Powerful ideas on building life-changing wealth — from passive income investment strategies to staying calm through stock market crashes and financial crises.

How much do you think a person needs to invest to make a million dollars?

$100,000? $250,000?

Try $1,525.

If you invested $1,525 today in a fund that tracked the Australian stock market’s growth over the next 20 years — and you committed to investing that much every month — your portfolio would grow to just over $1 million.

(That’s based on the Australian market’s annualized performance over the 20 years to December 2017.)

While past performance is never any guarantee of future returns — and this post most definitely does not qualify as financial advice — going by that historical return, a meagre $352 a week is all it would have taken to build a million-dollar portfolio in those 20 years.

When you consider that putting that much into a savings account would have yielded not even half that over the past 20 years, it’s clear why some of us are prepared to accept more risk when we’re considering which long term investments we want to put our money in.

It seems simple, doesn’t it? Creating a significantly brighter future financial situation for yourself (and your family) is a matter of socking away money on a regular basis — personal circumstances permitting, of course — and letting the market work its magic.

As you’re about to see, executing a successful long term investment strategy isn’t as easy as it may seem.

You need some key ingredients: Financial education and literacy, clear investment objectives, a solid grasp of personal finance, and a specific investment timeframe or horizon, to name a few.

This post introduces some key ideas around investing for long term success and financial freedom.

Read on to discover some of the fundamental ideas and factors for those looking to build long term, life changing wealth through consistent and patient investing.

Examples Of Long Term Investment Strategies’ Epic Performance (Despite Multiple Stock Market Crashes)

Seth Andrew Klarman is a billionaire. The private investment partnership he founded in 1982 has realized a 20% compounded return for the past 40 years.

Let that sink in for a moment.

Twenty percent a year. For 40 years.

What started as a $270 million fund has grown to be worth around $270 billion.

In that time, the US stock market has, according to Wikipedia, crashed 10 times.

The 1987 Black Monday crash alone was enough to inflict serious, lasting financial damage to someone in my own family. The rest of their life they had to live with consequences of having sold in panic as investors all over the world rushed to get out.

But over Klarman’s 40 years running his investment portfolio, none of the 10 crashes have, in the long term, impeded him from racking up what most of us would agree is insane wealth.

According to him:

‘The daily blips of the market are, in fact, noise — noise that is very difficult for most investors to tune out.’

‘Klar’, by the way, is German for ‘clear’.

Whether or not Klarman’s name had any bearing on the way he viewed the markets during his four decades (so far), it’s certainly clear that ignoring the so-called ‘noise’ in favour of a long term strategy has been immensely profitable for him and his investors.

Noise: The Enemy Of Successful Long-Term Investing

When we talk about market noise, we’re talking about a lot of things.

Daily price movements, economic changes that impact the markets, like interest rate rises, and news flow are three common examples.

Even the talk of interest rate rises — amplified of course by the media — has been causing market jitters in early 2022.

Here’s a quick example of just how useless most noise is — and why smart investors like Seth Klarman ignore it, preferring instead to focus on their strategy.

The chart shows you the S&P500 index between 2009 and mid 2017. As you can see, annotated along the line is every time the financial media claimed ‘the easy money has been made’.

In other words, nine times they claimed the good times were over for the S&P500…

That things were about to get tough for investors…

That you should perhaps be scared about what was about to happen to the stock market.

And yet, while in the short term the S&P500 did indeed fluctuate — sometimes severely and abruptly — over the seven-and-a-half years this chart shows, it still doubled in value.

We can’t know how many people were scared into selling their stocks each time they read a ‘the easy money…’ headline. But, you can bet there were quite a few.

I know people who won’t even get into the stock market on account of the fact values can fall, let alone stay in stocks they own through volatile or uncertain times. Such is their appetite for investment risk (zero).

Getting back to Seth Klarman’s point…

Successful Long Term Investing Demands That You Can Stomach Volatility, Noise & Risk

‘Get rich quick’ has become virtually synonymous with ‘scam’. You read those words and you know there has to be a catch.

