What is dividend reinvestment? How can you harness it in building your wealth? We explain this powerful type of income investing.

You have two options.

Option A allows you bank a capital gain of $400,000 on an investment over 20 years.

Option B allows you to bank $2.4 million on the same investment over the same time period.

Which do you choose?

As far as no brainers go, this one shouldn’t require a nanosecond to decide.

So how is it that the same investment could produce such drastically different gains over the same time period?

The answer is a simple — but super powerful — investing tool called a dividend reinvestment plan.

Dividend reinvestment is exactly what it sounds like: The reinvesting of income earned from a dividend paying stock.

How Does Dividend

Reinvestment Work?

Compound interest is the eighth wonder of the world.

— Albert Einstein

Einstein was once asked — allegedly — what he thought was the eighth wonder of the world.

His response: ‘Compound interest’.

‘He who understands it’, Einstein said, ‘earns it. He who doesn’t, pays it’.

A dividend reinvestment plan allows investors to tap into the deep power of compound interest.

Here’s how it works.

Companies that pay a dividend to shareholders can offer a dividend reinvestment option to those investors.

This means that instead of collecting cash then your stock pays a dividend, you instead reinvest that cash into more shares.

In other words, rather than accumulating cash in your trading account, you accumulate more shares.

That means your dividends compound in the form of capital.

The more you reinvest, the more shares you accumulate.

And the more shares you accumulate, the larger (in theory) your dividend grows over time.

As Einstein says, compounding can work for or against you.

If you have a loan you’re paying interest on, generally speaking, the longer you take to repay that loan, the more interest you’ll pay on it.

That means you’ll lose more money the longer you keep the debt.

But dividend reinvestment plans allow you to flip that equation and make compounding your ally.

And as with debt, the longer you keep it, the more the interest will accumulate.

Compounding is why…

Dividend Reinvestment Is A

Powerful Long-Term Investing Tool

A large income is the best recipe for happiness.

— Jane Austen

Take a look at this chart.

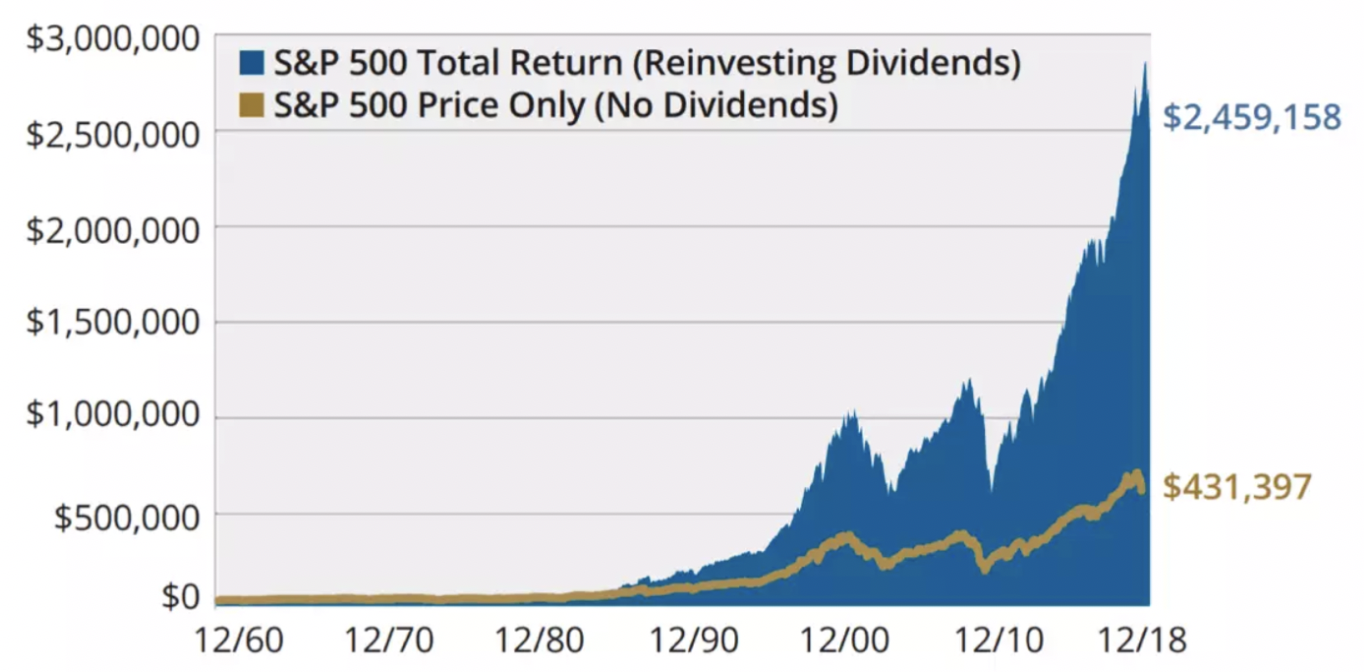

This shows you how a $10,000 investment in the S&P 500 index could have grown from December 1960 to December 2018.

As you can see, by using the dividend reinvestment policy, you would have accumulated a huge capital gain compared with collecting cash dividends for the duration of the investment.

This is of course a very long-term example.

But it shows you the potentially major long-term power dividend reinvesting represents to investors who are prepared to buy and hold income-paying stocks for a long time.

The biggest upside of dividend reinvesting is obviously the potentially generous lump sum you could access if you sell out of the stock after a long enough period.

The biggest downside is of course that you need to forgo regular income from cash dividends in order to tap into the power of compounding like this.

So, if you are considering using a dividend reinvestment policy with your dividend stocks, you should know this:

Navexa Automatically

Tracks Your

Australian Dividend Reinvestment

If you’re a Navexa user, you don’t need to worry about manually tracking your dividend reinvestments.

That can quickly get messy and confusing, as stock prices and dividend amounts fluctuate over time.

The good news is that your Navexa account allows you to automatically track your reinvested dividends.

Simply toggle the dividend reinvestment option to ‘on’ when you view that holding.

Navexa will then record each dividend as reinvested and reflect this in your capital gains.

You can track how many new shares each dividend payment amounts to and chart the accumulation and compounding over time.

All with one click.

We hope this have given you an insight into the power of compounding as it applies to dividend reinvestment.

And if you’re not already a Navexa user…