Part II in our series on self-directed investing.

Welcome to the second post in our series on self-directed investing.

Part one introduced the idea of taking ownership of your portfolio.

For those of us with the time, inclination and

discipline, taking ownership of our portfolio makes more sense than trusting

our financial future to fund managers who charge fees and who don’t always beat

the market.

(Go here first if you haven’t read the post yet.)

In this second post, we’re going to discuss some of

the important choices you need to make when creating and managing an investment

portfolio.

These choices divide broadly into two major questions.

- How will you approach building your investment portfolio?

- Which assets will suit your approach?

There’s a lot to cover in this installment of the

series, but we’re going to keep it simple to give you a broad overview (see the

bottom of this page for a list of great in-depth articles we recommend for

continued reading).

Before we get into the types of strategies and assets

you might wish to consider, a quick word about investing in general.

No two investors are the same.

That might sound obvious, but it’s worth remembering

that no single investment strategy can suit everyone.

In our experience, your best bet is to learn how different investors use various strategies to create and manage their portfolios…

Cherry pick the aspects that you identify with and

that fit with your own goals…

And create a strategy that fits your own financial and

personal situation.

This is better than trying to replicate what other

people have done in the past.

Because they are not you. And now is not then.

There’s a vast number of factors to consider when

forming your strategy and selecting investments for your portfolio.

Your financial goals, your obligations, your appetite

for risk, the amount of time and energy you’re prepared to put into researching

and monitoring your investments — these are just a few.

It’s important to be clear on where you’re at in your

investment journey, your career and your life in order to build a strategy that

will best serve your goals.

Your Game Plan: Buy And Hold, Value Investing And More

“You can’t adjust your portfolio based on the whims of the market, so you have to have a strategy in a position and stay true to that strategy and not pay attention to noise that could surround any particular investment.”

— John Paulson, Multi-Billionaire American Businessman

Like

we said, our aim here is to give you a broad overview of the types of

strategies you can deploy for your portfolio.

These

portfolio management styles are by no means a comprehensive list of those at

play in the markets today, but they do broadly represent the spectrum of

approaches you’ll find among investors.

Buy & Hold Investing

‘Buy

and hold’ investing is the ultimate slow and steady strategy.

This

style of investing is exactly as it sounds: You buy investments with a view to

holding them for a very long time — like decades.