While it’s true that some investors do bag huge gains from speculative investments like penny stocks, it’s very rare that they’re able to repeat those successes by applying any sort of discipline or formula.

Getting rich quick, we could say, depends on luck. You have to be in the right investment at precisely the right time and you have to sell it before it plummets back down to earth (as many do).

Getting rich slowly, on the other hand — building financial freedom and exponential wealth by investing like the Seth Klarmans and Warren Buffets of this world — depends on something else.

Building financial freedom through investing depends on discipline.

As you’re about to see in this post, you have to cultivate discipline around your saving, spending and investing habits. You have to be honest with yourself about your goals. You have to understand how much risk, volatility and stress you’re prepared to tolerate. You have to start thinking in decades, not years — and certainly not months or weeks.

In other words, you have to find or create a long term investing strategy that you feel comfortable and confident is going to result in the financial freedom you seek.

And, of course, you have to get wise to short-term market noise like attention-grabbing headlines about the easy money having already been made.

What follows are some generally-agreed upon solid ideas and approaches from both the investment industry and the financial freedom (or FIRE) community.

(Again, NOT financial advice 🙂)

Find Your Investing Mindset & Bring Order To Your Finances 🔥

If you’re yet to begin investing, or you’ve started but are still caught up in the idea of getting wealthy fast, then you need to lay the groundwork for your strategy.

A solid long term wealth building strategy can’t exist without a strong foundation of financial literacy, discipline and clarity.

This means you need to get into the weeds on every aspect of your financial life.

You need to have a firm grasp on your whole financial position as it stands: Income, debt, expenses, savings, everything. Why? Because successful investing — no matter whether you’re aiming to make $100,000 or $100 million — depends on a few key principles.

Three Rules For Investing Long Term

Here are three tenets the FIRE community generally accepts as foundations for building wealth:

- Spend less than you earn.

- Invest the difference.

- Continuously look to widen the gap between what you spend and what you earn.

If you don’t fully understand your personal finances, you’re not going to be able to confidently and consistently spend less than you earn.

And consistency, as many in the investing world can attest, is crucial to successful long term investment strategies.

The Power Of Investing Consistently Over The Long Term

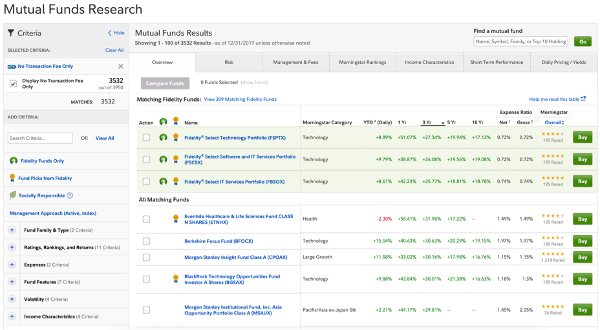

Take a look at this:

