Compound annual growth rate, or CAGR, is one of the key methods for calculating investment performance. Here’s how to calculate it manually — and a fast way to automatically see an investment’s compound annual growth rate.

CAGR, or compound annual growth rate, is a method investors use to measure the annual growth rate of an investment. Generally it’s only used for portfolios that compound their growth by generating income which is in turn subject to capital appreciation.

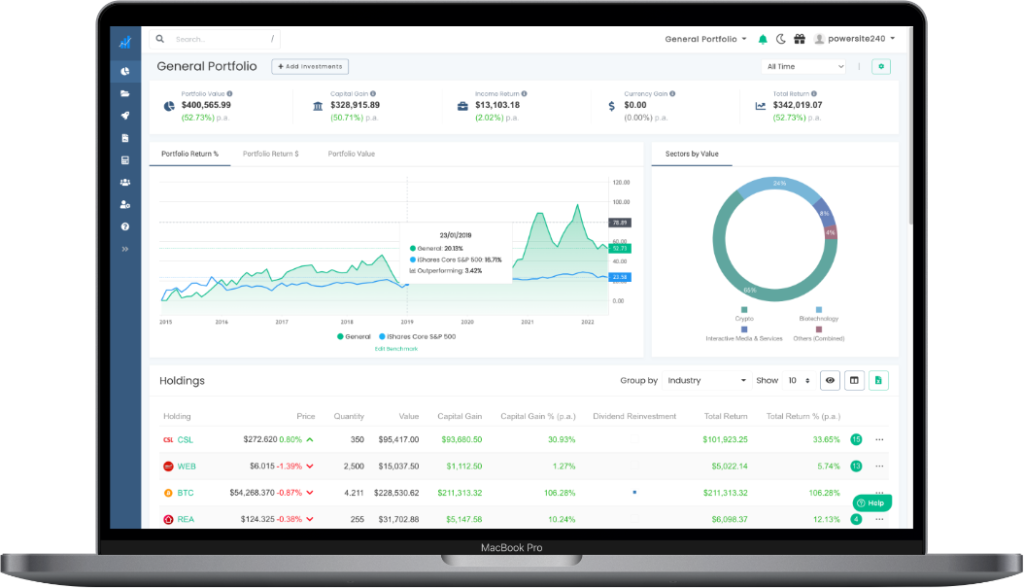

While it’s not the only method of determining an investment’s long-term annual returns, it is one of the most popular. As we’ll show in this explainer, CAGR has advantages and disadvantages — which is why the Navexa portfolio tracker allows you to compare CAGR-measured performance with other calculation methods.

What Is Compound Interest?

To understand CAGR and its possibilities, you should first understand how compound interest works. Compound interest is what happens when money accrues interest, and that interest then accrues more, and so on. Basically, it’s an interest you earn on interest.

On the opposite end, there’s simple interest. This type of interest represents financial gains an investor earns just on the principal portion of the loan or their initial investment. In other words, simple interest is limited to one earning cycle — it leaves out interest earning more interest.

Definition of Compound Annual Growth Rate

Compound annual growth rate is defined as the rate of return required for an investment to grow from its starting balance to the ending value. It’s used when profits are reinvested at the end of each period.

With CAGR, investors can compare the present value of two or more stocks, and see which one has performed better over a certain timeframe.

CAGR calculates past performance. Furthermore, the compound annual growth rate isn’t the same as the true rate of return. Instead, CAGR is a metric used to determine how an investment may perform in the future, based on past performance.

Investors use CAGR as an estimate, rather than the exact measurement of the portfolio performance. It’s important to understand that neither CAGR, nor any other performance calculation methods, are any guarantee of future performance.

Other Growth Metrics to Know

Here are some other metrics investors use to help measure their journey.

- Year-over-Year (YoY) Growth compares the changes in annualized metrics at the fiscal year-end date.

- Month-over-Month Growth (MoM) compares the changes in the value of a metric at the end of the current month compared to the past month.

- Last Twelve Months (LTM) is the timeframe of the immediately preceding 12 months, often used to evaluate a company’s performance.

- Reinvestment Rate is the expected return that occurs after the reinvestment of the previous gains.

What Is CAGR Used For?

The CAGR is used to calculate an investments’ performance when compounding gains, or interest, are taken into account. It presumes profits or income will be reinvested, and gives a representational figure, which, as you’ll see shortly, has benefits and limitations as far as understanding performance.

CAGR is useful for understanding long-term performance in that it smooths out the effects of volatility. If an investment is up 10% one year and down 5% the next, then up 4% the next year, CAGR shows the long-term trend.

Benefits and Downsides of CAGR

There are many advantages of using the compound annual growth rate formula:

- It’s one of the most reliable ways of calculating ROI for compound interest.

- Helps compare stock performance in different time periods.

- Can be used for each investment separately.

- Fixes the limitations of the average return calculation.

- Works better for short-term calculations.

Some of the CAGR calculation’s limitations:

- Doesn’t account for investment risks.

- Implies a constant growth rate, which is not always the case.

- Can’t be used to measure the profitability of an asset’s inflows and outflows.

- Ignores market volatility.

CAGR Formula

To calculate CAGR, investors divide the value of the investment at the end of the period of time (EV) by the value of the investment at the beginning of the period (BV).

The next step is to raise the result to an exponent of 1 divided by the number of years (n).

Then, subtract one from the result.

To get the percentage, investors multiply the result by 100.

The complete formula looks like this:

CAGR = (EV / BV) ^ 1/n – 1 x 100

Modification of the CAGR formula

Investors have to modify the CAGR formula to get the correct data on their investments.

