Asset allocation is perhaps the most important concept at play in the world of portfolio management today. Learn what asset allocation is, how it applies to your portfolio, and what the best asset allocation models in the world are today.

Asset allocation is at the centre of Modern Portfolio Theory, which is the concept that any portfolio of investments can be optimized to most efficiently balance the level of risk those investments carry.

The concept underpins everything from private investment portfolios to multi-billion dollar hedge funds in the stock market.

Since Nobel Prize-winning economist, Harry Markowitz, introduced his theory of asset allocation in 1952, the idea has become synonymous with diversification.

This post explains the ideas behind asset allocation and the common wisdom on diversification.

We’ll introduce you to the biggest asset allocation models you’re likely to encounter, the different types of assets available in the markets, and the benefits of having a well-diversified portfolio.

Plus, we’ll explain how our portfolio tracker’s reporting tools can help you analyze your diversification.

One important thing to know about asset allocation is that the ideal blend of assets depends significantly upon your age.

Generally speaking (and nothing in this post constitutes personal financial or investment advice), younger investors with a higher risk tolerance, moving towards a less risky asset allocation more in favour of fixed income as they become older.

While asset allocation is all about balancing and mitigating risks to your capital, you should always do your own research and seek professional advice before risking your capital.

What Is Asset Allocation?

Asset allocation, in its simplest form, is the composition of an investment portfolio. Specifically, it’s the relative percentages of stocks, bonds (or other fixed income investments), cash, and other assets you choose to invest in over the long term.

Most professional investors and financial advisors agree that choosing your asset classes is probably the most important decision you’ll make on your wealth building journey.

Now, that doesn’t mean choosing which stocks to invest in. Rather, asset allocation refers to the asset groups.

Modern Portfolio Theory holds that an efficiently diversified portfolio comprises a particular balance of stocks, fixed income instruments and cash.

For example, say you have a third of your portfolio in stocks, a third in bonds and a third in cash.

Low interest rates might drive stocks higher, while cash probably won’t perform so well.

But were interest rates to rise, causing the stock market to panic and stock prices to fall, the cash would start generating a better return.

Applying the strategy of your choice determines the relative extent to which you expose your capital to stocks, fixed income and cash.

Of course, within these groups, there are still many decisions to be made.

A $300,000 portfolio with equal thirds in stocks, bonds and cash could take many forms. For example, the stocks could be blue-chip, large cap companies with a strong track record of paying dividends.

Or, they could be speculative smaller or mid-cap stocks that have a chance of delivering a substantial capital gain.

Stocks have a large spectrum of risk and reward which you’ll need to consider relative to your objectives and the overall allocation.

Why Do I Need To Diversify?

The reason for diversifying can be explained using the eggs & baskets analogy.

If, for example, your portfolio consists of 100% banking stocks, all your eggs are in one basket.

If there’s a financial crisis or crash, the banking sector could get hit hard, meaning your entire portfolio gets hit hard. The basket falls and breaks all the eggs in it.

But if you own a mix of stocks, for example, some technology and pharmaceutical companies alongside your financial ones (and a variety of large cap, mid-cap and small cap companies), then you’re spreading your eggs out and exposing different percentages to different markets.

Diversification is all about spreading risk between investments so that you’re not over exposed. Your risk tolerance is a function of many things, including your time horizon.

Asset allocation and diversification aim for the same objective, but they operate on different levels. Whereas diversification often refers to the mix of stocks you own, asset allocation encompasses stocks and other investment classes (like bonds and cash).

It can also extend to property, cryptocurrencies, and pretty much any other asset which you’d count as part of your overall financial position.

There are two particular types of risk to every investment; systematic and unsystematic.

Systematic risk is a broad, market-wide economic risk (think the 2008 global financial crisis).

You generally can’t protect yourself against big events like this — no matter your risk tolerance.

Unsystematic risk is specific to a country, market or individual company — this is what diversification aims to mitigate.

How Can I Diversify?

