Last year was packed from beginning to end with extreme and unexpected events. The cryptocurrency markets were no exception. In this post, we reveal the top 10 performing cryptos in 2020, how they compared to the top performing stocks, and share some analysis and predictions on Bitcoin and the wider crypto and blockchain sectors for 2021.

Bitcoin is the coin we most often talk about when discussing the boom and bust cycle of the cryptocurrency markets. The original crypto recently smashed through US$40,000 to make yet another all-time high.

But looking back on 2020, it turns out Bitcoin didn’t even make the top 10 in terms of gains.

When you zoom out and compare the crypto markets to the major stock markets in the US, you’ll see that the top performing crypto — with a tiny market caps relative to Bitcoin — eclipsed even the so called ‘Golden Bull’ microcap NASDAQ top performer last year.

So what wild and unexpected twists and turns will we see across stocks and cryptos in 2021 after the crises-packed 12 months just gone?

Let’s start with the top performing cryptocurrencies of 2020 (all prices are in US Dollars).

An Average Gain Of Nearly 1,700%: The Top 10 Performing Cryptocurrencies Of 2020

With so many different exchanges and price trackers around for cryptocurrencies, it’s not uncommon for investors to never really know the all-time high for a particular coin.

The same goes for determining the precise price movement for a given period.

According to coincodex.com, the top performers for 2020 were:

KSM: 4,813%

CEL: 3,263%

YFI: 1,832%

THETA: 1,776%

SNX: 1,481%

ZIL: 1,204%

ADA: 662%

ETH: 608%

WAVES: 595%

XEM: 533%

Bitcoin came in 15th, just over 300%, before it embarked on its steep ascent to new highs the first weeks of 2021.

Ethereum was by far the biggest crypto by market capitalization in the top 10, ending the year just over $100 billion.

Top performer, KSM, had just over half a billion dollar market cap.

So you can see that much like the microcaps that come from nowhere each year to top the stock market gains leader boards, it was — apart from ETH — the smaller, lesser recognized cryptocurrencies that produced the biggest gains in 2020.

A $1,000 investment in KSM could have transformed into just under $50,000 in 12 months.

As for the top 10 cryptocurrencies by market cap, this widely-referenced annual experiment spread $1,000 evenly across each.

The return, a less stellar but nonetheless impressive 139%.

Still, when you compare that against the S&P 500’s 16% gain in 2020 (admittedly, still impressive during a pandemic!), there’s no denying where you would have been better investing that $1,000 last year.

Given the explosive start to the year cryptos have had in 2021, what might be possible in the next 12 months? We’ll get to that. First, let’s look at stocks.

NASDAQ Plays Host To Biggest 2020 Stock Gains (Thanks BTC) While Tech Stocks Dominate S&P 500

The NASDAQ more than doubled the S&P 500’s 16% annual gain in 2020, finishing up 43% higher at the end of the year.

But the top performing stocks on those indices gained way more than that.

Technology dominated the S&P 500, where Tesla ended 2020 the top performer on 743%, Etsy delivered 302% and Nvidia gained 122%.

Over on the NASDAQ, however, a string of microcap tech companies not traded on the S&P 500 delivered some crypto-esque gains.

In fact, the top performer, Bit Digital (which gained 3,691%) owed it’s number one status directly to the crypto bull market that took hold late in the year.

The microcap car rental company focused on mining bitcoin, which allowed it to outperform vaccine companies, renewable energy stocks and biotech players.

Three of the NASDAQ’s top 10 last year gained their spots through cryptocurrency activity.

The highest performing non-crypto stock on the NASDAQ last year was Novavax, which received more than $1.6 billion as it emerged as a player in the COVID-19 vaccine contest of 2020.

So it’s not as though last year was a write-off for stocks and a home run for cryptocurrencies.

But, while the best performing stock on the major US exchanges could have turned $1,000 into more than $40,000 (thanks Bitcoin), the top performing crypto last year still could have made you a better return.

And if you’d gone for a more measured approach and deployed that $1,000 across the top 10 cryptos by market cap (which represent most of the capital in the crypto markets), you could still have more than doubled your money, compared to relatively weaker double-digit gains from the NASDAQ and weaker again from the S&P 500.