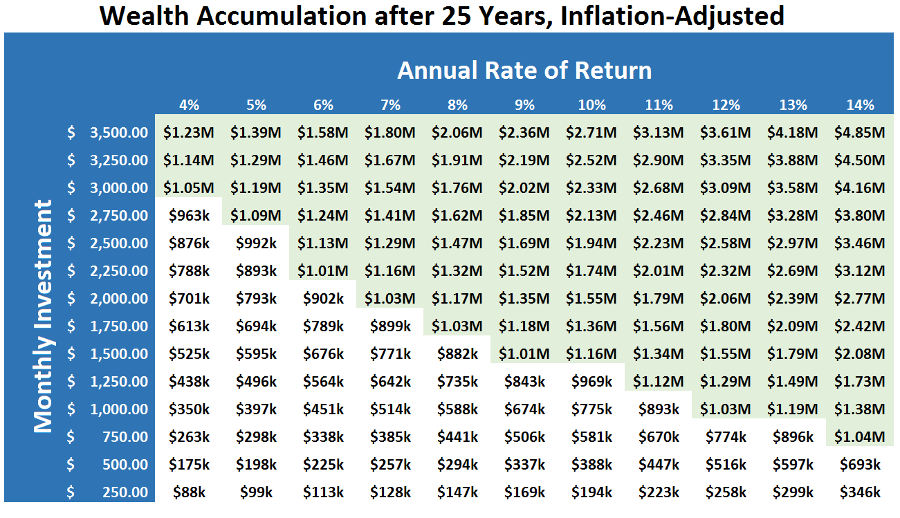

This table shows you how much your portfolio would be worth 25 years from now based on different monthly investments, which you can see on the Y axis, at different annual rates of return, which you can see along the X axis.

As you can see, just $750 a month ($9,000 a year) has the power to become more than $1 million.

That works out at $173 a week. So when you see a table like this, ask yourself:

How much money are you prepared to commit to become a millionaire?

If you’re not — or if you don’t have $173 a week at your disposal — then you need to assess your goals, priorities and your financial position.

Remember, the first rule is that we should spend less than we earn and invest the difference.

The Australian stock market returned an average 9.7% between 1991 and 2021, according to Canstar.

Going by the 25-year table above, a monthly investment of $1,500 would hit $1 million at that rate.

As you can see, the most powerful factor here is time. Remember Seth Klarman’s portfolio performance and opinions regarding ignoring market noise.

And consider this:

Choose A Strategy (And Commit To It)

There’s no end to the opinions and advice out there about exactly how one should set about building long term wealth in the stock market.

Only you can determine your goals, values and risk tolerance.

Fortunately, we’re living in a time when there has never been such a plentiful and wide range of opinions and advice.

This section details three broad investing strategies commonly employed by long term investors.

First, a word of warning on getting too caught up in other people’s ideas about investing success (or any success, for that matter):

While there’s lots to learn and much to gain from following in the footsteps of great investors, it’s important your investment strategy suits you first, not someone else.

(If I had a dollar for every person who says they subscribe to ‘the Benjamin Graham method’, I wouldn’t need my own investment strategy.)

Idea #1: Buying Exchange Traded Funds

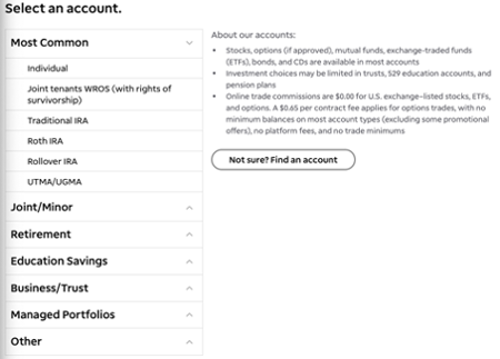

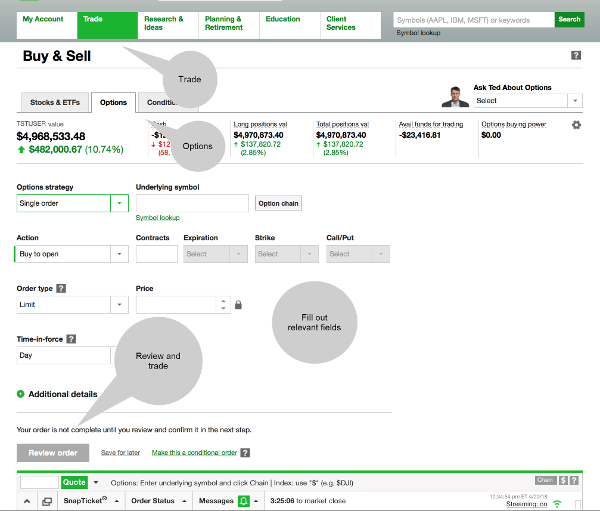

Exchange traded funds, or ETFs, have been growing in popularity in recent years — particularly among the FIRE community.

