Dividend yield is what drives income investors to buy shares. It’s what companies pay their shareholders as both reward and incentive. We explain dividend yield and how to easily calculate it.

Dividend-paying stocks form part of many portfolios for a good reason; they pay investors to hold shares. Owning dividend stocks means investors need to be able to easily determine their dividend yield — and the impact this income has on their broader portfolio performance.

Dividend yields are important for investors. By analyzing dividend yields, they can gain insight into how profitable and generous to shareholders a company may be. Being able to accurately calculate dividend yields can help investors predict how much a particular investment might pay annually.

Receiving dividend yield from companies can help portfolios grow and balance the risks of a volatile share market.

However, calculating dividend yield might seem tricky. Luckily, we’re here to help you figure out how to calculate dividend yield. Keep reading to learn more about the value of dividends, how share price affects the yields, and what to look out for.

What Are Dividends?

Dividends are defined as the distribution of a company’s earnings to its shareholders. Once they invest in a company that pays out dividends, investors can earn money for holding that stock.

The board of directors usually decides whether the company pays dividends or not. Dividends can be paid in cash, or in additional shares.

What About Dividend Yields?

Yield is defined as the amount of money an investment generates over the period of time while an investor holds it. Yield is usually expressed as a percentage based on:

- The invested amount

- The current market value of the security

- The face value of the security

Yields might be classified as known or anticipated, depending on the valuation of the security.

How and Why Do Dividends Generate Yield?

When a company decides to pay out dividends, it’s rewarding its investors for buying the company’s shares. By paying a dividend, it creats a yield for investors in the form of cash or additional shares. The company may also incentivize investors to keep holding the stock.

Dividends might also make the company attractive to other investors. When new investors buy into the stock, the stock price could rise.

Dividend Yield Stocks to Consider

Some common dividend yield stocks traditionally include companies in the following industries:

- Electricity, water, natural gas supply

- Consumer staples

- Telecommunications

- Real estate

A well-established business may be more likely to pay dividends than a smaller company. Larger companies tend to have more income, and be more financially stable, so they can pay part of their income to investors.

Still, companies may decide to stop paying dividends in the future. There are a variety of reasons why dividends may decrease or stop altogether.

Are There Different Types of Dividends?

There are many types of dividends. For example:

- Cash dividend

- Bonus share

- Property dividend

- Scrip dividend

- Liquidating dividend

A cash dividend is paid in cash per share terms. It’s the most common type of dividend paid to investors.

Bonus shares are additional shares awarded to investors.

A property dividend is a payment in the form of an asset.

A scrip dividend is a promise that an investor will be paid later.

Finally, liquidating dividends are paid when the company shuts down, and represent the return of the original investment to the shareholders.

Other Dividend Types

There are other dividend forms you might see when exploring how to generate dividend yield. For example:

- Ordinary dividend

- Qualified dividend

The main difference between ordinary and qualified dividend is the tax investors have to pay. Ordinary dividends are generally taxable as income. Qualified dividends may be taxed at lower capital gains rates.

Different Types of Dividend Yield

A high dividend yield isn’t always the best single reason for investing, especially long-term. When companies pay high dividend yields, it can sometimes be unsustainable.

A good dividend yield is generally considered to be between 2% and 4%. This range is considered safe and strong. On the other hand, a dividend yield above 4% may appear like an attractive opportunity — but it may carry more risk.

Low dividend yield may be a sign of poor company health. Generally, income investors want to avoid low dividend yield stocks.

They should, however, consider other stock attributes besides the dividend yield alone. For example:

- Stock price

- Earnings per share

- Price to earnings ratio

- Frequency of dividend yield

How Often Is Dividend Yield Paid to Investors?

Dividends are usually paid out quarterly or annually. Shareholders know ahead of time exactly when to expect their payment. Some dividend payouts can be paid monthly, but those tend to be rare.

Advantages of Dividend Yield

There are several advantages of dividend yield for shareholders, including higher ROI (than simply profiting through capital appreciation alone).

High Return on Investment

Dividends can grow steadily over time — larger companies, especially, may increase their dividend payout annually. For example, some companies have increased their dividend payout for 25 years. This generates a higher compound annual growth rate, which benefits long-term shareholders.

Of course, stocks’ values rise and fall. One stock our founder held, for example, went nowhere for many years. This is where dividend yield can be so vital to investment performance. In his case, he nearly earned back in dividend yield what he bought his shares for, despite the lack of capital appreciation.

Dividend Yield Is Useful for Equity Evaluation

Dividend yield can be a good signal of how stable a business is. Investors may see high dividend yield as a sign of strong earnings.

Disadvantages of Dividend Yield

One of the main disadvantages of annual dividends for individuals is that they are observed as taxable earnings.

For companies, the pressure to pay or maintain a high dividend yield may put pressure on the business’s finances, or even inhibit reinvestment and growth.

Does a Stock Price Affect Dividend Yields?

There’s a direct correlation between dividend yield and stock price. Dividends can change as a company’s stock price changes. Plus, companies can change the size of the dividend yield, regardless of stock price.

