Our guide to what is — and is not — taxable for cryptocurrency investments in Australia. From basics like capital gains tax from selling crypto, to paying tax on crypto staking income, declaring capital losses and understanding how the ATO treats DeFi.

If you’re buying and selling cryptocurrencies in the hope the Australian Taxation Office either won’t know about, or won’t be able to tax, your profits and income, I have bad news:

Crypto’s ‘wild west’ days — at least in terms of mainstream adoption and regulation — are gone.

While you’ll find many a tweet about how ‘it’s not too late to be early’, it is, in fact, too late to slide into what was once a murky, misunderstood world of strange new digital currencies.

(As an aside, I first heard about Bitcoin from a friend of a friend on a tram in Melbourne around 2013. That was early.)

The markets have grown exponentially since Bitcoin’s inception.

Today, the Australian government, like many others around the world, has a greater grasp on the cryptocurrency markets and blockchain technology than ever.

As you’ll see in this guide to crypto tax in 2022, as the technology and markets for digital currencies and assets grows and becomes more complex, so do the tax laws surrounding them.

Now, more than ever, Australians investing in (or trading) the cryptocurrency markets need to prepare themselves to accurately track, report and declare their activity.

As the ATO states:

‘Everybody involved in acquiring or disposing of cryptocurrency needs to keep records in relation to their cryptocurrency transactions.’

This guide covers basic concepts around how the government in Australia treats digital currency for tax purposes, capital gains and taxable income, tax deductions and even tax-free digital asset transactions.

Plus, we’ll introduce some useful services and tools which may be helpful in tracking and reporting all the information the ATO requires when lodging crypto information at tax time.

Please bear in mind this article is neither tax nor financial advice. It is general information collated from credible sources, including the ATO.

The ATO Knows About Your Cryptocurrency

As the crypto markets and the platforms people use to navigate them have grown in recent years, there’s been an increasing emphasis on ‘know your customer’, or KYC practices.

KYC is a way both for governments to impose regulation on crypto providers, and a way for crypto providers to communicate legitimacy — and distance themselves from the criminal activity which continues to plague the fast-evolving crypto space.

In Australia, this means you can’t register for a crypto exchange or wallet without providing documents and details that prove your identity (like your driver’s license or passport) and address.

The crypto providers, in turn, must provide details on their customers to the ATO, which began collecting details in 2019 to ensure Australians active in the crypto markets were complying with tax laws.

So if someone doesn’t declare their crypto activity, that doesn’t mean the Australian government won’t know about it. And, when someone does report it, the ATO can match what’s reported with what they have on file as a result of their data matching program protocol (the current version of which runs until 2023).

In other words, it’s probably not going to work out well for those who attempt to dodge declaring their crypto activity or paying tax on it — see here for more.

The ATO Can Legally Tax Australian Residents’ Crypto Activity

Australian tax law and the ATO have caught up to the crypto markets significantly in the past few years. As we mentioned, the wild west days are over. While Bitcoin survives, it’s now one of thousands of digital currencies.

Today, those investing in and trading ‘virtual currency’ need to accept taxation as a given, just as they would with traditional stocks and other assets.

As the crypto space continues to expand in bold new directions (while initial coin offerings were once crypto’s hottest topic, NFTs are the latest booming multi-billion dollar acronym), the tax regulation surrounding it grows ever more complicated.

Below, you’ll find introductions to many different tax scenarios surrounding various areas of the crypto markets (like DeFi and staking).

The basic premise though, is this: The ATO does not treat virtual currencies like currency at all. It’s not ‘money’ for tax purposes. They treat digital assets as property.

For the purposes of applying capital gains tax, or CGT, the ATO treats crypto like any other investment asset (like shares or property). In other cases, it will treat crypto as taxable income.

The ATO makes a distinction between two types of crypto activity.