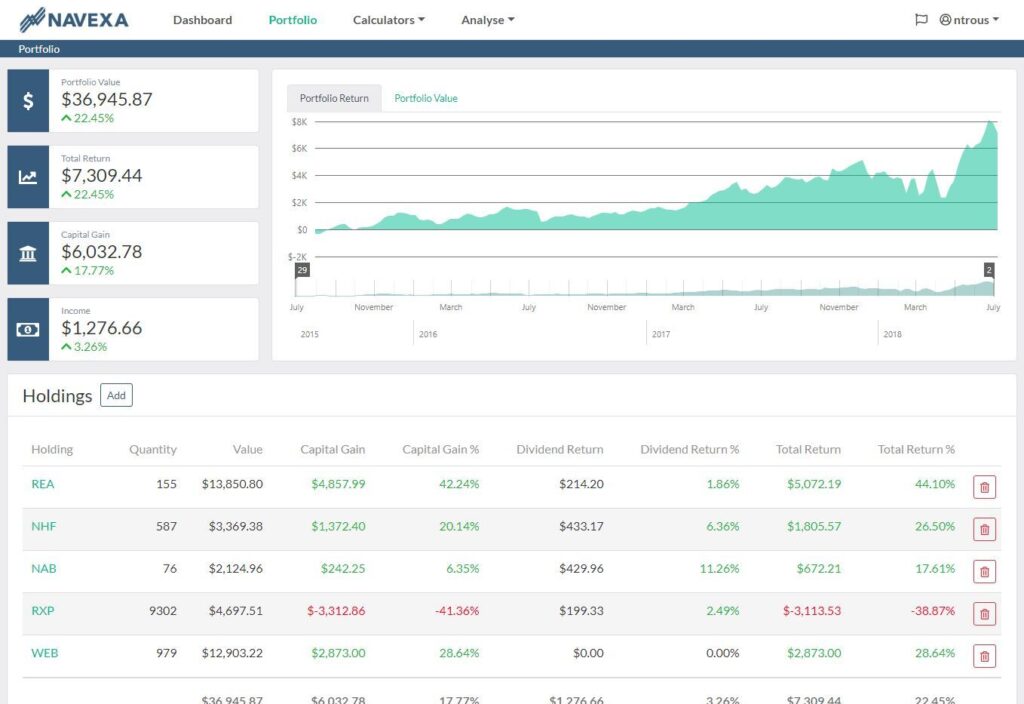

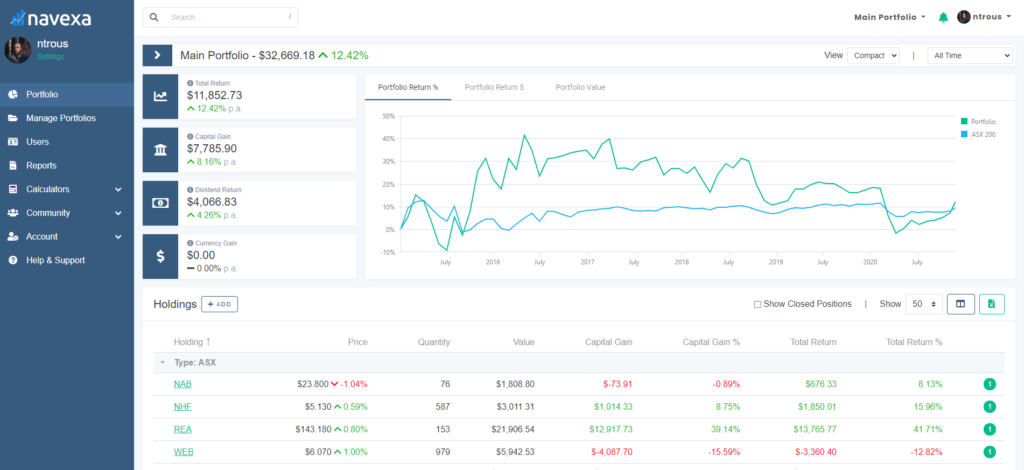

Here at Navexa we aren’t in the business of telling you what to buy or sell.

Whether it’s an asset class, a sector or an individual investment, we only look at the data. The past is never a guide to future performance for any market, sector or investment.

When you consider what a wild ride the world and the markets went on last year, you can understand why making predictions about 2021 is especially fraught.

Our Crypto Analyst’s Three Predictions For 2021

Aaron Boyd is a blockchain engineer and co-founder of Pretoria Research Lab in Berlin.

According to Aaron there are three major developments on the cards in the crypto space this year.

The first hinges on continuing monetary expansion and currency devaluation (which you can read more on in our Medium article here).