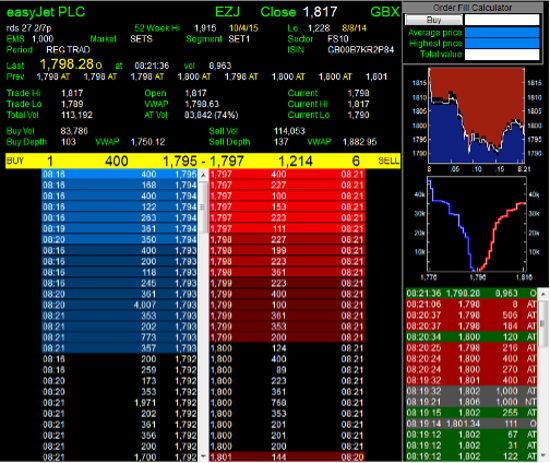

You can buy an ETF like you would any shares on the stock market. The difference is these funds are structured to track indexes, sectors and other specific market themes.

For example, I recently bought shares in an ETF that tracks the Dow Jones technology index. This means I’m exposing my capital to the progress of that entire market, as opposed to picking out a particular company to invest in.

Many long term investors and financial freedom seekers favour ETFs as they are relatively ‘low touch’ — you can buy them easily and bypass the need to conduct research into individual securities.

Think of ETFs as a door through which you can access different parts of the markets and financial system. You might choose an ETF than tracks growth stocks in Asia. Or, you could choose one that tracks a particular commodity or currency pair. Index funds, while different investment vehicle, can service a similar function, as do mutual investment funds.

Idea #2: Buying Growth Stocks & Value Stocks

While you can bypass researching individual stocks using ETFs or index funds, you might actually prefer to invest directly in particular stocks.

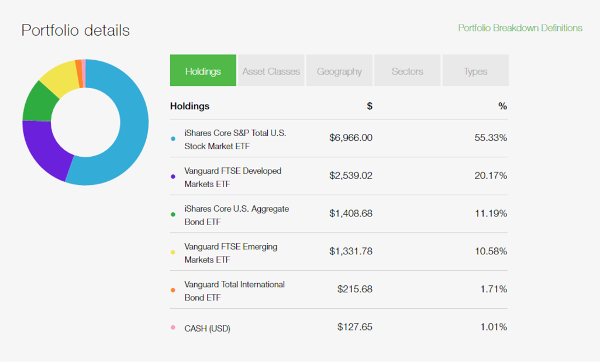

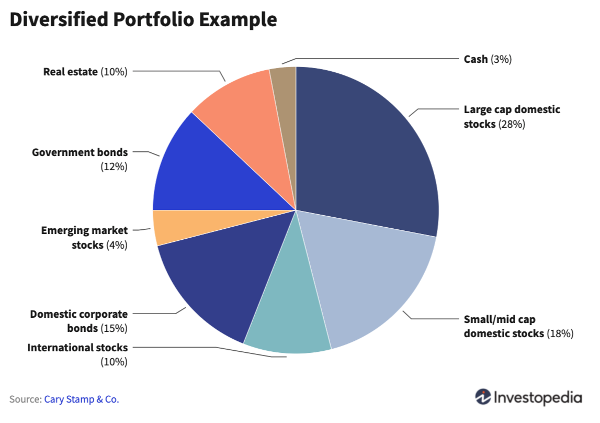

One thing you’ll need to understand when building and managing your investment portfolio is diversification. This is a good place to start.

If the risk tolerance, strategy and investment timeline allow for it — and if an investor can commit to doing in-depth market and company research — they may choose to invest in companies.

While there’s a lot of different types of companies trading on the stock market, from the miniscule (speculative penny stocks) to the mammoth (Tesla, for example), across all sorts of criteria and risk profiles, let me introduce you to two types you might find in a long term investment portfolio.

Pocket Rockets For Your Portfolio 🚀

Growth stocks are the jet boats of the stock market. They’re exciting, attention-grabbing companies that carry both higher promise and higher risk relative to more established, stable companies.

