CommSec is one of the most popular trading platforms in Australia. I’ve been a customer for nearly a decade. In this in-depth CommSec review, I share my experiences and give my honest opinion on the pros and cons.

If you’re investing in Australia, chances are you’ve heard of CommSec.

The trading platform attached to one of the country’s biggest banks (Commonwealth Bank of Australia) is one of the highest-profile stock brokers in the national market.

More than half of Australian investors choose CommSec for their share trading, investment research, and more. While the platform’s brokerage fees are among the highest in Australia, it remains a massively popular share trading account choice.

That’s despite the proliferation in recent years of several digital-first trading platforms — like SelfWealth, STAKE and Pearler — giving greater numbers of investors greater choice in who they can invest with, with low or even no trading fees.

Run by Commonwealth Bank of Australia, CommSec has been in business nearly 30 years, having launched in 1995. Today, CommSec share trading encompasses both its extensive web platform as well as CommSec Pocket, an ETF-focused mobile app.

My CommSec Review: What I Love — And Dislike — After 10 Years As A Customer

This in-depth CommSec review gives you my honest opinions about the platform.

I’ve been using CommSec to trade since 2013. In my nearly 10 years of researching and executing trades in Australian shares and exchange traded funds with Australia’s largest broker, I have a lot of experience with the platform’s features, strengths, and weaknesses.

I wouldn’t continue to use it were it not a robust, reliable provider of brokerage and settlement services. But, as you’ll see in this CommSec review, while the platform does deliver a lot of value, in my opinion, it’s not perfectly suited to all my needs around measuring and tracking performance.

This CommSec Review will cover:

- How to open and set up a CommSec share trading account

- How to buy and sell shares using CommSec

- A review and comparison of CommSec’s trading fees

- A guide to the CommSec share trading platform’s key tools and benefits

- One critical weakness to CommSec — and other major Australian share trading account providers

- A tool my team and I have designed to help CommSec customers get better, more accurate information about their investments and portfolio performance.

Before you read on, full disclosure: I’m the founder of Navexa, a dedicated portfolio tracking platform. While my product doesn’t compete with CommSec in any way, my views on certain aspects of the CommSec platform may be (let’s face it, they are) biased.

Opening a CommSec Account: Here’s What You’ll Need

If you’re an Australian resident with all your basic credentials at hand, it’s pretty straightforward to open a CommSec account.

Make sure you have these details ready:

- The personal details from an official ID like your passport or driver’s license.

- A valid Australian residential and postal address.

- A valid email address.

- Your mobile phone number.

- Your Australian (or, if applicable, overseas) tax information.

Got all that? Then you’re good to go.

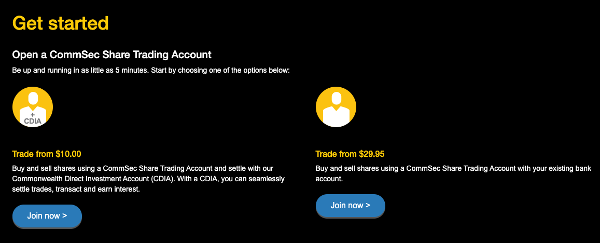

Now, you have two options when you create your CommSec account.

The first lets you create a CDIA (Commonwealth Direct Investment Account) when you create your trading account.

The second lets you use your existing bank account for your trading transactions and settlements.

As you can see, CommSec incentivizes you to open a CDIA with them rather than use another bank account.

Transacting and settling with them means you can trade for as little as $10 as opposed to about three times that if you choose not to.

Your next stop is a standard series of forms, which, I have to say, are pretty painless given the high level of regulation around investment services.

Buying & Selling Shares Using Your CommSec Account

So you’ve set up and verified your CommSec trading account.

You’re ready to buy shares.

Shares, I should add, that are fully CHESS sponsored. CHESS sponsored simply means that any shares you buy through a CommSec share trading account are recorded by the ASX’s Clearing House Electronic Subregister System — the system which the Australian Stock Exchange uses to manage share transactions.