The Difference Between Investing In & Trading Cryptocurrency

As in the traditional investment markets, there’s a distinction between investing and trading in crypto, too. Some people buy some Bitcoin or Ethereum in the hope they’ll someday realize a huge profit.

Others will buy and sell frequently, perhaps even as their full-time job.

With crypto, the ATO makes this distinction between investors and traders.

How a person classifies their crypto activity has a significant impact on how they’ll be taxed on it in Australia.

You’re A Crypto Investor, If…

You are an individual buying crypto for the purpose of generating a future return. This means you buy and sell digital currencies as you would shares in a company, with the same goal — profiting from long-term capital gains as those assets rise in price.

Generally speaking, most Australians in the crypto space would be classed as investors by the ATO.

You’re A Crypto Trader, If…

You use crypto activity to make an income from a business. This includes short-term buying and selling, mining crypto, and operating an exchange, for example. Whatever proceeds you generate from your crypto business activities, the ATO treats as taxable income.

Obviously, given the ATO’s oversight on crypto activity in general, both of these use cases demand detailed record keeping, regardless of how seriously or casually one is active in the market.

The big difference from a tax perspective is that while investors can qualify for capital gains tax discounts (resulting from holding an investment longer than 12 months), traders cannot, since their crypto profits are classed as taxable income, not capital gains.

For the purposes of this explainer post, we’ll focus on crypto investing, not trading.

Which Crypto Activity Does The ATO Tax?

In short, everything. The ATO classifies four main CGT events for crypto activity.

You’ll be taxed when you:

- Sell cryptocurrency (or gift it to someone).

- Exchange one crypto for another.

- Convert crypto to fiat currency like AUD.

- Pay for good or services in crypto.

These are just the main taxable events the ATO looks at. We’ll get to the more complex scenarios shortly.

First, it’s worth noting that the ATO doesn’t consider a digital crypto wallet as an asset. Rather, it treats the individual crypto assets within a wallet as separate CGT asset (the same way that an investment portfolio is not taxable — the investments within it are).

Paying Tax On Crypto Capital Gains

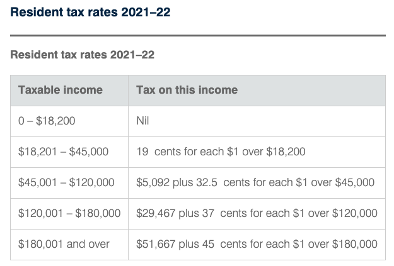

Australians pay capital gains tax on their crypto investments at the same tax rate they pay on their personal income for the financial year.

So, for example, if someone earns $100,000 from their employment and makes a $20,000 profit from selling some Bitcoin and Ethereum, they’d held for less than 12 months, their capital gains tax rate would be 32.5%.

This means they would be taxed $6,500 on the capital gains they realized by selling their crypto.

It’s important to note that capital gains tax rates differ for individuals, companies and self-managed superannuation funds in Australia.

More on individual income tax rates here.

Capital Gains On Crypto Held More Than 12 Months

Australian tax law makes a distinction between long term and short term capital gains. This effectively incentivizes investors to hold investments for more than a year.

In the example above the investor has held their Bitcoin and Ethereum for fewer than 12 months before selling and realizing their capital gain.

This means they pay the same tax on their crypto gains as they do their personal income (for tax purposes, capital gains profits are added to other income to determine the tax rate).

But if they held the Bitcoin and Ethereum for more than 12 months, they’d qualify for a 50% CGT discount.

So, instead of paying $6,500 of their $20,000 capital gain, they’d only need to pay $3,250 — substantially less money.

Learn more about capital gains tax obligations in Australia here (ATO) and here (NAB).

Declaring Capital Losses On Crypto

Of course, people don’t always sell cryptocurrency for a capital gain. If someone bought 100 Solana at $100, got excited when it rose to $150, but then panicked when the coin dipped back to, say, $70, they might choose to sell to stop any potential further losses.