“Twenty five percent of all US Dollars in existence were printed in 2020.”

That’s not a typo.

The amount of money in the global financial system exploded higher again last year as governments keep up the same strategy they’ve been using to deal with crises for centuries — printing more.

Aaron: “Trillions more Dollars will be printed in 2021 for COVID relief and stimulus packages. This will result in new all-time highs for crypto assets — and stocks.”

That might sound strange, but as fiat currency itself grows less valuable as a result of its diminishing scarcity, that ‘cheap money’ pours into the stock market at the same time as it boosts interest and confidence in Bitcoin’s intrinsic (and decentralized) scarcity.

In other words, in terms of crypto and stock prices in 2021, expect to see more of the what we saw in 2020.

Aaron notes that cryptocurrencies are increasingly becoming a credible alternative hedge to expansive monetary policy.

Gold and other precious metals have historically held this safe haven role.

But in 2021, we’ll see more private investors and institutions choosing Bitcoin over bullion.

It won’t all be smooth sailing and ever higher prices, though, according to Aaron.

“There will be another market correction after the past couple of months’ bull run.

“Bitcoin will be declared dead for the 417th time!”

No Matter Where Stocks & Cryptos Go In 2021, Make Sure You’re Effectively Tracking Your Performance

Whichever way you slice it, 2021 is going to be an unprecedented year for the markets.

Bitcoin probably could be declared dead yet again… And then go on to hit $100,000 a month later.

That’s not a prediction. But after such a turbulent 2020, you have to concede that anything is possible this year — in both stocks and cryptos.

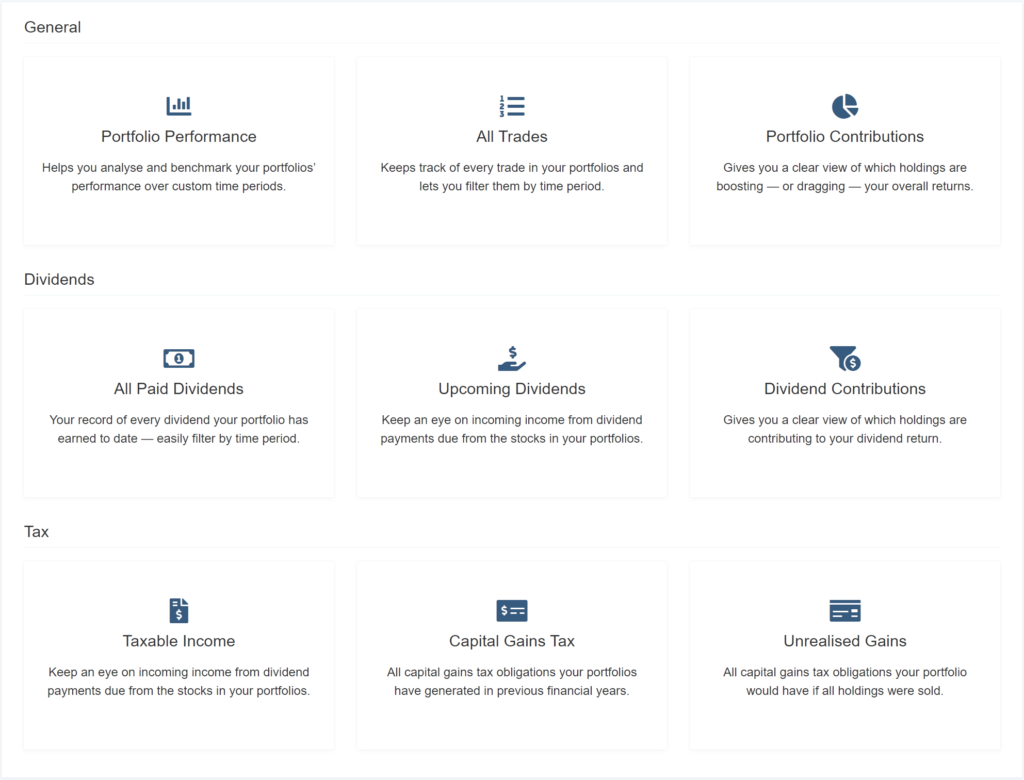

Whether you’re investing in one or both, make sure you’re getting the data and insights you need to make informed decisions.

The Navexa portfolio tracker gives you the tools to track, analyze and report on ASX, NASDAQ and NYSE holdings and every cryptocurrency, as well as cash accounts and unlisted investments.