You’ll find a lot of opinion and comparison online about CHESS sponsored share trading. What it boils down to is that when you buy a stock through CHESS sponsored trading accounts, your ownership of the shares is recorded directly with the exchange, as opposed to a third party, like a broker.

According to CommSec, the benefits of CHESS sponsored shares include the ability to make faster sell trades (thanks to trade information being stored directly with the exchange) and being able to ‘automatically keep track of your portfolio and its market value’.

That last point isn’t, as you’ll see, entirely accurate. But, I’ll get to that shortly.

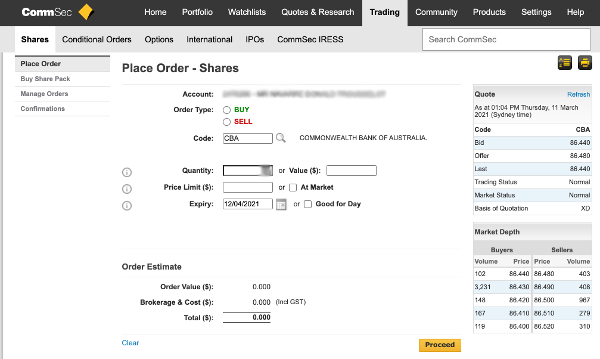

Here’s a quick guide to making a trade in your CommSec trading account.

Along the navigation bar at the top of your account, click ‘Trading’.

That will bring you to the screen below:

Buying And Selling Shares In CommSec

Like most traditional trading platforms, CommSec’s buy and sell function is pretty self-explanatory.

- Select either BUY or SELL.

- Enter the ticker symbol of the stock or fund you wish to trade — this will bring up a useful table to the right showing you the current quote details and market depth data below that.

- Enter either the quantity or value you wish to buy or sell.

- Then, enter the price limit or select ‘At Market’ if you’re not worried about short-term price fluctuations while CommSec fulfills your order.

- Finally, use the dropdown menu to choose an expiry date for your order, or select ‘Good for Day’.

Now, you’ll see the order details estimated in the table below.

From there, just hit ‘proceed’.

In my experience, executing trades in my CommSec account is straightforward.

I like that I can control my buy and sell limits, and set orders to stay in the market until an expiry date if I need to.

I also value the quote/market depth snapshot I get each time I enter a ticker symbol before I enter the particulars of a trade.

Buying & Selling International Shares With CommSec

It’s worth noting that buying and selling foreign shares through CommSec’s share trading account isn’t as straightforward as some of the newer, app-first trading platforms have made it.

To trade internationally, CommSec requires that you create something called a Pershing account. To do this, you have to complete the W8-BEN-E US tax form, which CommSec will lodge with the IRS for you. Other platforms don’t require this, and have automated the US tax registration process as part of their onboarding, since US shares and ETFs are front and centre of their product offering.

Not only is this manual form requirement a bit of a hassle, CommSec’s fees for international trading are definitely at the more expensive end of the market — as are their fees for trading Australian shares, which we’ll cover in the following section.

Not The Smoothest Onboarding Process For International Share Trading

Some customers have found CommSec’s international trading process so clunky they’ve given up after multiple failed attempts at completing the registration. One even reported having to print and scan physical documentation — which in 2022, seems unnecessarily time consuming when so many other share trading platforms have nailed smooth, automated onboarding.

So, those are the basics of getting started — creating your CommSec account and placing your first trades.

Now, let’s dive in and review some of the key features CommSec offers customers.

As I said, I’ve been trading on the platform since 2013. What follows are my personal opinions based on my experience.

Let’s start with CommSec’s fees.

CommSec Share Trading Fees: Some Of Australia’s More Expensive Brokerage Fees

CommSec encourages you to choose their CDIA-linked trading account by saying ‘Trade from $10.00’.

While that’s a good price for a single buy or sell, I want to point out that this only applies to trades up to $1,000.