They need to know how long they’ve been holding a particular asset. To get this number, investors calculate how many days they held an asset for the beginning and the end of the period, then take into account all the other “complete” years, shown in days.

For example, someone held the investment for 300 days during the first year, plus three years (equals 1,095 days), then exited the position after 200 days in the last year. Their total holding period is 300 + 1,095 + 200 = 1,595 days.

To get the years, divide by 365, which makes 4.369.

They can then use this number in the CAGR formula, where n = 4.369

CAGR Calculated via Excel Spreadsheet

Some investors like to track their stock performance via an Excel spreadsheet. It’s possible, but not as easy — Excel requires that they use “RATE” (used for calculating the rate of return), and the “COUNTA” function (counts the number of years) to get the desired value.

However, there’s an easier way to calculate compound annual growth rate, using the CAGR calculator online.

CAGR Calculator

An online calculator is a simple solution to calculate an investment’s compound annual growth rate. Online calculators are straightforward, and investors get results immediately.

But, if you don’t want to deal with any calculations, Navexa is here to help.

Navexa: Automatic CAGR Calculations

Sometimes, calculating CAGR requires collecting a lot of data from your portfolio. The Navexa portfolio tracking platform can calculate investment performance using multiple formulas. Just upload your portfolio, and Navexa will do all the work for you.

Once you finish uploading your holdings, you can toggle between “Simple” and “Compound” and the platform will provide you with detailed performance metrics.

With Navexa, there’s no need to question whether the CAGR calculator is correct. You’ll get the data instantly within the app, so you know how your portfolio performs.

Example of CAGR Formula

If you’re still struggling to understand how compound annual growth rate works when using a formula, here’s an example.

Let’s say a company has a revenue of $100 million at the end of year 0.

Three years from then, the company is projected to reach a revenue of $150 million.

To start calculating, you should ignore the initial year (year 0), as the formula only takes into account the compounded revenue. To get the initial balance, subtract the beginning period (year 0) from the ending period (year 3).

Proceed to enter the following data into the compound annual growth rate formula:

Beginning Value = $100 million

Ending Value = $150 million

Number of Periods = 3 years

In this case, the annual growth rate CAGR formula looks like this:

CAGR = (150 million / 100 million) ^ 1/3 – 1 x 100

Based on this example, the compound annual growth rate is 14.47 %

CAGR vs. IRR

CAGR shows the return of an investment over a specific time period. However, there’s one more calculation you should know about — the Internal Rate of Return (IRR).

IRR also measures growth rate and performance, but in a more flexible way compared to CAGR.

One of the key differences between CAGR and IRR is that CAGR is used for simple calculations. Additionally, investors can calculate CAGR by hand, or with a CAGR calculator.

IRR, is used to show the growth rate of complex investments. IRR is used with portfolios with various cash inflows and outflows. If you want to measure IRR, you’ll likely need a powerful calculator or an accounting system.

IRR is often used for an investment that can’t be managed with a CAGR calculation.

CAGR vs. AAGR

Average Annual Growth Rate (AAGR) is another performance calculation. While CAGR accounts for the compound annual growth rate, AAGR doesn’t. Instead, it’s a linear measure that shows the average annual return.

What is Risk-Adjusted CAGR?

The risk-adjusted formula helps the investor determine whether a certain investment is worth the risk. With this method, investors measure and compare the generated returns and risks. This gives them an idea of the potential ending value of their portfolio.

Risk-adjusted CAGR requires a bit more calculation, and is more advanced. This is because it takes into account the standard deviation figure — a measure of volatility, which is different for every asset.

Calculating risk-adjusted CAGR is done by multiplying the CAGR by 1 and subtracting the standard deviation. In case the volatility number is 0, CAGR remains the same. However, with a higher standard deviation, CAGR gets lower.

This formula helps investors compare multiple investments and decide which one can provide the highest likelihood of returns for the desired time period. Again, no calculation method is ever going to protect against investment risk or predict future performance reliably.

How Investors Use CAGR

There are many ways to use CAGR in investing. The first is to determine the rate of return and likely future value of an investment.

Additionally, CAGR helps investors set objectives and calculate the rate they need to successfully grow their investment. This is especially true for risk-adjusted CAGR. This formula includes the risks related to a specific investment, which helps determine future growth rates.

The CAGR formula is also an ideal way of comparing multiple investment opportunities. Using it to forecast future value helps investors make strategic decisions.

The Importance of CAGR for Companies

Investors aren’t the only ones calculating growth rates and dealing with CAGR. Business owners and CEOs also utilize CAGR to determine company performance.

Finally, CAGR is crucial for companies that plan to give out dividends to shareholders, as it shows the company’s (positive or negative) performance between two different years.

What is Considered Good CAGR?

Generally speaking, a CAGR of 15% to 25% for the period of five years would considered a good compound annual growth rate for stocks and mutual funds.

However, if the CAGR were lower than 12% for stocks and mutual funds, investors might gravitate towards other opportunities, such as real estate or other securities.

See Your CAGR & Simple Returns in Navexa

Compound annual growth rate (CAGR) is one of the methods investors measure the performance of their holdings. The formula is fairly simple, but it doesn’t account for market volatility and investment risks, unless you use a risk-adjusted one.

The CAGR formula can only be used for compounding investments. Compound annual growth rate is different from AAGR, which simply shows the average change for one year. Many investors prefer CAGR since it smoothes out the year-by-year volatility in growth rates.

Among many other features, Navexa also offers CAGR calculations based on uploaded portfolio data. Simply toggle between ‘Simple’ and ‘Compound’ to get accurate data instantly. To check out how it works, register today and start your free trial.