If you’re looking to stop working for an employer and start your own

tech startup, I want to share my experience with you.

I’m going to show you how I combined my passion for technology and

fascination with investing into a project that allowed me to quit my job.

I became a full-time professional software developer in 2011.

By 2018, I was making good money and working on multiple side projects.

My goal was to transition away from full-time work and focus on my dual

passions:

Founding a fintech startup (two, actually) and building long-term wealth

through value investing.

The way it worked out for me, the latter sparked the former.

Let me explain.

I realised in my mid-20s that I wasn’t going to be content working a

Monday to Friday job.

I was extremely frustrated working in businesses where I could see so

many ways to improve things but was powerless to do so.

Big corporates move at glacial speed, especially in technology.

I wanted to be at the cutting edge of tech. Not another face in a big

corporate team waiting for Friday to roll around, again.

And like so many beginner investors, I wanted more out of life than any

salary a corporate software gig could give me.

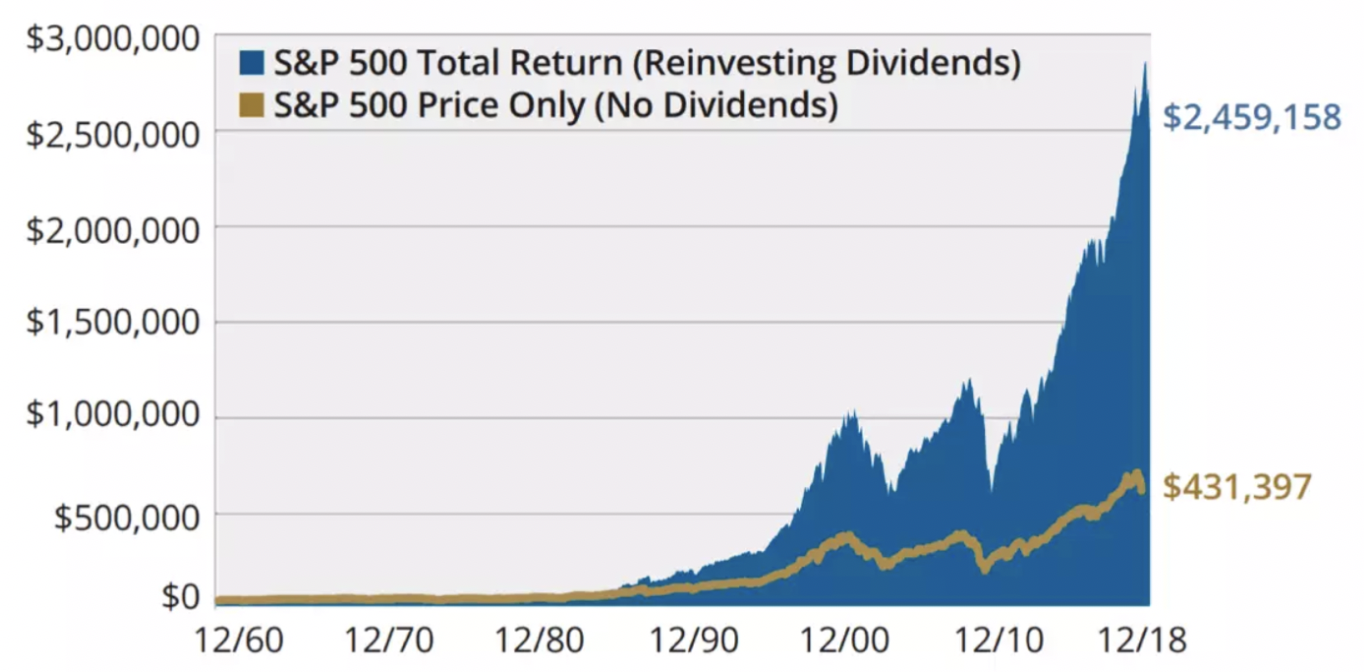

I looked at the phenomenal success of Warren Buffet, for example.

What he had achieved got me hooked on the idea of building wealth by

investing.

Buffett’s principles of wealth building appealed to me and I wanted to

have a go at applying those principles in my own investing.

I’m a long-term, strategic thinker. Probably more so having spent the

best part of a decade embedded in development teams in Australia’s biggest

financial institutions.

At that point, I wanted to start a business, too.

But, I didn’t know what — or why — so I put my focus into learning

about the stock market.