For trades over $1,000 and up to $10,000, you’ll pay $19.95.

For trades over $10,000 and up to $25,000, CommSec will charge you $29.95.

Above $25K, you’ll pay percentage-based brokerage fees; 0.12%.

As this list shows, there are plenty of trading platforms that will charge you much lower trading fees.

Over on CommSec’s Pocket mobile app, the fees are different. They’ll charge you just $2 for trades up to and including $1,000, and 0.2% on anything above that. Bear in mind, though, that CommSec Pocket is aimed at beginner investors and offers a limited selection of ‘themed’ ETFs, as opposed to the full range of shares, funds, derivatives, options and CFDs you can find in the full CommSec platform.

For international trading, CommSec’s brokerage fee structure is as follows:

- USD $19.95 for trades up to USD $5,000

- USD $29.95 for trades up to USD $10,000

- 0.31% for trades above USD $10,000

See a complete brokerage fee schedule for CommSec share trading accounts.

For me, while CommSec’s fees may not be the lowest available, the platform does justify its pricing in one other key area. I’ll cover that later in this Commsec review. And with approximately 55% of Australian investors choosing to trade with a CommSec share trading account despite the relatively high costs (and less-than-optimal international share trading registration process), it would appear I’m not alone.

Everyone’s personal situation is different, but I know that in my own investing, I prefer to take my time with research and strategy before making a trade. This means I tend to place few trades, and hold positions for longer periods than other investors might. So CommSec’s higher trading fees don’t impact me as much as someone who’s placing multiple trades a week, for example.

CommSec’s Portfolio Section

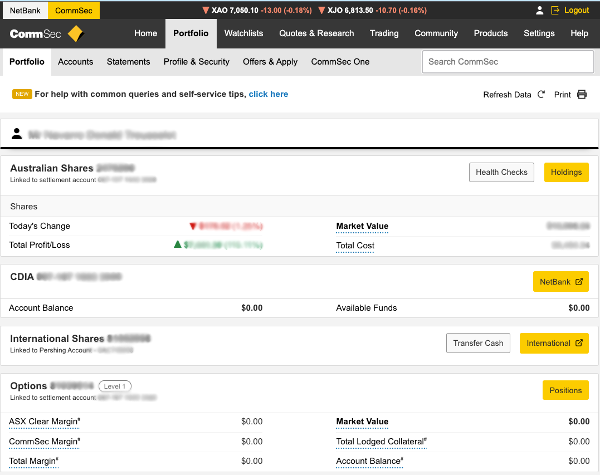

Let’s take a look at the CommSec share trading account in a bit more detail. The interface has two rows of navigation.

Along the top, you see the major sections, including Portfolio. When you click one of these tabs, you’ll see a sub-menu below it.

In the case of the Portfolio tab, you’ll also see Accounts, Statements, Profile & Security, Offers & Apply, and CommSec One — a high level service for advanced traders.

In my opinion, you can’t criticize CommSec for a lack of information and resources. My account is packed full of data and tools to help me research and execute trades smoothly and securely.

I also know from my own experience and talking with fellow investors, that CommSec’s long-established dominance in the trading industry here in Australia provides a sense of security which sometimes isn’t apparent with newer, smaller trading platforms and apps.

I’ll quickly walk you through all the information you can find under the Portfolio tab.

First, you’ll see an overview of your trading account:

- Today’s change in dollars and percentage terms.

- Your total profit or loss.

- Your CDIA account balance (if you’ve selected it during setup).

- Information on international shares and options, if these apply to you.

I don’t personally trade international shares, options, or other more complex financial products, so I can’t review these parts of the CommSec service. I prefer to invest in companies and ETFs. Derivative and CFDs have a track record of losing money for most retail investors who trade them, which is part of the reason I’d rather keep it simple!