These stocks often tend to be technology companies, and are often smaller companies that are in the midst of capturing market share. According to Bankrate, these companies ‘generally plow all their profits back into the business’, since they’re in the process of expanding. This means they may be less likely to pay dividends to their shareholders, who rely instead on rising valuations to generate returns on their investments.

Growth stocks don’t necessarily have to be small-cap companies. Generally speaking, investors probably need to be prepared to be more active when it comes to owning a growth stock, since their value can rise and fall faster than blue chip companies. This means a ‘set and forget’ strategy which may be appropriate for ETF investing may not apply to riskier growth stocks.

Buffett’s Favourite Types Of Companies 🛳️

Value stocks, on the other hand, present a very different prospect for an investing strategy. If growth stocks are jet skis, value stocks are a cruise ship.

In basic terms, a value stock is a company that is trading at less than their ‘true’ value. How you determine that value isn’t an exact science. There are several methods you can use to calculate whether a company’s share price is trading at a discount on its fundamental value (one of the most common methods is the discounted cashflow calculation, which you can run in our portfolio tracker for free).

Value stocks often display high dividend yields and low price-to-earning ratios. They tend to be big companies that don’t have much room left to grow relative to their smaller, more dynamic counterparts, but which can also produce higher long-term returns (even if they may not deliver spectacular short term gains like a growth stock).

Value stocks might suit more of a low-touch, buy-and-hold type of investment strategy. For many seeking financial freedom, the prospect of lower share price volatility and a steady stream of dividend income makes value stocks a sensible inclusion in their portfolio.

It’s worth noting as well, that there are ETFs on the market that track value stocks — meaning you don’t necessarily have to approach value investing company by company.

Idea #3: Dividend Stocks & Passive Income 💵

For many on the financial freedom trail, dividends are king. Here’s why.

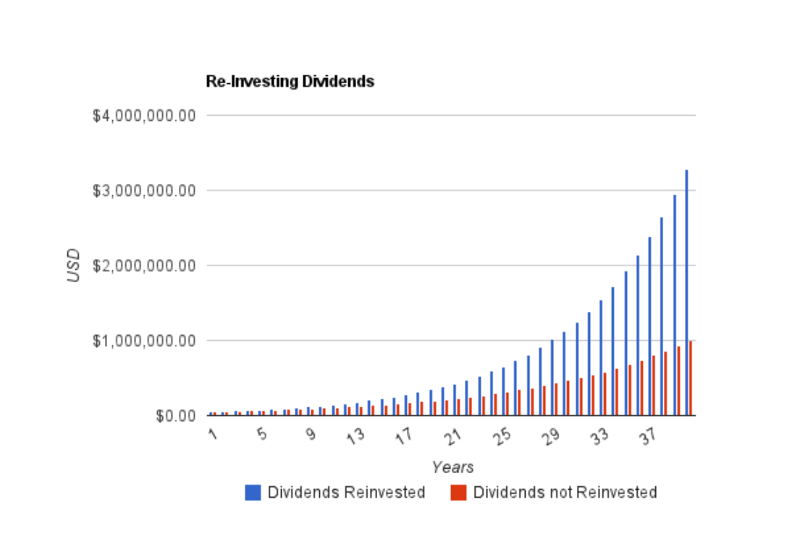

What you see here is the power of income in a long term investing strategy.

The red bars represent the annual returns over 40 years of holding a stock that rises an average 8% a year and collecting the dividend payments as cash.

The blue bars show you the same investment with reinvested dividends over the same time period.

If you held the stock and pocketed the dividend cash, after 40 years a $50,000 investment would have grown to around $1 million.

But if you reinvested those dividends — meaning you opted to receive additional shares as opposed to cash — you would end up with more than $3 million.

That’s a substantial difference. Of course, the example doesn’t account for what you could have done with the cash if you’d taken it instead of reinvesting it (more on that below).