This

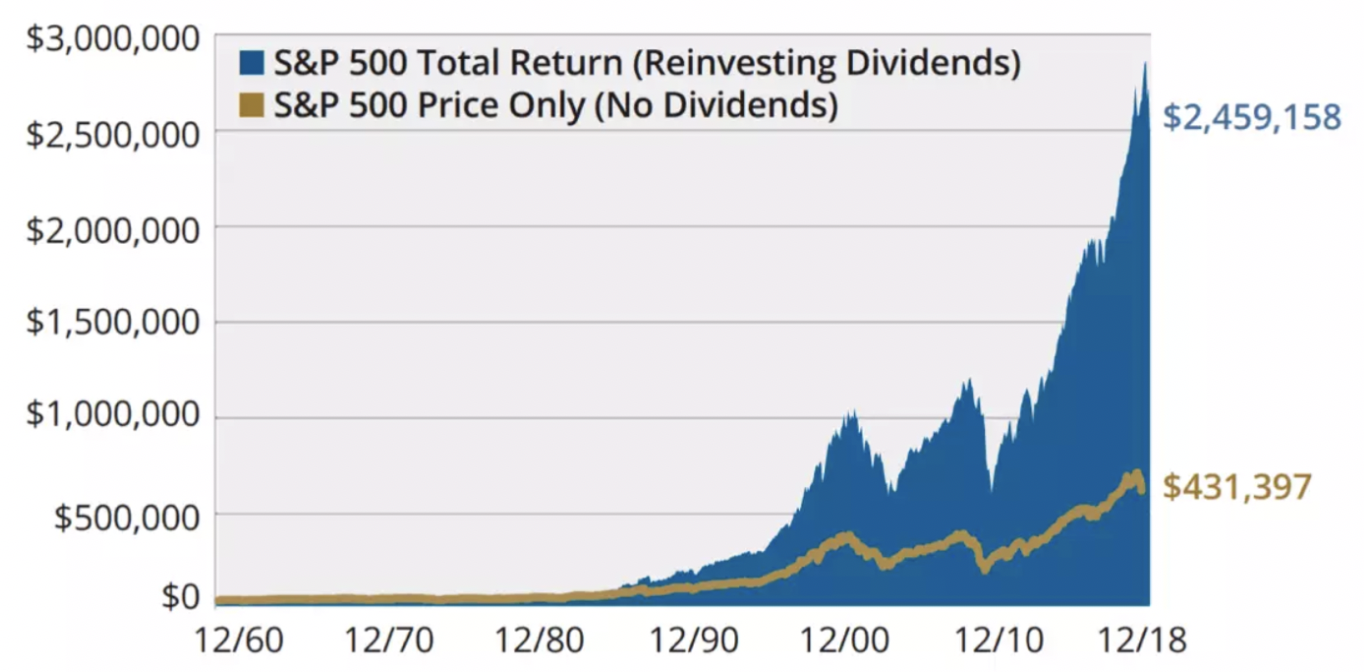

strategy hinges on the idea that, over the long term, stocks always go up and

the returns are always good, if not spectacular.

You

may have heard the phrase ‘time in the market is better than timing the

market’.

Buy

and hold investing is hands-off in that you make your decisions early, and then

largely leave your portfolio to grow and generate income for a very long time.

Value Investing

A

‘value stock’ is a stock which an investor calculates to be trading at a lower

price than it should be.

Value

investors look to create portfolios full of assets that — according to their

research and analysis — will rise over the medium term as the market price

catches up to the true value of the business.

Warren

Buffet is widely regarded as being one of the greatest at picking undervalued

stocks and holding them long enough to generate substantial returns.

Value

investing is more hands on than buy and hold.

But

it is flexible, depending on what sorts of sectors and assets you dive into.

Growth Investing

Growth

investing is more aggressive than the two strategies above.

The

idea is to ‘buy high and sell higher’, using the momentum of a rising stock

market to capture short and medium term gains from stocks riding high on a wave

of optimism and economic growth.

Many

tech companies can be classed as growth stocks.

Growth

stocks tend to be smaller, faster growing businesses that are capturing market

share.

Growth

investing requires a higher tolerance for risk, and in most cases a more active

approach to portfolio management (more frequent buying and selling).

Portfolio Theory

Portfolio

theory is less about which types of stocks you invest in, and more about balancing

the mix of assets you hold in a particular way.

The

idea is to capture maximum upside from your portfolio while minimising the risk

you take by being exposed to the market.

Key

to this is diversification, which you no doubt have heard about before.

Diversification

is a way to spread risk between distinctly different type of investments, like

stocks, bonds, exchange traded funds and so forth.

Diversification is about creating a mix of investments that balance out gains and losses in the short term, and grows in value over the longer term.

Choosing Investments

For Your Portfolio

“The secret is if you have a lot of stocks, some will do mediocre, some will do okay, and if one of two of ’em go up big time, you produce a fabulous result.”

— Peter Lynch, averaged 29.2% return for 23 years straight

There are many different types of assets you can invest in

within your portfolio.

The sort you go for will depend on the strategy you pursue, which as we mentioned will depend on your goals, risk tolerance and so on.

We often talk about

the types of assets and financial instruments in terms of a ‘risk ladder’.

At the bottom of the

risk ladder is cash (or precious metals if you prefer, but we won’t discuss

that here).

Cash

Cash in the bank is

the simplest investment asset.

It guarantees your

capital and gives you exact knowledge of your return (the interest rate).

It’s how most of us

store our wealth by default.

The problem with

cash, though, is that interest rates tend not to beat the inflation rate

(meaning your cash’s value will diminish over time).

Bonds

Bonds are next up the

risk ladder. A bond is a debt instrument.

You buy a bond from a

government or business and they guarantee to pay you a fixed interest rate

while you hold it.

Bonds are a common

way for organizations to raise capital.

Interest rates on

bonds tend to be better than what your cash will earn in the bank.