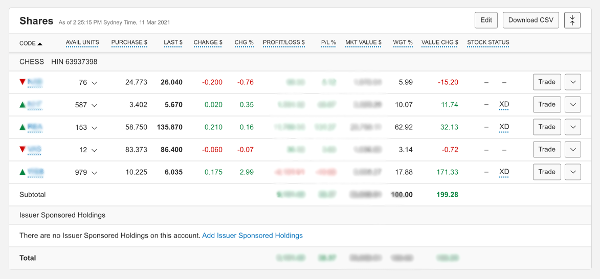

Under Accounts, you’ll see a holding-by-holding breakdown of your portfolio.

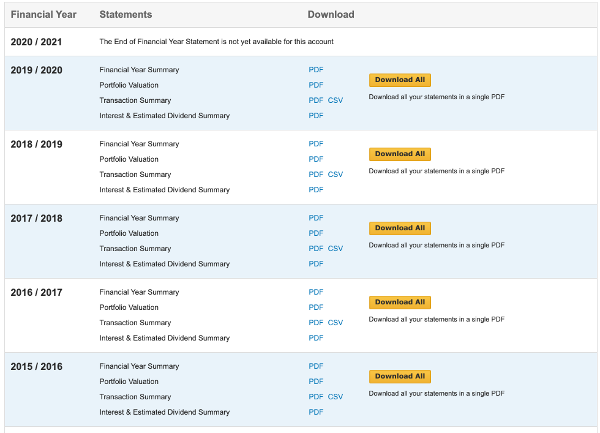

Under Statements, you can view and download trading account statements by financial year.

Profile & Security contains your CommSec accounts display, personal and password settings.

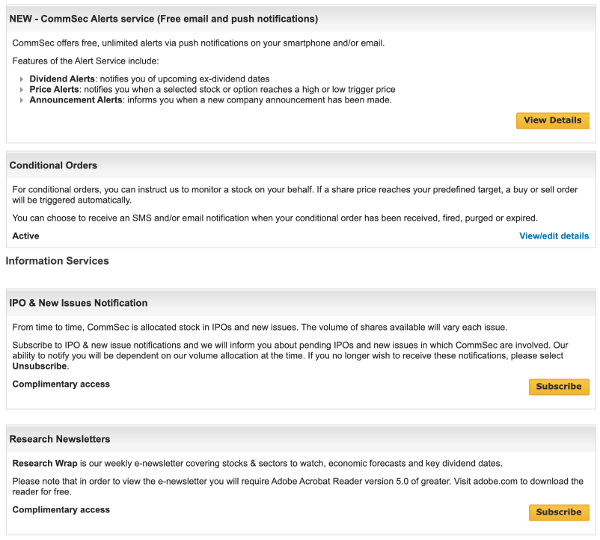

Offers & Apply may at first seem like nothing more than a screen on which to set your email promotion alert preferences, but scroll down and you’ll see a large amount of potentially very helpful options!

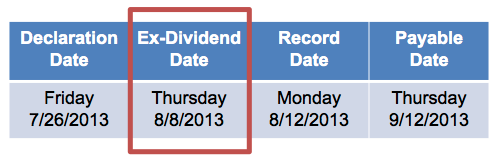

Here you can subscribe to research newsletters, IPO alerts, and CommSec’s email and push notification alert service for updates on trigger prices, upcoming ex-dividend dates, and more.

This is a great example of the serious firepower CommSec offers investors who want tailored, up-to-date data about their portfolio or investments they’re researching.

Great Market Intel & Trade Research Tools

I can’t fault Australia’s largest share trading platform for the wide range and depth of tools they’ve packed into it for investors over nearly 30 years in business. But, as I’ve alluded to, it amazes me that even after so long at the top of the country’s online share trading market, CommSec and parent company CommonWealth Bank, like pretty much all other trading platforms out there, don’t make it easy to fully understand portfolio performance.

As I’ll explain shortly, price action and holding value are, of course, important to investors. But they’re not the only factors in actual investment performance.