Using the principles of value investing laid out by Buffett and Benjamin

Graham before him, I wanted to be able to carefully analyse, monitor and plan

my investments.

And being a tech guy, I went looking for a software solution to help me.

I soon found something that did the job.

You can probably guess what, given that at the time that particular

service was the only one on offer in Australia.

So off I went on my journey towards massive gains and stock market

wealth!

But I soon found a problem.

The software I was using to track my investments wasn’t what I had hoped

for (especially for the price I was paying).

And as a self-confessed software nerd, I quickly started to think I

could do a better job.

Why muck around with this sub-par (IMO) solution when I could create my

own to better suit my needs?

When I thought about how many people in Australia alone had been

investing for many decades, it didn’t make any sense to me that there wasn’t a

suite of high quality tools out there to help them.

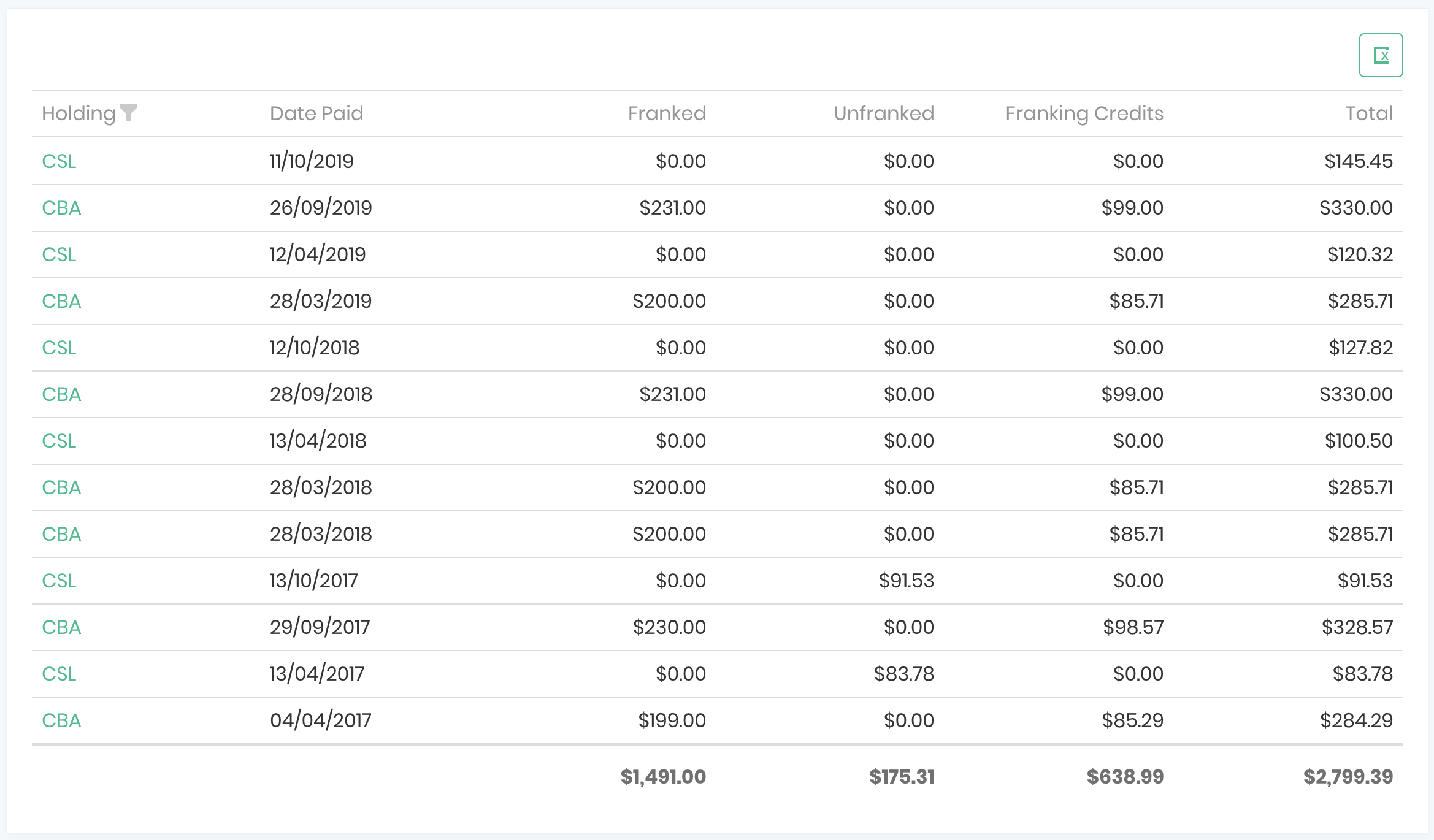

Specifically, I found it super difficult to get an accurate measurement

of my investments’ performance; colleagues and mates I talked to had the same

issue.