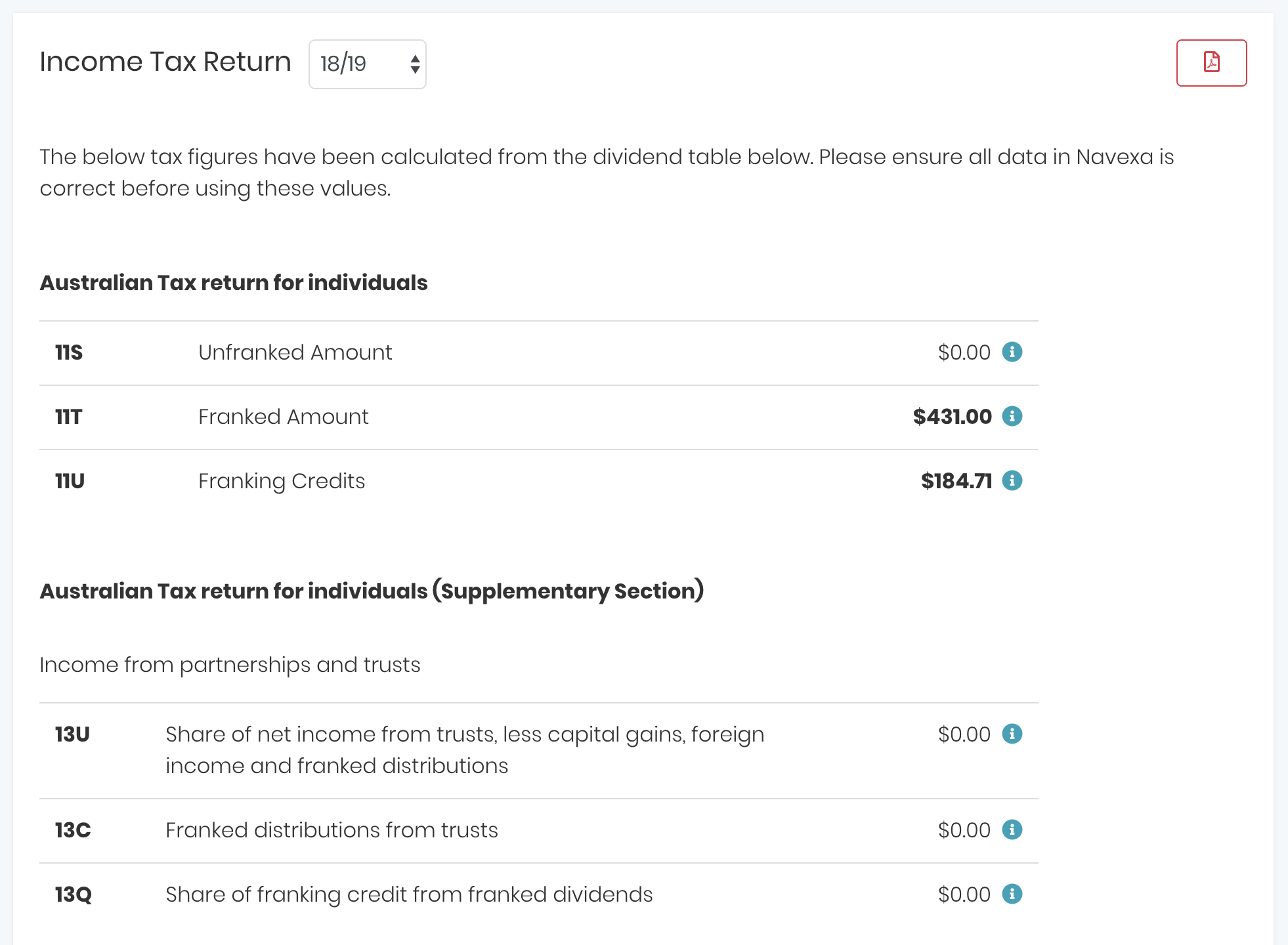

Stocks

Stocks essentially

let you participate in a company’s activities.