So you know you need to spread your eggs out into different baskets, and consider your time horizon and risk appetite.

That’s the most basic principle of diversification (the two terms are commonly used interchangeably.

The second principle to understand is negative correlation. This is the idea that a properly diversified portfolio (or sensible asset allocation) will include investments that not only don’t react the same way to economic and market events… but that react the opposite way.

The example we gave earlier about interest rates impacting equities and cash savings in different ways is an example of low or negative correlation.

In other words, a well-diversified portfolio will be more resilient and stable than a poorly-diversified one. This is the theory.

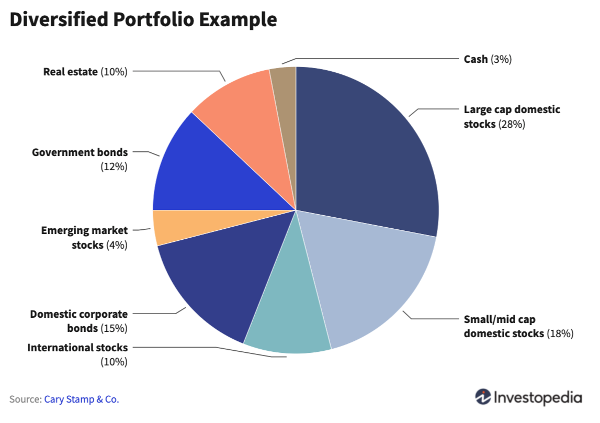

Check out this example:

You can see the portfolio comprises four assets: Stocks, bonds, real estate, cash.

So the allocation is 60% stocks, 27% bonds, 10% real estate and 3% cash.

Within the stock allocation especially, you can see diversification at play.

There’s large cap and small cap domestic stocks, which expose the portfolio to the lower and higher risk/reward ends of the local market, respectively.

There are international stocks, which expose it to companies and markets overseas. And there’s a small percentage of emerging market stocks, which expose it to the potentially large gains and losses in overseas economies which are developing and growing quickly (but tend to be volatile).

The bonds, too, are split between government and corporate issuers, providing a spread of risk among the fixed income allocation.

In this example, the investor may have individually chosen each investment. Or, for the stocks especially, they could have invested in ETFs that track the respective sectors.

Which Assets Should Be Included?

You can see in the graphic above that the example portfolio includes investments across four asset classes.

Generally speaking, today we tend to consider four main asset classes.

The Four Main Asset Classes

· Asset Class 1 — Cash: Money in the bank is generally a stable, secure form in which to keep some of your capital. It’s how most of us store our wealth by default.

The problem with cash is that interest rates tend not to beat the inflation rate — meaning your cash’s value will diminish over time.

· Asset Class 2 — Bonds: A bond is a debt instrument. It provides a fixed income. You buy a bond from a government or business and they guarantee to pay you a fixed interest rate while you hold it. Interest rates on bonds tend to be better than what your cash will earn in the bank.

· Asset Class 3 — Stocks/Equities: Stocks essentially let you participate in a company’s activities. You own shares in a business. Those shares can rise, fall and pay income in the form of dividends.

Blue-chip companies pay good dividends and have a record of climbing steadily over the long term.

After mid-cap stocks, you have growth stocks, or small-cap companies, are smaller businesses on an upward trajectory. They are riskier but can deliver bigger, faster returns. Risker and more dynamic again are small-cap and penny stocks.