Many couldn’t even tell me if their portfolio was doing well or not.

That decided it for me.

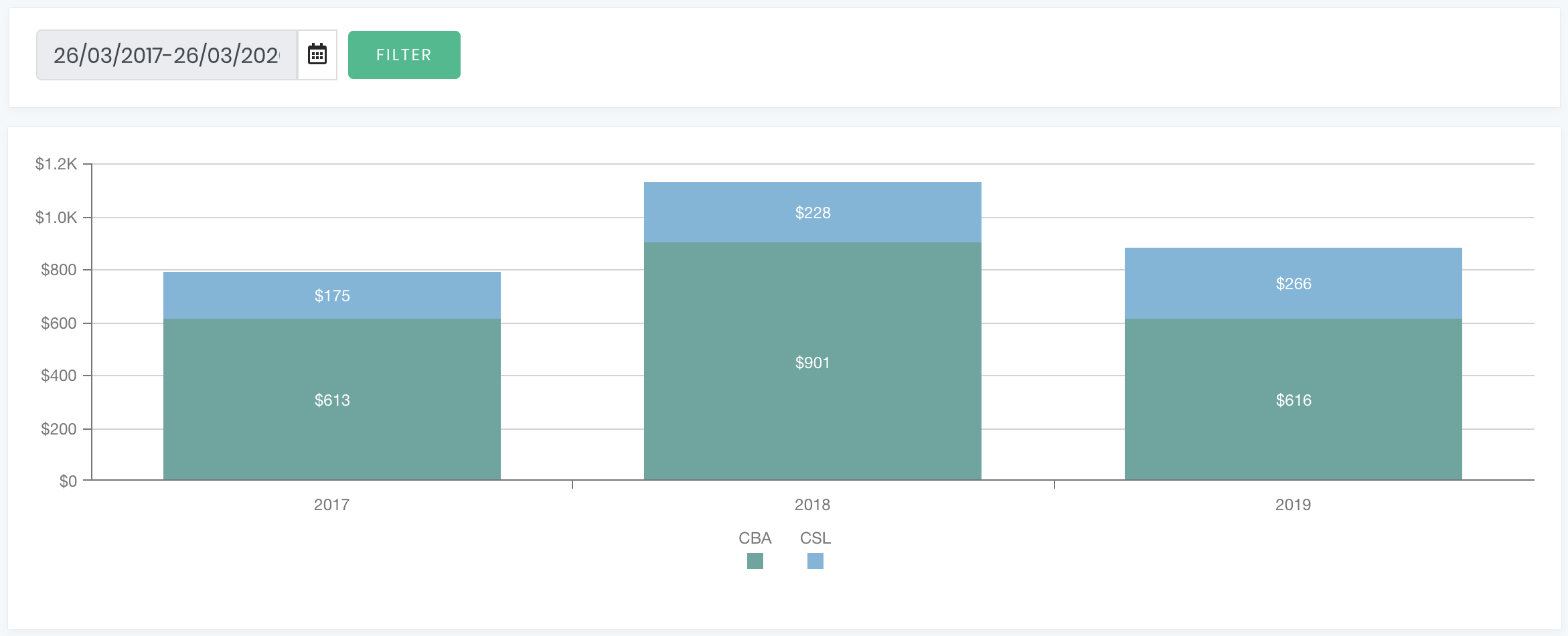

My next project would be a portfolio tracker that I could use to help me

make smarter moves in the stock market.

The idea of using my own tools to help achieve financial success appealed

to me a lot.

The idea of turning those tools into a business that helped others

appealed even more.

This was the moment I realised how important it was that the project

directly benefit me and others in my position.

I relate it back to investing in companies where the CEO has a huge

stake in the company themselves.

It means that their success with the company is also success for them

personally.

With this idea at the core of my plan, I got stuck in.

Building a fintech application was more exciting, challenging and

rewarding than I could have imagined.

It took two things that I have a passion for — technology and finance —

and combined them into one thing I could focus on.