Still, in my experience, CommSec makes it easy to access information about both your existing trades and the relevant market intelligence you want for your next potential buy or sell. While plenty of new share trading platforms have entered the market since I became a customer — many of which have campaigned for my business on the basis of low or non-existent brokerage fees — CommSec has retained me in the changing market largely due to the range and depth of trading and research tools in my account.

This brings me to the next feature I want to highlight.

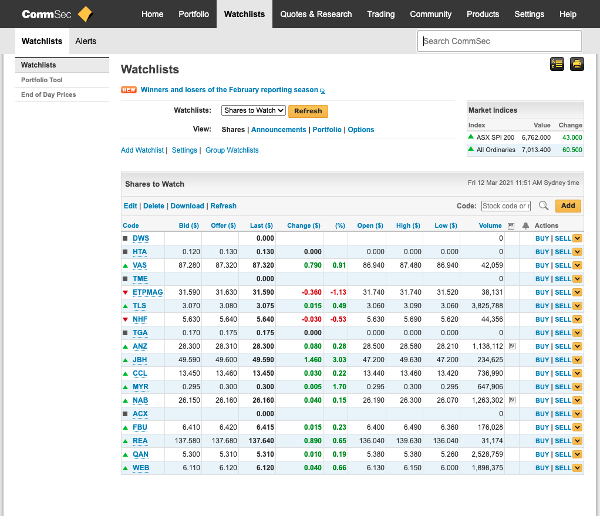

How CommSec’s Watchlist Can Help Your Investment Research

One of my favourite features of the CommSec platform is the Watchlist section.

You can find it between the Portfolio and Quotes & Research tab along the top of your account.

When I make an investment — a buy or a sell — I prefer to do a lot of research into the company, its stock, and especially its valuation.

I’m a disciple of the Warren Buffet and Charlie Munger school of investing. This means I prefer to adopt a ‘deep dive’ approach into individual businesses to uncover companies that are trading below fair value. Although to be honest, these days I am growing more enamoured by exchange traded fund investing and the way it lets you buy into large trends, themes and sectors.

Whether I’m looking at a company or an ETF investment, the watchlist tool in my CommSec account provides me with an excellent way to shortlist and monitor potential trades.

I can easily create multiple lists of stocks and funds I want to analyze and track — sometimes for months.

When I check my watchlist, I can see at a glance what these assets are doing in the market.

I can rank them by price movement, open, close, volume, and more.

And, I can just click the end of each row to open a buy or sell trade on any of them.

I can also toggle the view and see things like announcements, which I find useful in the research phase.

This part of my investing — the research — is largely what keeps me on board as a CommSec customer. That, in my experience, mitigates the CommSec share trading account’s relatively higher fees and explains why the CommonWealth Bank of Australia owned trading platform remains such a dominant player in the market.

Let’s dive into the research side of a CommSec account in more detail.

CommSec’s Research Tools Are Second To None In Australia

If you click Quotes & Research, you’ll come through to what, in my opinion, is an absolute war chest of investment research.

One that, as I’ve said, makes CommSec’s relatively high trading fees a little easier to stomach.

Some of the tools and resources CommSec have packed into the platform are, in my own and others’ experience, far superior to what you’ll get access to with other trading accounts — particularly the newer generation of lean, app-first brokers.

In the Market tab, you can see what’s happening on the ASX right now.

- A performance heat map.

- Latest headlines.

- Official CommSec summaries.

- Video reports.

- A list of upcoming dividends.

These make this page alone super useful to anyone wanting to keep their finger on the market’s pulse. It’s why some investors I know barely use any other platform for keeping track of market news, announcements and analysis.