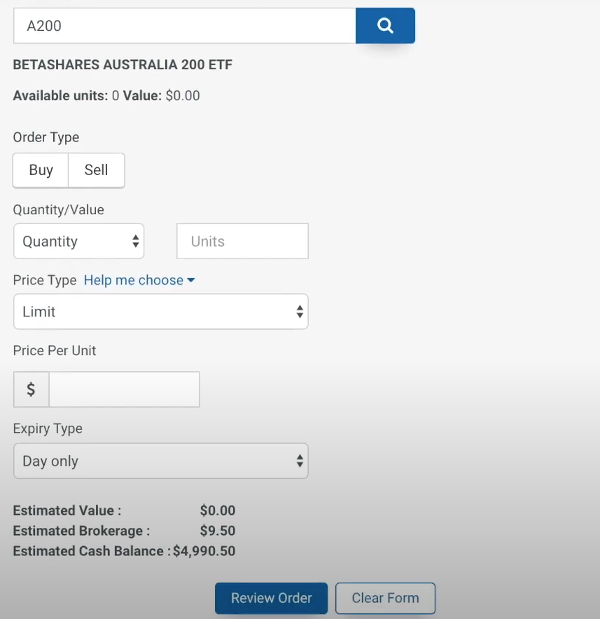

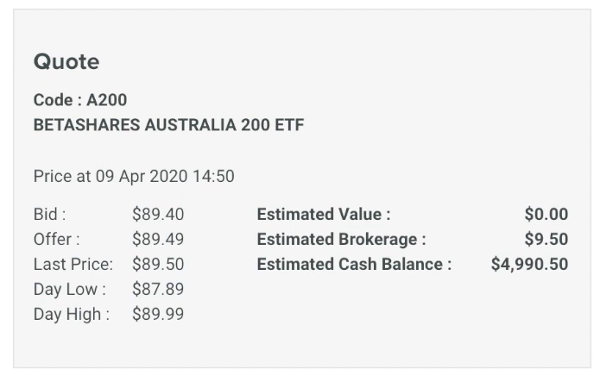

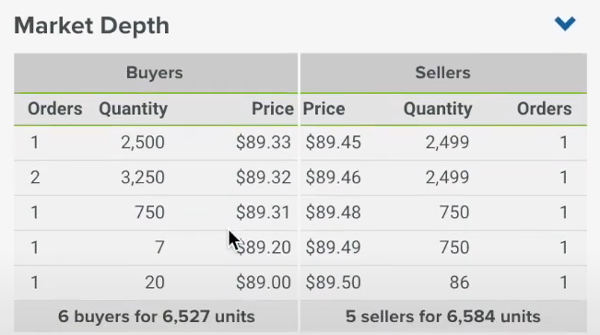

· Asset Class 4 — Mutual Funds & ETFs: Mutual funds are investment funds where many investors pool their capital and allow a professional fund manager to control it. These funds do charge management fees, though, and require you to allow a third party to select the assets the fund invests in.

An ETF — or exchange traded fund — tracks an underlying index, like the ASX200, for example. Owning shares in an ETF exposes your capital to a specific mix of assets. Like stocks, ETFs vary greatly in risk depending on the sector or market they track.

What Are The Benefits Of Diversification?

The main objective of diversification is to mitigate risk.

Because low or negative correlated assets (like stocks and bonds or other fixed income investments) should, in theory, balance each other out over time, a well-diversified portfolio should steer your capital towards multi-year and multi-decade profits.

Think of it like a correctly-balanced diet.

By eating the right foods from the right food groups, in the right amounts, you’re giving your body the fuel it needs to grow and recover.

If you don’t do this, and your diet is lacking in key nutrients, or excessive with the wrong foods, your body will decline — especially over the long term.

Consider your time horizon in these terms too. An unhealthy lifestyle may carry more risk later in life than when you’re younger.

Common Asset Allocation Strategies

Strategic: This strategy relies on a ‘proportional combination’ of assets based on how much you expect each to return. You can set initial targets and rebalance from time to time.

Dynamic: This is a more active approach, in which you frequently adjust the mix of assets based on market shifts and price movement. The key to dynamic asset allocation is selling assets that decline and buying more of those that perform well.

Insured: A strategy for the more risk-averse. You start by selecting a value you won’t let your portfolio drop beneath. As long as the investments keep the portfolio above that base value, you actively adjust your allocation. And if it does drop below, you move your capital into safe fixed income assets or cash. You might find mutual funds suitable for this strategy.