One thing that would benefit me and others and potentially become a

viable business in the long term.

For me, writing code that translates into making money on the stock

market is pretty damn exciting.

I love coding. I’m a proud tech enthusiast. Always have been, always

will be.

Those close to me probably regard me as the quintessential obsessive nerd.

And they’d be right. When I get stuck into a project I believe in, I

tend to go all in.

At the start, I was still working a full time job at a big corporate in

Melbourne and Navexa at night.

I’ve realised over time that what I thought was normal in terms of

working on a side project, was not the norm for most people.

I would get home from my full time job and settle in for a solid night

of coding before bed.

Lame, I hear you say.

Perhaps, but like I say, when you find a project you’re passionate about

both as a business and as an intrinsically beneficial tool, you feel compelled

to really dive in.

Even now that I work for myself full time, I’m still keen on coding all

night.

However I balance it out a lot more with family time now.

It was around August of 2018 that I decided to work on Navexa full time and finally take it from being a side project, to a legitimate business.

This was also around the time I welcomed some of my first customers into

the then free version of Navexa.

This was a milestone for Navexa. It pointed me in the right direction in

terms of what the service needed to be for its customers.

I started building mutually beneficial relationships with my customers.

I can’t stress how important that is.

My users contact me directly to tell me what they like and don’t, and

what they want from the service.

I had people suggesting features such as supporting cryptocurrencies.

Others were telling me how the user experience of the site could be

improved.

I was able to gather feedback fast and implement the ideas just as fast.

I learned that it was crucial to get feedback from people using the

service and adapt the product to help them address their pain points and solve

their problems.

Why build what you think people want when you can build exactly what they want by listening?

Many of the features that you can see in Navexa today were built off the

back of customer feedback.

To those who generously offered their advice and feedback in the

beginning — and those who continue to do so — Navexa wouldn’t exist as you

know it without you!

A couple

of months into my journey, I was presented an opportunity to help start another

fintech business with my brother.

This

particular business had the potential to make money very quickly. So I decided

I would pause my work on Navexa and get stuck in.

This was

a very good decision because it gave me an income very quickly which meant I

was less likely to need to go back to a full time job.

Then once

that business became established I started to resume work on Navexa and work on

both at the same time.

Securing

starting capital and cashflow while you’re working on a new business is, of

course, hugely important. But there are many other blogs out there that go into

that specific side of it in great detail!

So, back

to my portfolio tracker.

From that point to mid 2019, was a hard slog of getting Navexa into a

state where it could be used by most Australian investors.

I spent many months on stabilising the platform, finding bugs and fixing

them and adding new features along the way.

By late 2019, about a year after I really started committing my time to

this project, the feedback was growing more positive.

But the work was getting more demanding, too.

More features, more users, more ideas I wanted to implement — and

limited startup capital to do so with.

It was time to ask my loyal users for money.

The first time you charge money for a product or service is a big moment

for any business.

I loved providing the service for free and got a lot of satisfaction in

helping customers get better insights into their portfolios.

But Navexa had taken substantial time and capital to create and develop.

I needed to start generating revenue.

In late 2019, Navexa welcomed its first paying customers.

This was a crazy experience.

I’d never done anything like this before. I had never run a website that

someone could sign up for and then pay me real money.

The fact that I now had people paying for this service, made me feel an

increased sense of responsibility.

I want my paying customers to feel like they are getting maximum value out of the service, so it caused me to strive even harder to ensure they are getting their money’s worth.

This leads us up to now. May 2020.

I’m working on Navexa most days. Building new features, helping

customers, fixing bugs and working to spread the word about Navexa.

There is no other other job I’d rather be doing.

I know the next six months will be just as crazy and exciting as the

last — more, if early indications are anything to go by — and I’m looking

forward to what I’ll learn and the people I will meet along the way.

I have an extensive road map of where I want Navexa to get to.

Like any tech startup, we’re monetizing the work that has gone in so far

to offering a high-value, competitively priced service.

With the product the best it has ever been and our marketing efforts

starting to yield more revenue, we’re on a mission to grow the business

substantially.

The first two years have been the biggest learning curve of my career.

The next 12 months should eclipse that.

Thanks for reading about my journey into the world of fintech startups.

I’m always keen to connect with inspiring, driven people in the

technology and investing spaces.

Feel free to connect with me on LinkedIn or Twitter.