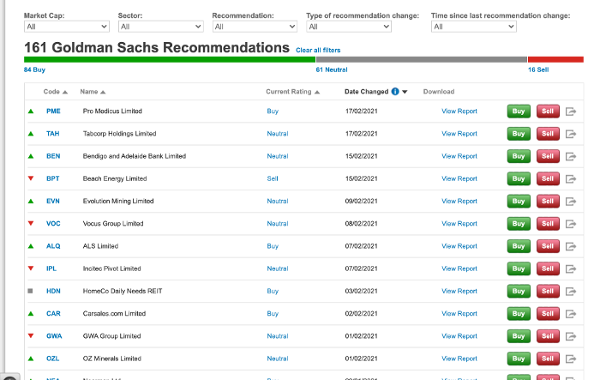

The Sectors tab lets you drill down on each of the ASX’s sectors with performance graphics, peer analysis, headlines, and research from Goldman Sachs — a global leader in investment research.

You can also see market-sensitive announcements and trending searches!

One particularly useful tab — and one that in my opinion is great for those just learning about investing in the market — is Trading Ideas.

The Trading Ideas screen comprises recommendations from Morningstar and Goldman Sachs on which investments their analysts believe are worth buying, selling, or holding.

You can find more from Goldman and Morningstar on the Recommendations tab.

You’ll also find an ETF Screener and Stock Screener among many other useful tools. As my own interest in ETF investing has grown in the past couple of years, I’ve found resources like this super useful. And they’ve only reinforced my decision to open a CommSec account and remain a customer.

Having access to stock-specific research from providers of this calibre is a huge asset for the everyday investor. I can compare my own findings and opinions against detailed research papers from some of the biggest names in the investment intelligence business.

At the time of writing, there were 161 Goldman recommendations in my CommSec account. And I don’t just mean the ‘Buy’, ‘Sell’ or ‘Neutral’ in the ‘Current Rating’ column. If you click on ‘View Report’ you’ll go through to an incredibly detailed, in-depth research paper the bank has published on that stock.

For instance, the Pro Medicus Limited report is 16 pages long and packed with more charts and commentary than you might find in an hour of your own independent research online.

Diving this deep into your CommSec account does deliver some major firepower when it comes to acquiring knowledge on a potential investment. In practice, though, I wonder how many of CommSec’s legion of customers use the full extent of their platform. With so many investment options and research tools supporting those investment options, there is certainly a risk of information overload and analysis paralysis.

In my opinion, not only is CommSec a robust, secure, and reputable (if not the cheapest) trading platform. It’s a portal for self-directed investors to connect with market-leading research and recommendations from some highly respected and credible sources.

For this reason alone, I believe CommSec is a brilliant trading platform for Australian investors. The numbers show I’m far from alone in judging Australia’s most popular trading account in this way.

However, when I consider all my needs as a self-directed investor, there’s one area where I feel CommSec is lacking. And this isn’t something you’ll find in many, if any, other CommSec review posts doing the rounds online. While it’s common knowledge that CommSec charges some of the highest brokerage fees in the industry (yet maintains market dominance despite competitors offering little to no brokerage fees!), it’s perhaps not as widely known that there is a significant hole in the platform’s performance tracking.

CommSec Customer Service: Multiple Ways To Get Support

One of the other benefits to using CommSec is that Australia’s dominant trading platform offers myriad ways to resolve issues and seek help with your account.

From a well-structured FAQ page, full product disclosure statement documentation, and plenty of guides on the various processes you can use CommSec for, you’ll likely be able to find what you need without escalating a query to live support.

But, if you do need to reach out, CommSec has branches for email support, phone contact in Australia and from overseas, plus this Twitter account, which seems to be actively monitored and can provide pretty prompt assistance.