In that case, they’d be selling for $7,000 a crypto investment they paid $10,000 for in the first place — realizing a $3,000 capital loss.

Firstly, they don’t need to pay any tax on the $7,000 they received from selling the asset, since it represents a loss. Secondly, they can deduct that $3,000 loss from any other capital gains they might declare in the same — or a future — financial year.

Going back to the previous example, assuming someone needed to pay a $6,500 capital gains tax on their crypto profits, but had in the previous year realized a $3,000 loss, they could apply that loss in their current tax return, bringing the total payable CGT on their crypto down to $3,500.

Declaring a capital loss on crypto can allow an investor to offset gains they may have realized not just on other crypto, but on shares or property. They cannot, however, carry them over as a deduction on regular income.

Paying Tax On Crypto-To-Crypto Transactions

The ATO doesn’t just view selling crypto for fiat currency (like AUD) as a CGT event. It also requires Australian investors report any crypto-to-crypto transactions for capital gains tax.

Remember, for tax purposes in Australia, every asset within a digital wallet is considered a separate CGT asset. So when people trade between different assets within a wallet or on an exchange, they need to track and record this like any other investment CGT event.

Since crypto is effectively property as far as the ATO is concerned, its value is based on a given currency’s market value at a given time.

Here’s an example to illustrate crypto-to-crypto tax in action:

Crypto-Crypto CGT Example

An investor trades some ETH for some SOL.

Say they bought $2,000 worth of ETH. Over three years, their $2,000 investment rises to $6,000.

Then, they trade it for $6,000 worth of SOL. By doing so, they realize a capital gain of $4,000, because they’re effectively ‘selling’ out of their ETH investment. It’s just that they’re realizing their gain in SOL, as opposed to AUD.

So while they don’t convert any crypto back into AUD, they still need to declare this trade as a CGT event when they file their tax return.

Similarly, had their ETH investment fallen by 50% to $1,000, and they’d traded that for SOL, they’d be able to declare a capital loss of $1,000.

Transferring crypto between different digital wallets is not a taxable event in Australia, since people don’t realize a capital gain by doing so.

Crypto Staking Rewards = Taxable Income

Crypto ‘staking’ is a blockchain mechanism whereby holders of particular cryptocurrencies can contribute to the coin’s blockchain by making their coins available to help validate transactions.

If that’s too complex, don’t worry. The simpler way to think of crypto staking is like a savings account that pays interest.

When you stake crypto, you earn more of that crypto back as a percentage of the amount you choose to stake on its blockchain.

For example, say I have 100 SOL worth $10,000 ($100 each) and I choose to stake it at a rate of 7% per annum. Nine months later, I ‘unstake’ my SOL and receive an extra 5.25 SOL in staking rewards.

Let’s say in the nine months I staked my SOL, the value rose 50%.

So when I receive my new 5.25 SOL, they’re worth $787.50 — the market value at the time I receive them.

How To Treat Staking Rewards For Tax Purposes

Unlike the other transactions we’ve looked at so far in this post, the ATO considers staking rewards as ordinary taxable income.

This is different from a capital gain. In this case, the $787.50 gets added to my regular income (like my salary, for example) and taxed at the appropriate personal tax rate.

In other words, it’s taxed like interest I might earn from keeping money in a savings account.

But, were I to sell the extra SOL I earned by staking my initial investment, I would have to pay capital gains tax on that — although the base price would be the market value at the time I received it, not the price I paid for the initial investment.

Crypto Tax On Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, is one area of crypto where Australian tax policy is seemingly still playing catchup.

DeFi is, in basic terms, is the finance marketplace on the blockchain. As the name suggests, this is finance without centralization — or intermediaries like banks, finance brokers or credit card companies.

DeFi protocols allows people to lend and borrow capital through blockchain-based peer-to-peer financial networks.

While you could argue DeFi is still in its infancy, reports suggest there is already nearly $1 trillion ‘locked’ into DeFi protocols such as Aave (AAVE), Solana (SOL) and Uniswap (UNI).

