As a 24-year-old, who’d just started investing, I was excited.

I wanted to put my hard-earned money to work.

I wanted to make money while I slept.

I wanted to invest as much as I could.

But…

I didn’t really know what I was doing.

I was jumping between individual stocks.

Buying ETFs.

And trying to build a ‘diversified’ portfolio.

But without knowing it, I was concentrating my risk.

I was not as nearly as diversified as I thought.

How could this be?

I owned several different stocks.

A few different ETFs.

But, my naive 24-year-old brain was missing something about my investments .

I had a big overlap problem

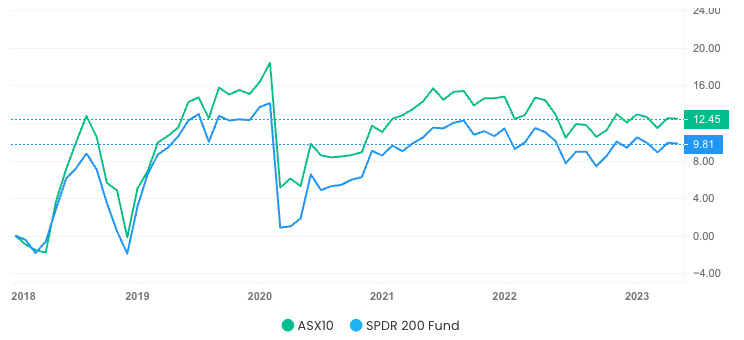

I bought some blue chip stocks.

Then I bought a financial sector ETF.

Then an index tracking ETF.

But what I didn’t realize is that some of the same stocks were in all three of these.

The index tracker was top heavy with banks.

The financial sector ETF had those same banks in it.

And I had also bought those banks again individually.

Did I really want to be so exposed to the banking sector?

Absolutely not!

But this is a common situation I have found when talking with passive investors.

Often, they don’t actually know what is inside the ETF they have bought.

By the time you buy a bunch of them thinking you are diversifying…

You end up like I did.

So how does an investor avoid this?

Know your ETF

When buying an ETF, do your research and find the list of stocks that are inside it.

From here it becomes pretty obvious if you are going to have an overlap problem or not.

For example, if you own a lot of Apple shares and the ETF you want to buy has a position in Apple as well, you need to decide if that is what you want.

And depending on your strategy, you may be perfectly happy with that.

But the point is, you need to know that this overlap exists.

Build your knowledge, build your portfolio

Back when I started investing I clearly didn’t have enough knowledge.

And look what happened.

I ended up concentrating my risk into a few stocks by mistake.

Losing money because that particular sector didn’t move much.

All the while, thinking I was diversified across the market.

Even though I harp on about strategies a lot…

This issue can still crop up even with the best of strategies.

The key here is building your investment knowledge.

Be aware of what you are buying.

Things on the surface can look great.

But diversifying is not always as easy as just buying ETFs.

Knowledge pays the best dividends,

Navarre

The Data-Driven Investor