A company that’s committed to paying dividends will generally be expected to increase the payout if its stock price rises. This both benefits the investors and can make the company more appealing to potential investors.

How to Calculate Dividend Yield

Calculating dividend yield is not that difficult. All you need to do is use the dividend yield formula. Divide the annual dividend by the current share price and you’ll get the dividend yield.

Keep in mind that dividend yield is not calculated by using quarterly, semi-annual, or monthly payments.

If you get stuck, find the company’s annual report which lists the annual dividend per share.

Calculating Dividend Yield From Quarterly/Monthly Dividends

If you find a company that pays dividends quarterly, you’ll have to convert the quarterly payments into annual payments to calculate the dividend yield. Meaning, you’ll have to multiply the most recent dividend by four to get the annual dividend.

If your dividend yield is inconsistent, you’ll have to add the last four quarterly dividend yields to get the annual dividend yield. Then you can use the yearly dividend yield formula.

The same goes for calculating monthly dividends — you’ll have to find the annual dividend per share to be able to calculate your dividend yield.

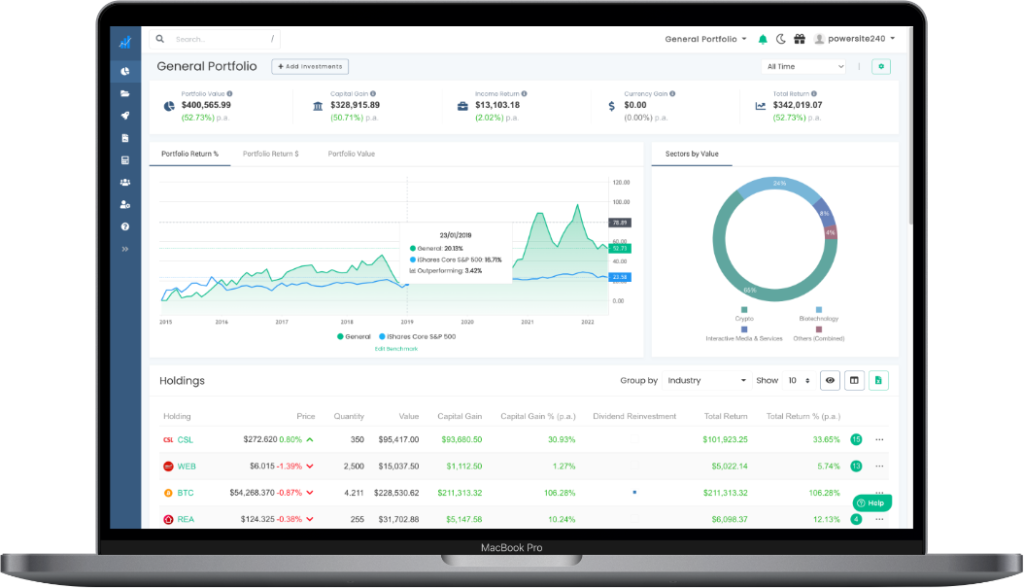

Of course, you don’t need to worry about calculating your dividend yield manually. When you use Navexa to track your portfolio, the platform automatically records your dividend payments and calculates their impact on your portfolio performance.

The Importance of Dividend Payout Ratio

Besides the annual dividend payment, you’ll also want to take a look at the dividend payout ratio. It’s defined as the total amount of dividends that’s paid to shareholders, relative to the net income of the company.

Payout ratio = dividends paid/net income.

You can also calculate it based on the retention ratio, which is equal to earnings per share divided by dividends per share.

This number tells you more about the company’s maturity and whether it can continue to pay out dividends. For example, a company might reinvest all its earnings, which results in a 0% payout ratio.

On the other hand, the payout ratio would be 100% for organizations that pay all of their income as dividends each year.

Potential Dangers of High Dividend Yield

Here are some things to consider about high dividend yields.

The Yield Trap

Just because a stock’s dividend yield is high, that doesn’t guarantee the business is stable or growing. A yield trap, or dividend trap, is when investors fail to do their due diligence and invest purely for an attractive dividend yield.

In an extreme scenario, an investor might buy shares of a stock based on its attractive dividend yield, only to find the value of their investment plummeting, negating any gain they might have hoped to realize from the dividend income.

This is why it’s always important to look at both long-term performance for any potential investment, and to research the company’s underlying financials, rather than just skim headline numbers like dividend yield.

Track Your Dividend Yield Automatically

Understanding how dividends work, and how they’re tied to share price is just a small piece of the investing puzzle. By understanding dividends, you’ll understand part of what to look for when you dig deeper into a company’s financials.

It’s generally best to analyze the whole company, the current market conditions, the stock’s value and long-term performance, and many other factors. Plus, in some cases, you can earn dividends you can reinvest for greater compounding returns over the long term.

The Navexa portfolio tracker tracks every trade and transaction for your portfolio. It automatically records and calculates an investments dividend or staking income, and shows the total yield at both the individual holding and portfolio level.

It’s simple and free to start using. Once you join Navexa, you can add your portfolio in minutes and begin tracking your performance.