At this stage, while the ATO doesn’t have any specific guidance as yet, this doesn’t mean that DeFi activity can’t be taxed.

If someone uses a DeFi protocol to earn crypto, chances are the ATO would consider this taxable income. And like crypto staking, if they sold or traded any crypto earned through DeFi, this would trigger a CGT event.

This excellent guide details the possible tax implications of various DeFi actions.

Tax Breaks For Australian Crypto Investors

It’s not all tax obligations when it comes to crypto activity for Australian investors.

As with traditional investments, there are three main ways the ATO offers tax relief.

The first is the standard personal income tax break on the first $18,200 of personal income. While it’s probably unlikely someone in the crypto markets would make less than that in a financial year, it is, technically possible to pay no tax on crypto gains in this respect.

Second, the 50% capital gains tax discount is not to be underestimated. If someone realized $100,000 in gains on crypto they held less than 12 months, and that gain is taxed at the highest rate (45%), they’ll net just $55,000.

But, if they tactically hodl longer than 12 months before realizing the gain, that $45,000 tax bill comes down to $22,500 — meaning they keep $77,500. This is a significant financial difference when you consider that the difference between ‘less than’ and ‘more than’ 12 months is a single day.

The third way Australians can qualify for a crypto tax break is through personal use. The window for claiming crypto activity as personal use is quite small. Basically, if someone buys up to $10,000 worth of crypto and then immediately buys something else with it, they can claim personal use (as opposed to investing for a future gain).

As with everything when it comes to crypto tax, it’s always important to closely track and record every transaction. The burden of proof is on investors to produce the records required to prove what they claim in their tax return.

Tax-Free Crypto Transactions? They Exist!

Not only are there tax breaks available to those investing in crypto in Australia — there’s even a list of crypto transactions that trigger no tax events.

These are, of course, transactions in which the person probably won’t make a significant profit.

Australian investors won’t pay crypto tax when they:

- Buy cryptocurrency

- Receive cryptocurrency as a gift

- Give cryptocurrency as a charity donation

- Hold cryptocurrency (even if it goes up 10,000%)

- Receive cryptocurrency from ‘hobby’ mining

- Move cryptocurrency between digital wallets

- Buy goods and services up to the value of $10,000 using cryptocurrency (see the personal use scenario above)

Where To Find Tools & More Information About Crypto Tax In Australia

It might seem difficult to understand the nuances of crypto tax law in Australia. But the reality is that for the average crypto investor —someone who buys and sells crypto with the objective of making some money — it should be pretty straightforward.

By and large, you could apply the same tax rules to your crypto portfolio as you would for investments in stocks.

If you sell an investment for a capital gain, you’ll need to pay a capital gains tax.

If you make money from an investment, you’ll need to declare it as income and pay tax at the marginal rate applied to your total income for the financial year.

But, as you’ve seen in this post, things can quickly grow more complex the deeper you get into the crypto markets.

Here at Navexa we’re proponents of continuously searching for and acquiring financial literacy.

Here are some resources we consulted in putting this guide together that may help you with your own crypto investing and tax reporting:

Where To Learn More About Cryptocurrency Tax

- The Australian Tax Office

- Australian Crypto Tax Guide 2022 (Updated Regularly)

- Cryptocurrency Taxes In Australia (2021-2022 Guide)

- Crypto Tax Australia Guide 2022

As always, seek professional advice and support when considering investing and its tax implications!