You own a shares in a

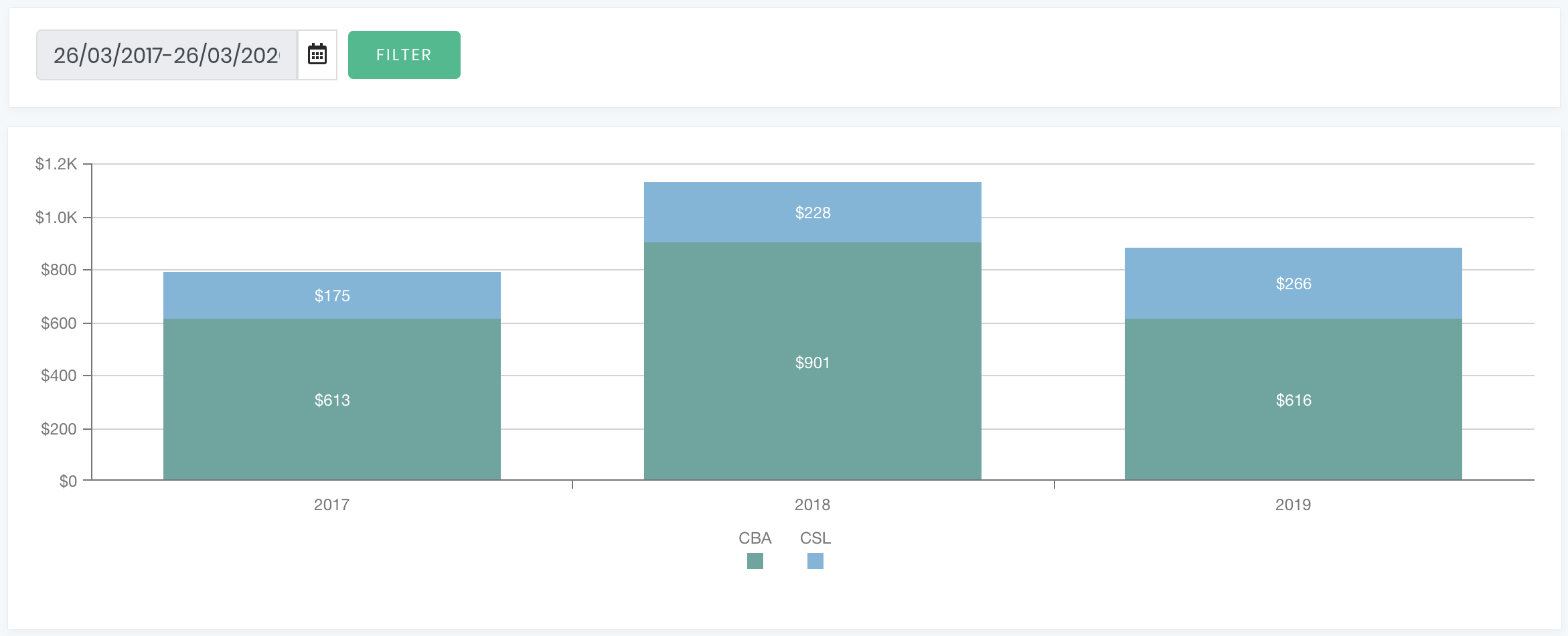

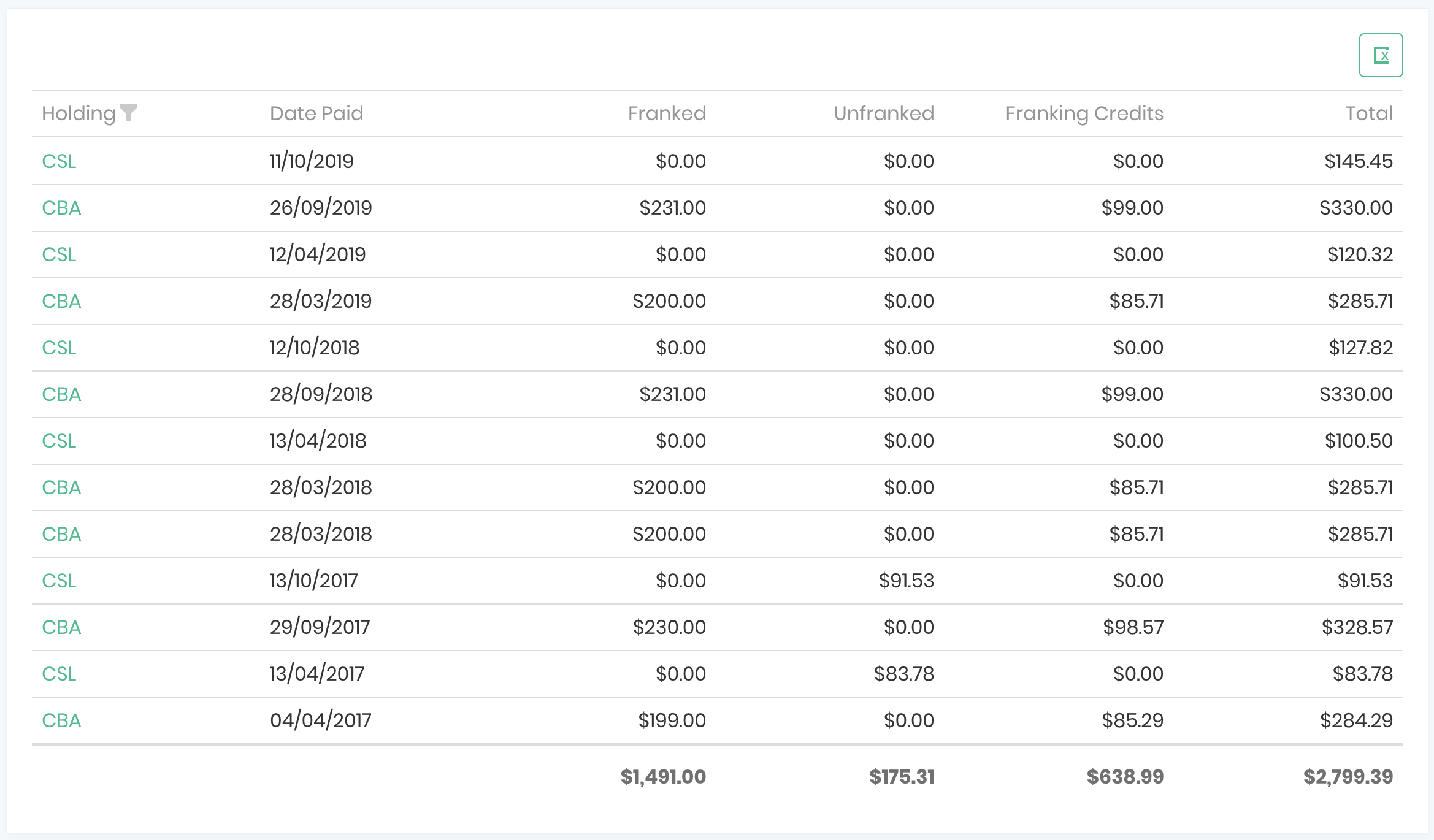

business. Those shares can rise, fall and pay income in the form of dividends.

Within stocks (or

equities), there is another risk ladder, which spans from the bottom to the top

of the business world.

Big, established

companies that pay good dividends and have a record of climbing over the long

term are known as blue-chip stocks, or sometimes income stocks.

