Your Unrealized Gains Report is a useful tool for seeing at a glance what your tax obligations would be if you were to sell part, or all, of an investment portfolio.

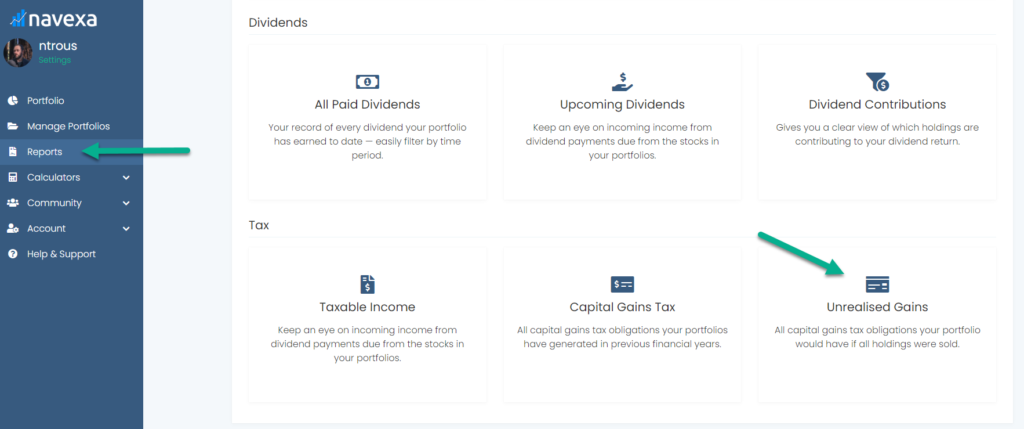

Like all the reports in your account, you access your Unrealized Gains Reporting tool via the ‘Reports’ link in the menu.

Down the bottom of the reports page, under the Tax heading, you’ll find Unrealized Gains.

Wait a moment while the platform runs the report on your selected portfolio.

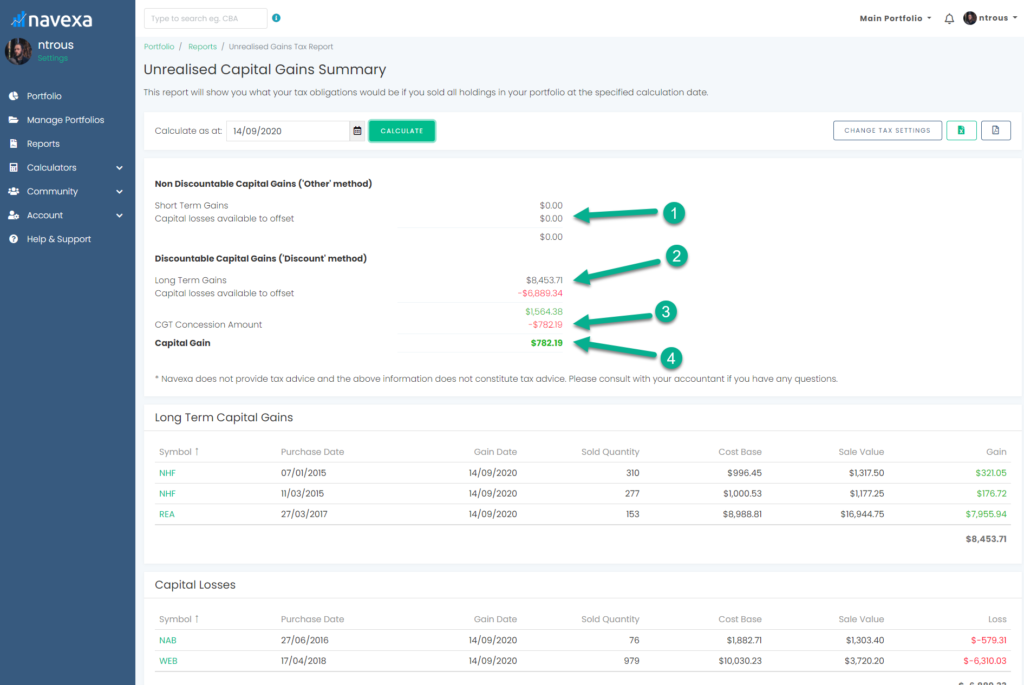

Then, you’ll see the following information:

- Your ‘non-discountable’ capital gains — on holdings you’ve held shorter than 12 months.

- Your ‘discountable’ capital gains — on holdings you’ve held longer than 12 months.

- The value of your portfolio that qualifies for the CGT concession.

- Your total capital gain after your portfolio’s capital losses and CGT concessions have been factored in.

Your Capital Gain figure is the total taxable capital gain if you sold every holding in your portfolio at current market prices.

Below this calculation, you’ll see your gains and losses displayed in a list of holdings.

You’ll see:

Short-term capital gains

Long-term capital gains

Capital losses

You can sort these tables using the headings at the top of each column.

This is where you can see which holdings are contributing the biggest gains and losses to your overall capital gain calculation.

If you’re looking to liquidate, say, $10,000 worth of a portfolio for cash, this report is a quick way to determine which holdings you can sell to minimize your net capital gain and therefore potentially minimize the tax you’ll pay on that gain.