Navexa: Automated Tracking For Crypto Capital Gains & Income

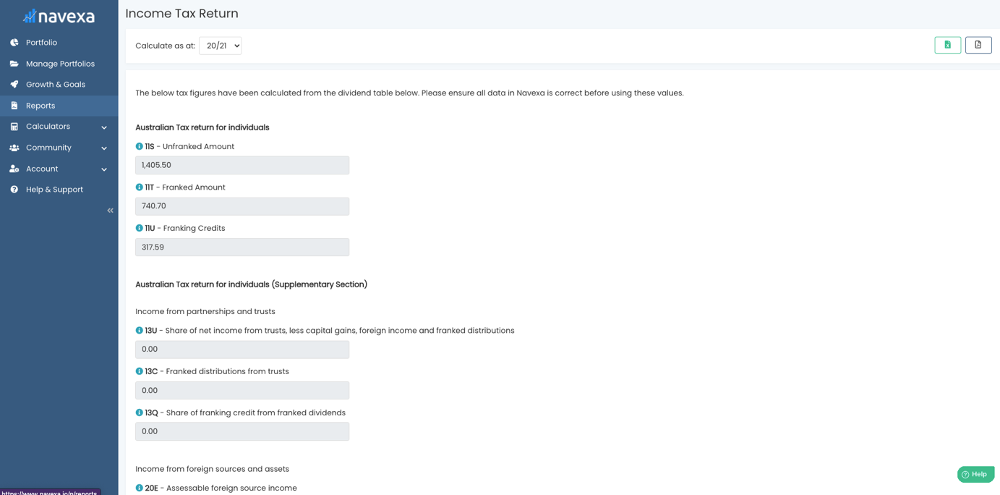

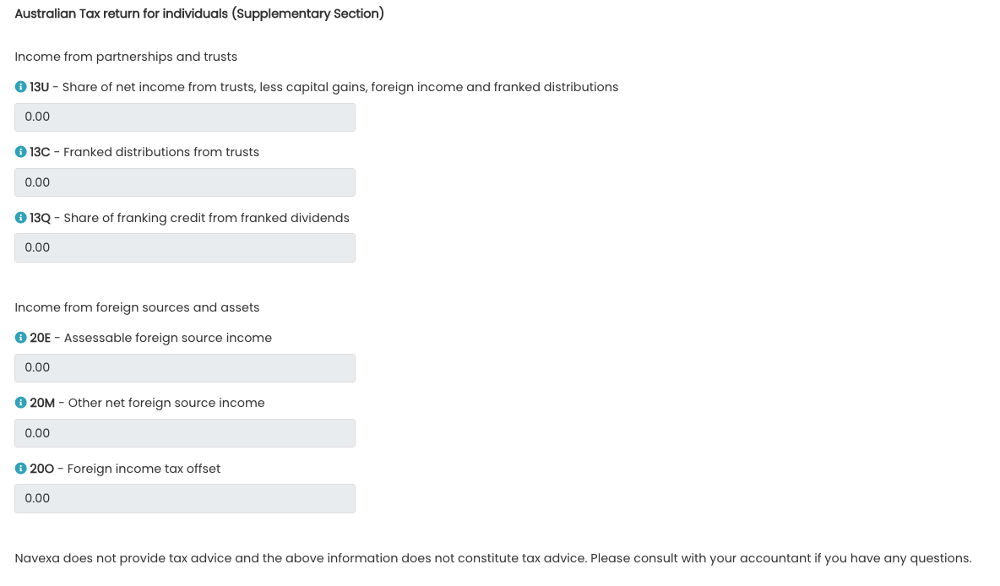

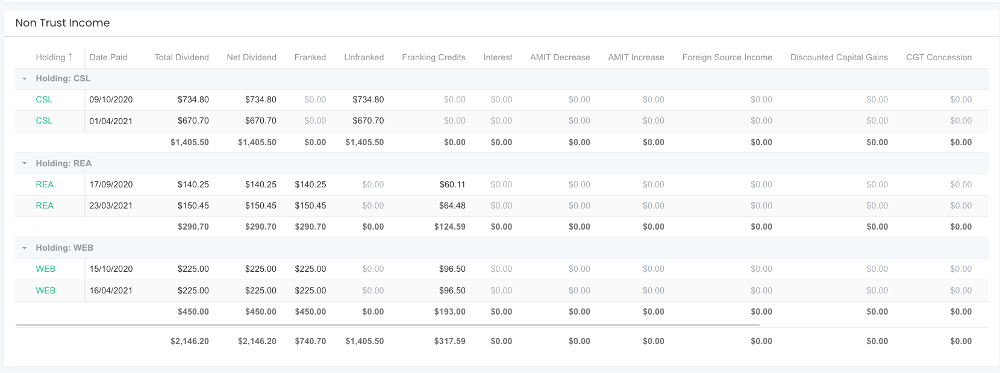

If you’re investing in cryptocurrencies and you’d prefer a quick, automated way of not only tracking your portfolio performance and returns, but also of generating comprehensive, accurate tax reports, try Navexa.

We’ve developed Navexa to give investors radical insight into how their portfolio performs over time.

Not only does the platform break down your total return by capital gains and dividend income, it calculates the impact of trading fees on your portfolio performance.

As you may already know, trading fees can have a massive impact on crypto transactions. The Ethereum blockchain has been notorious in recent years for slapping users with transaction fees which often outweigh the value of the coins being transacted.

If you don’t consistently and accurately track the impact of fees on your crypto investments, you may end up with a distorted picture of how they’re performing.