CommSec’s Weak Point: Portfolio Performance Tracking

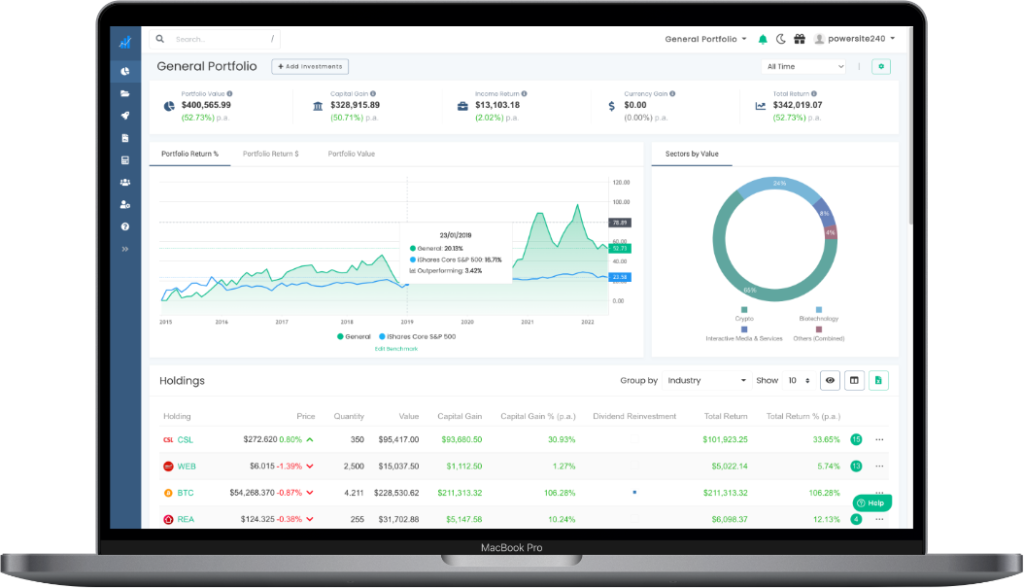

Full disclosure: I am the founder and lead developer of a dedicated portfolio tracking platform designed purely to help self-directed investors understand their true returns and performance.

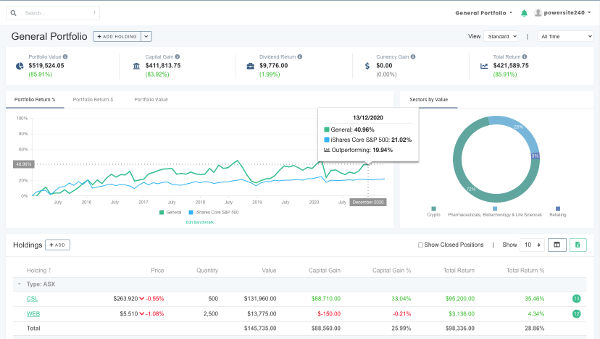

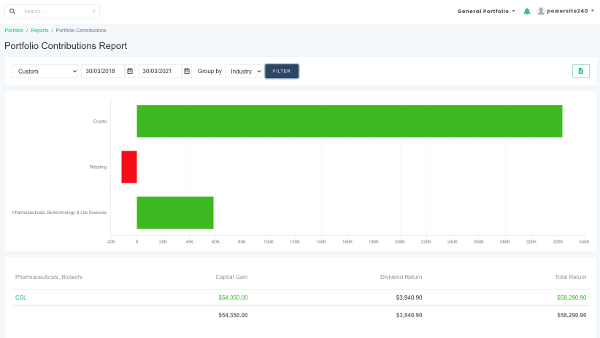

My platform, Navexa, which hosts this blog, is a broker-agnostic performance tracker and tax reporting tool. While any performance tracking and analysis you get within your brokerage account will limited to the trades you’ve placed within that platform, we’ve built Navexa to allow investors to track everything in one place. Whether it’s crypto, stocks, unlisted investments like property — and whether you have those investment in one or 15 different accounts — you can track every gain, dividend, trading fee and much more in our platform.

So you could say I’m a little biased on the point of assessing broker platforms’ performance tracking — even a platform I’m a long-term, satisfied customer with.

But here’s the thing.

Despite giving me loads of valuable information on the market and the various recommendations I just mentioned, CommSec doesn’t deliver a huge amount in the way of data, analytics and reporting about my portfolio itself.

Take a look at the portfolio screen.