Why Income Investing Suits Long Term Investment Strategies

Remember the three points from the start of this post:

- Spend less than you earn.

- Invest the difference.

- Continuously look to widen the gap between what you spend and what you earn.

You can understand why income investing is so attractive for those seeking financial freedom.

Dividend reinvestment hits all three of these action items. This is why so many investment strategies include income investments.

Once I’ve bought your shares and committed to leaving them for a long period, I don’t need to put any more of my regular income into the stock.

As the stock pays me dividends in the form of more shares, I automatically invest the difference.

And, even better, the more shares I accumulate through dividend reinvestment, the more I widen the gap between what I spend and what I earn (remember that in the example above I start with just $50,000 and end up earning nearly $3 million through capital gains and reinvested income).

Einstein’s Theory Of Compounding Investment Returns 🔬

Income investing is popular for good reason. Especially with those looking to invest for long term wealth.

If you decide to make dividend stocks (or ETFs — remember ETFs exist for most markets and sectors, and you can find plenty of income-focused funds on the market) part of your long term investment strategy, you’ll be in good company.

Legend has it that someone once asked Albert Einstein what he thought was the eighth wonder of the world.

His response: ‘Compound interest’.

‘He who understands it’, Einstein said, ‘earns it. He who doesn’t, pays it’.

Wise words worth keeping in mind as you assemble your plan to build long term financial freedom!

Aim For ‘Infinite’ Investment Returns ♾️

If this sounds a little ‘hidden secrets of the rich’, that’s because it is.

Infinite returns are ultimately what you should aim for if you aspire to the sort of financial freedom the world’s wealthiest long term investors are able to enjoy.

The idea behind the term is that you buy an investment, which makes you money (either through capital gains, income, or both) and then you sell your initial stake at a certain point.

For example, say you buy $50,000 worth of shares in an ETF that tracks relatively stable, income-paying companies. You leave it alone for five years. Between capital gain and reinvested dividend income, your position grows to be worth $100,000. Then, you take out your initial $50,000, and leave the investment to run on profits alone.

If you consider the dividend reinvestment illustrations above, just imagine that the $50,000 you start with in the 40-year example was the result of profit from a previous investment.

The, imagine you do it again. What started as $50k profit becomes the capital for a new investment. Then that investment generates its own profit, allowing you to free up the $50k and continue ‘cycling’ through new opportunities.

This is the essence of infinite investment returns. Of course, this explanation makes it sound super straightforward. Like everything in the investing world, this strategy carries risk.

But when you adopt the long term investing mindset…

And you’ve learnt to ignore the market noise that triggers so many into FOMO buying and panic selling (I literally saw this in the course of writing this post)…

And you’ve structured your personal finances in such a way that consistently investing in the assets you want your money in for the long term without adversely impacting your day to day…

Then the prospect of infinite investment returns becomes more and more attainable the longer you stick to your plan.

If buying a lotto ticket is one extreme of the investing world, then infinite returns are the opposite extreme. They don’t happen overnight and they take time and sacrifice to create.

As Blake Templeton, of Forbes, points out, building wealth is a long term game.

‘Those dreams of hitting it big in the stock market are exciting, but they rarely come true. Instead, focus on building long-term wealth that grows consistently over time, like the super-rich. When you use their same strategies for wealth-building, you set yourself up for exponential gains that you can pass down to future generations.’

Takeaways: Continuously Invest In Knowledge — And Track Everything As You Go 📈

Perhaps the most important investment you’ll ever make on your journey to financial freedom through long term investing is in yourself.

(Yes, you’ve probably read versions of that a thousand times on Twitter. But it’s for a reason!)

At a high level, you have to back yourself to create the discipline, strategy and trajectory that will allow you to realize your vision of financial freedom.

Once you’re making progress though, it’s not only financial assets you need to invest in. You should also make time to build your knowledge of finance, investing, economics and useful information about the wider world (as opposed to ephemeral, short-lived ‘noise’).