Proper tracking is also a requirement if you find you need to provide detailed information to the ATO regarding your tax return. As we outlined above, you need to be able to show the fine details of transactions to substantiate capital gains, losses and income that you’re claiming in a tax return.

While you can pull this information together using data from exchanges and wallets, Navexa allows you to consolidate your crypto portfolio data even if you trade across multiple platforms.

Remember the 50% capital gains discount the ATO offers on crypto investments held longer than 12 months? If you’re filing a tax return containing 100 trades off various sizes across 100 different dates within the financial year, calculating which qualify for the CGT discount could quickly become a headache.

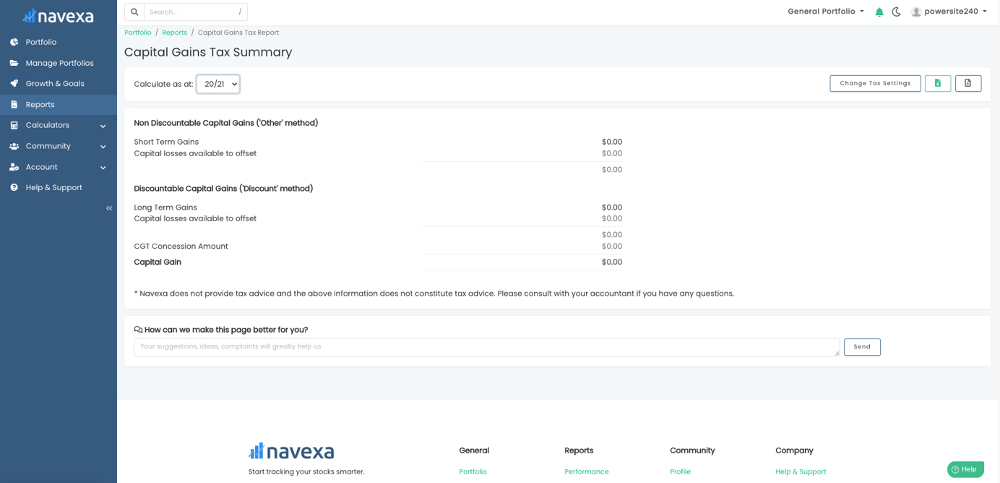

With Navexa’s tax reporting tools, this calculation is completely automated — your account gives you a detailed breakdown of which holdings qualify and which do not in a single click (so long as all your portfolio data is accurate and up to date!).

We’ve built (and are constantly) developing Navexa’s analytics and reporting tools to empower investors in stocks and crypto to get powerful insights into their portfolio performance and make calculating and reporting tax details fast and easy.