Having been in the market since 2013, and done my fair share of buying and selling, all I can see are two performance metrics: Today’s Change, and Total Profit/Loss.

To be blunt, that’s not enough for me.

Why? Because portfolio performance is a lot more complex than just my total profit or today’s change. I need to see lots more.

My annualized return, for one. What about brokerage fees? Taxes? Dividend income? All these factors impact my returns, so I want to see them all when I’m checking my portfolio in my CommSec account.

I bought NAB shares a few years ago. After a while, I checked how my trade was doing in my CommSec account, according to which I had made no gain, 0% return. Now, based on that information alone, I might have said to myself, ‘this trade is going nowhere, I’d be better selling my shares and buying something else’. If I’d done that, by the way, I would have of course incurred another round of trading fees, which when you track them — especially for a more expensive provider like CommSec — quickly add up to a significant impact on your actual returns.

But the reality of my NAB investment was not what CommSec was showing me. In fact, I’d earned a significant amount of dividend income during the holding period. So much dividend income, in fact, that the income return had pretty much meant I’d realized a nearly 100% gain, despite not seeing any significant change in the share price.

That’s just one example of how a lack of complete portfolio performance tracking can lead investors to form a mistaken opinion about their investments.

I don’t point this out to bash CommSec. CommSec is a trading platform designed to deliver robust brokerage services and market intelligence. It does not promise or deliver extensive portfolio performance tracking. It delivers massive value in terms of trading tools and investment research. But the lack of comprehensive portfolio performance tracking is the reason this CommSec review wouldn’t award a 10/10.

But — and this is also my personal, and obviously biased opinion — CommSec falls short of my requirements for tracking, analyzing, and understanding my portfolio performance beyond just my daily or annual gains.

CommSec: More Than Enough Value Despite The Brokerage High Fees

As I’ve said, I’ve used CommSec for my investing since 2013.

The platform gives me more than enough functionality and value to justify trading on it.

However, as a self-directed investor with an appetite for data and analytics, I ran into problems when trying to track my portfolio performance using my CommSec share trading account alone.

That’s precisely why I created and launched a dedicated portfolio tracker, Navexa.

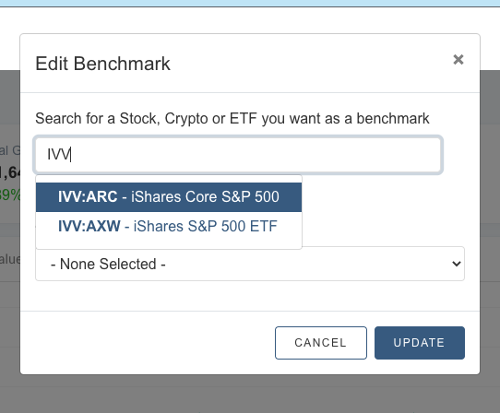

Navexa tracks the annualized, true performance of my portfolio and its constituent holdings with far more detail than I can access in my trading account.

By ‘true’ performance, I mean my net gains (in dollar and percent terms) after I’ve accounted for the time in the market, trading fees, currency gains or losses, taxation, and dividend income.

In other words, my portfolio tracker gives me a complete picture of my actual portfolio performance, as opposed to a partial one.

And as I mentioned earlier, our platform is broker-agnostic. This means you can track all your investments from as many different trading accounts as you like in the one place. This is especially powerful at tax time, when accurate and complete trade and transaction records are paramount.

Plus, I can generate a variety of reports, from calculating unrealized capital gains to taxable income, portfolio contributions, and many more.

So, for me, pairing my CommSec trading account with a dedicated portfolio tracker like Navexa gives me everything I need.

I can research and execute my trades in my trading account.

And I can track and analyze those investments and my portfolio as a whole in Navexa.

I hope my CommSec review has been helpful for you.

If you’re interested in learning more about your true portfolio performance, beyond just what you can find in your CommSec account, check out Navexa.