That means making connections, reading books, listening to podcasts and following blogs (like this one, obviously). Like everything in life, the investment world never stays still. Change is constant and often dramatic.

Trends shift and investment strategies that work today may no longer work next year — see the ructions over the US Federal Reserve’s announcement about (finally) raising interest rates in early 2022.

Make sure you have good sources of information to keep building your financial literacy and stay informed of the deep themes and trends at play in the world and its markets.

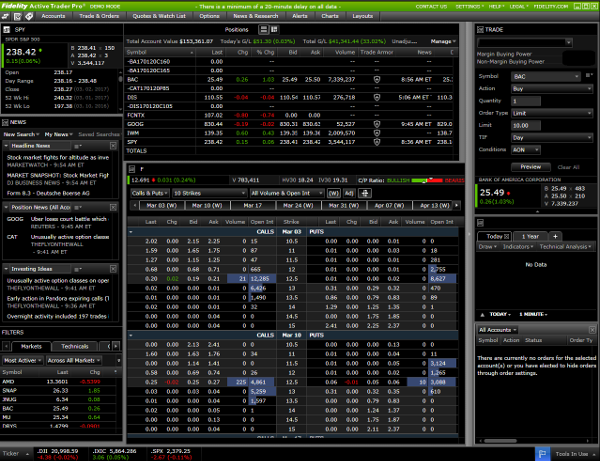

Track & Analyze Your Portfolio Consistently

Most of all, make sure you have good sources of information about your own financial position and portfolio progress. As Peter Drucker points out:

‘What can’t be measured, can’t be improved.’

As so many people have found when they start tracking their fitness, their diet or their personal finances, you start behaving differently when you can fully grasp your long term progress.

Long term investing is no different.

Whether you’re investing $500, or $1,000, or $5,000 a month towards financial freedom decades down the line, you’re going to need to accurately track your progress.

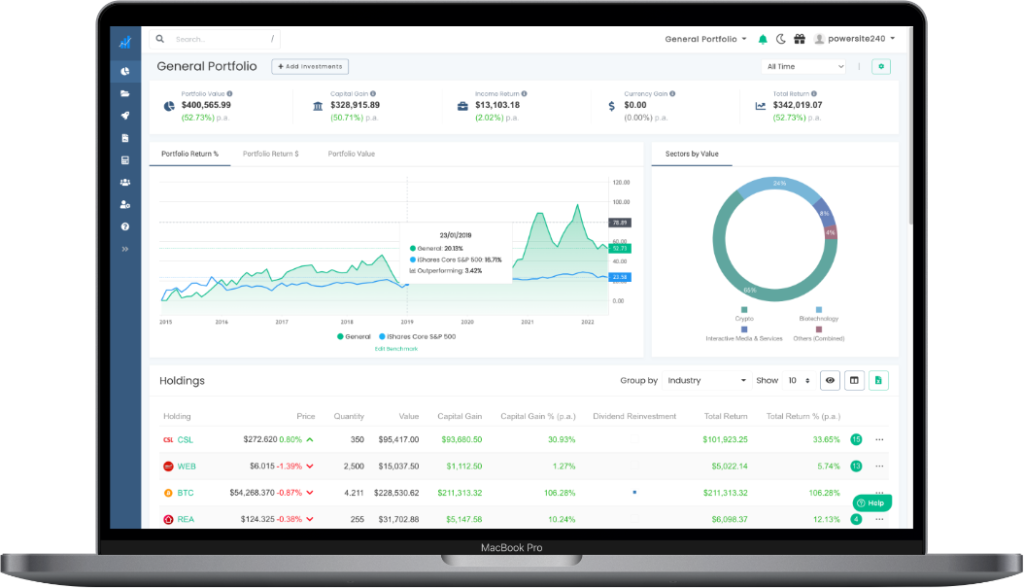

This is what we specialise in here at Navexa — advanced investment analytics for everyday people looking to build long term wealth.

If noise is the enemy of long term investing, then proper portfolio tracking is one of your best defences against it.