Tactical: Tactical allocation is similar to strategic allocation except it allows for ‘tactical’ trades aimed at capitalizing on short-term opportunities within your broader, longer-term wealth building plan. For example, you might invest a small amount in the cryptocurrency markets to expose yourself to some of the big (but volatile) potential gains. Once you’ve made a gain, though, you quickly capture the profits and return them to your main allocations.

Looking for more strategies? Check out these stock trading strategies.

H2: Should You Use An Active Or Passive Management Strategy For Your Investments?

How hands-on, or hands-off, should you be with your asset allocation and portfolio management?

Like so many things in the world of wealth building, how active or passive you are with your portfolio comes down to you, your objectives, your risk tolerance, time horizon, and your other commitments.

The markets change every day. So no single strategy or approach is going to be the best one all the time.

A passive management strategy might take the form of a ‘set and forget’ portfolio. This would involve setting your asset allocation and diversification, spreading your starting capital between the stocks, bonds, cash and other assets, and leaving the portfolio with minimal management or adjustment.

One type of investment that might suit the more passive portfolio and risk-averse is an ETF, since these funds, like mutual funds are often weighted and diversified in terms of the investments they track.

This hands-off approach — if the portfolio is correctly allocated and diversified — should perform solidly over the long term, even if there are times when it doesn’t perform so well due to not being altered to suit changing market conditions.

An active management strategy is more like those listed above — the tactical approach especially. Active is hands on. You’re looking at your portfolio performance often, identifying opportunities to rebalance and re-diversify your portfolio.

Active portfolio management may mean you can expose your capital to better short-term growth opportunities, or protect it from short-term risks.

This style of portfolio management requires a lot more time and research than passive investing. It may also mean your portfolio performance suffers a greater impact from trading fees, since you might buy and sell more often.

The Best Way To Monitor Your Portfolio Performance

Everybody’s allocation models and portfolio diversification strategies are unique to them. Your own objectives and risk tolerance will determine how you distribute your capital across your investments — and how active or passive you are in managing the portfolio.

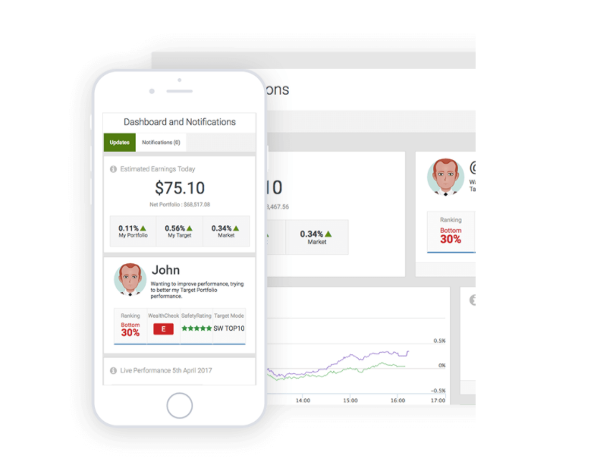

Whether you’re a set and forget investor, or an active trader monitoring the markets every day, there’s one thing you must make sure you do.

Correctly and thoroughly track your portfolio performance using a dedicated portfolio tracker.

This is because true portfolio performance factors in more than just your nominal gains.

It accounts for how long you’ve held a position, trading fees, currency gain, taxation and dividend income.

