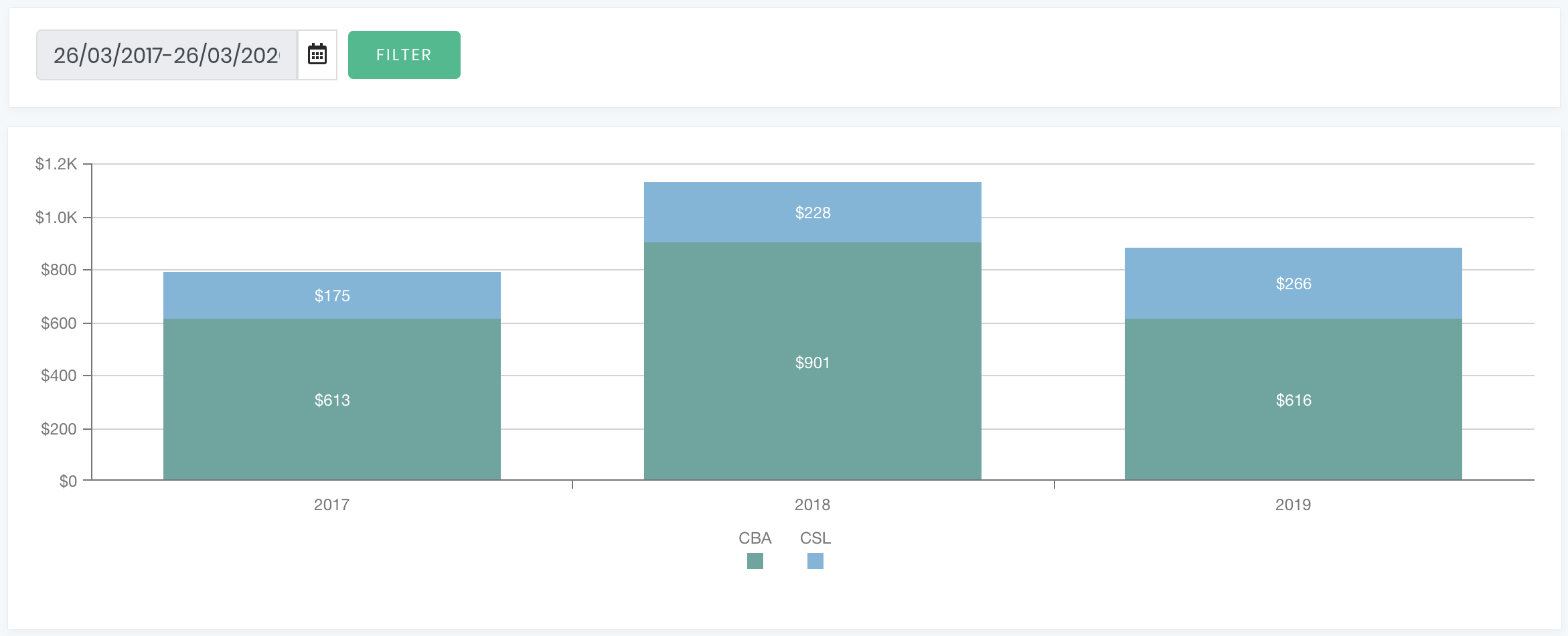

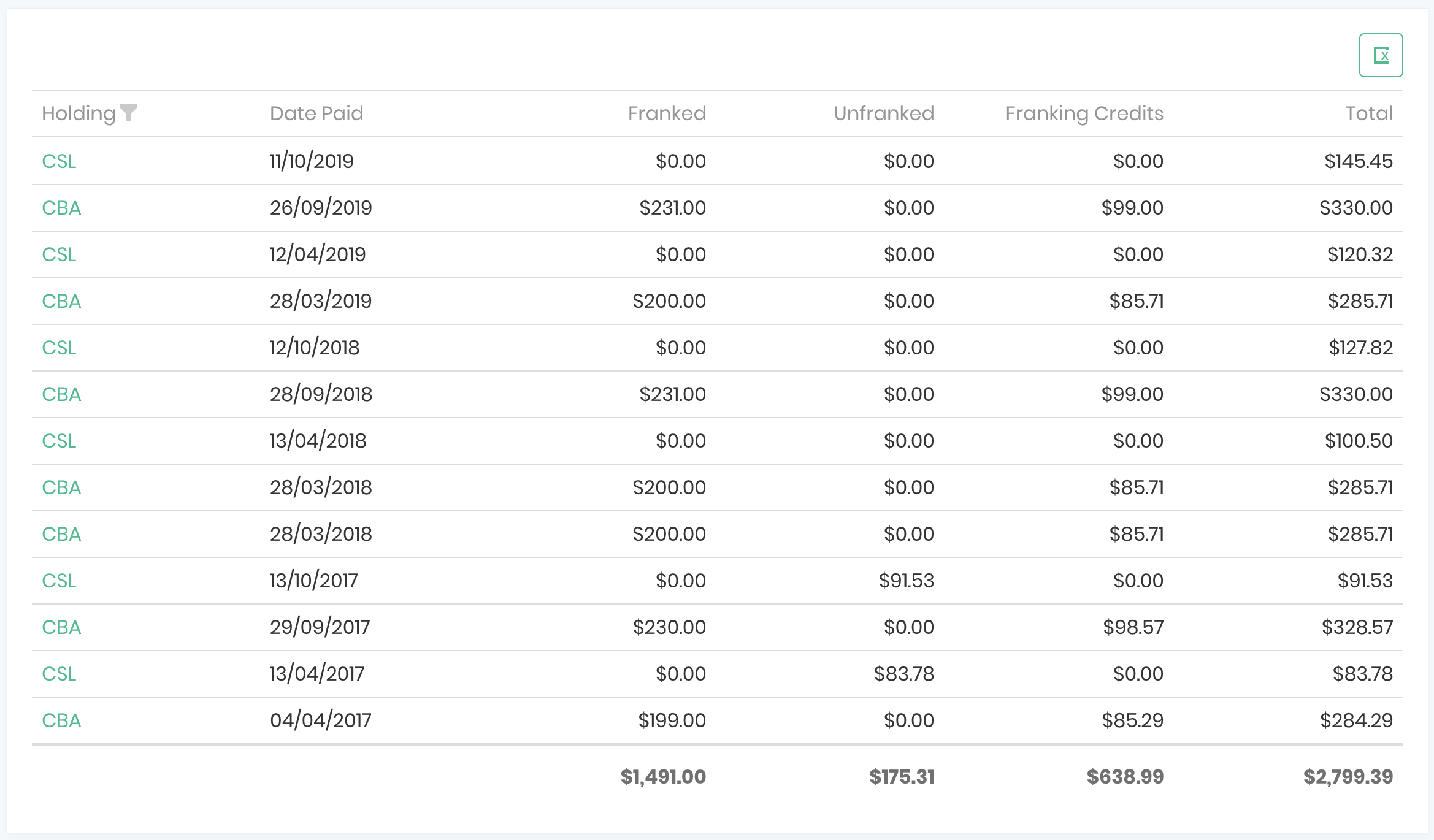

You can use it to view income generated over a given time period…

To track dates and amounts of individual dividend payments…

To add notes and statements for those payments, and to generate a report you can hand to your accountant to succinctly show exactly what you’ve made from your stocks in the past financial year:

Keep Your Dividend Income

Flowing Without Stressing

About The Details

Making money in the stock market divides into two distinct things:

Buying shares that you sell for a higher price later.

And earning income from shares for the duration of holding them.

Income is a huge part of investing.

As a private investor, one of my dividend stocks has already paid me back nearly half my initial investment.

Deploying capital into dividend-paying stocks, with enough time, can make investors substantial amounts of money.

As such, income becomes an important part of your performance calculations for your overall portfolio.

But it also becomes a burden at tax time.

The solution is simple — use a portfolio tracker to record, analyse and report on ever dollar of investment income your portfolio generates.