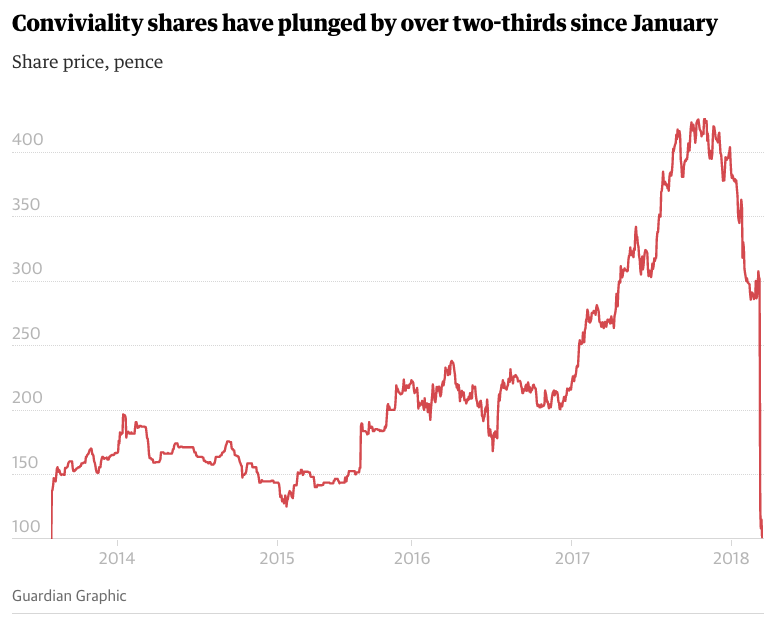

Growth stocks are

smaller businesses on an upward trajectory. They are riskier but can deliver

bigger, faster returns.

Risker and more

dynamic again are small-cap and penny stocks — small, unproven companies aiming

to capture market share.

These stocks can rise

and fall dramatically, meaning investors who hold their shares stand to gain

and lose proportionally.

Mutual

funds & ETFs

A mutual fund is an

investment fund where many investors pool their capital and allow a

professional fund manager to control it.

Mutual funds focus on

certain sectors or types of investments.

Some mimic particular

markets and all aim to deliver solid, reliable returns.

These funds do charge

management fees, though, and require you to allow a third party to select the

assets the fund invests in.

An ETF — or

exchange traded fund — tracks an underlying index, like the ASX200, for

example.

Owning shares in an

ETF exposes your capital to a specific mix of assets.

Like stocks, ETFs

vary greatly in risk depending on the sector or market they track.

Their popularity has

exploded in the past few years.

The approach ETFs

allow you to take — essentially buying an entire market or sector with low fees

— appeals to some of the heaviest hitters in the financial world.

Buffett told CNBC he

thinks using ETFs “makes the most sense practically all of the time”.

Mark Cuban, another

billionaire rockstar of the investing world, also likes cheap index funds as a

way for new investors to start building their wealth.

The growing FIRE (Financial Independence & Retiring Early) community is also quite fond of ETFs as a wealth building tool.

Again, this isn’t an

exhaustive list of the types of assets available to Australian investors — we

haven’t covered commodities and derivatives — but this gives you an idea of the

basic options you have when creating a portfolio.

Selecting

The Right Mix Of

Assets For Your Chosen Strategy

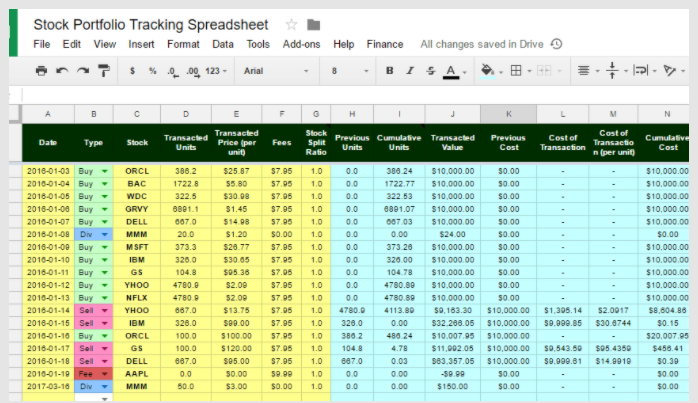

Choosing an investment strategy and a mix of assets for your portfolio requires, above all else, clarity.

You need clarity on what you want to achieve, what you’re prepared to risk, and how much time and energy you want to put into managing your portfolio.

Building a portfolio is a lot like buying a new car.

No car is going to suit two drivers the same.

Maybe you want a people mover that offers great fuel economy so you and your family can take a long, relaxing drive.

On the other hand, perhaps you want a high performance sports car that costs loads to fuel but which delivers extreme speed and handling.

Carefully consider your goals and what you’re prepared to do to hit those goals.

If you’ve never bought a stock before, go read about my experience buying my first shares and how a careful, deliberate approach has allowed me to more than triple my investment.

Recommended articles for further reading:

https://www.thebalance.com/top-investing-strategies-2466844

https://investormint.com/investing/types-of-stocks