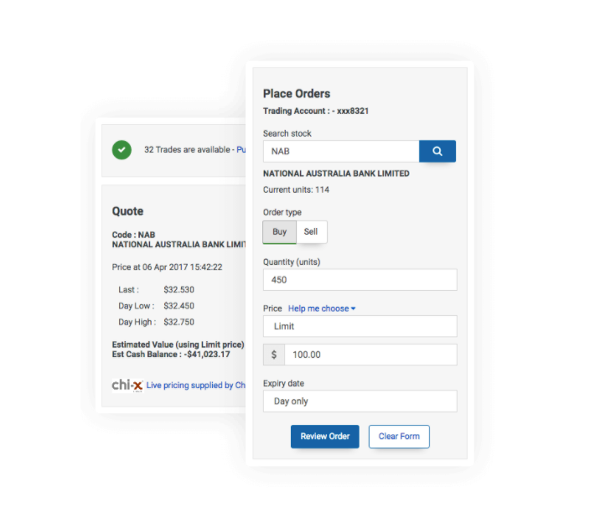

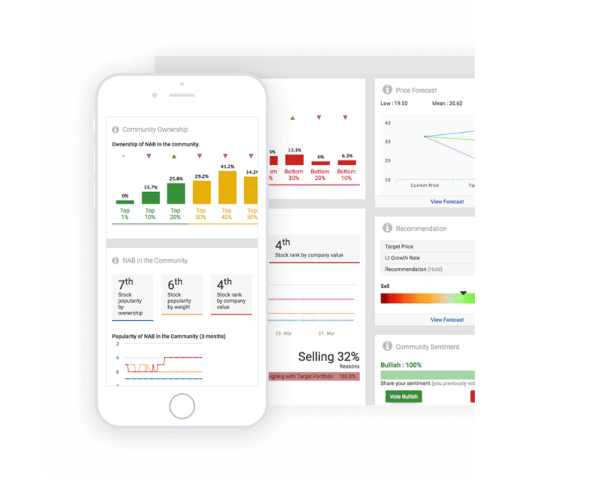

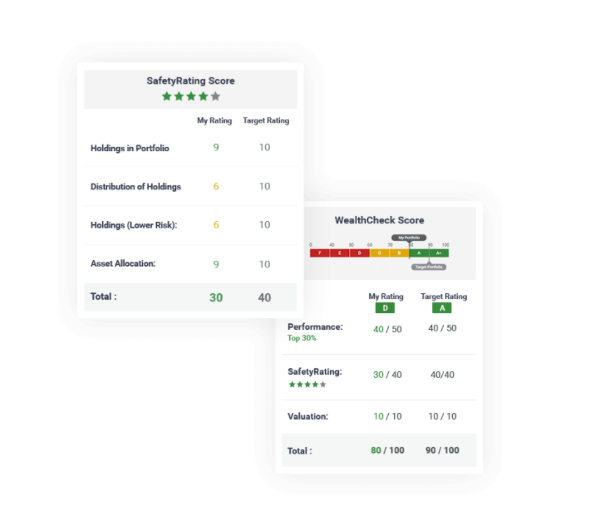

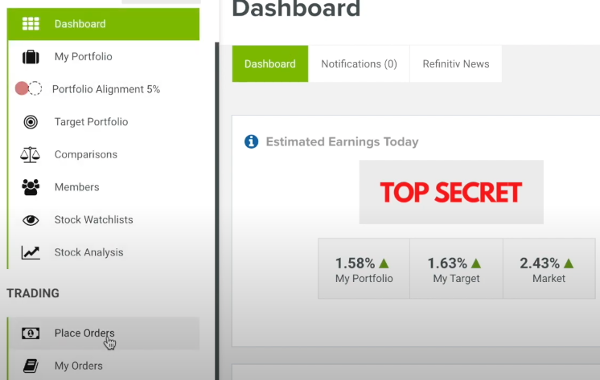

The Navexa portfolio tracker does all this (plus, you can generate a variety of reports, from calculating unrealized capital gains to taxable income, portfolio contributions, and many more).

Key Navexa Tools

Portfolio Contributions Report: Instantly see which holdings in a portfolio are contributing the most to your overall performance — and which are dragging on your returns.

Portfolio Diversification Report: See the exact percentages of your portfolio diversification and asset allocation (each sector and each holding within that sector).

Dividend Contributions Report: Income is a huge part of your portfolio performance. Especially over the long term. Use our dividend contributions report to identify which of your holdings are generating the most and least income.

Use these reports today when you try the Navexa portfolio tracker for free!