Investing in stocks is a popular way to build wealth. However, navigating the tax implications associated with stock investments can be daunting.

This guide explains the key tax implications associated with stock investments in Australia.

Why Understanding Investment Taxes is Crucial

Taxes on investments can significantly impact overall returns.

Knowing the specific tax obligations and benefits can help with planning an investment strategy more effectively.

In Australia, the two main types of taxes that affect stock investors are capital gains tax (CGT) and investment income tax (dividends, distributions etc). Each of these has its own set of rules and considerations.

Capital Gains Tax (CGT)

Capital Gains Tax is calculated on the profit you make when you sell a stock for more than you paid for it.

Understanding how CGT works can help you plan the timing of your sales and take advantage of potential concessions, such as the CGT discount for long-term holdings.

In our detailed post on CGT, you’ll learn:

- What constitutes a capital gain or loss

- How to calculate CGT

- Strategies to minimize CGT

- Relevant exemptions and discounts

Read more about Australian capital gains tax.

Investment Income Tax (Dividends)

Income generated from your investments, such as dividends, is also subject to taxation.

Australian tax law has specific provisions for different types of dividend income, including franking credits that can reduce your tax liability.

Our post on investment income tax explains:

- How dividend income is taxed

- Understanding franking credits

- Implications of different types of dividends

- Dividend Reinvestment Plans (DRP)

Read more about Australian investment income tax.

Taxes: Unavoidable, but not as rigid as many presume

Taxes are an inevitable part of investing, but with the right knowledge and strategies, you can optimize your tax outcomes and your investment returns.

Our series of posts on Australian investment taxes for stocks gives you a all the key information and insights you need to navigate calculating and reporting tax as an investor.

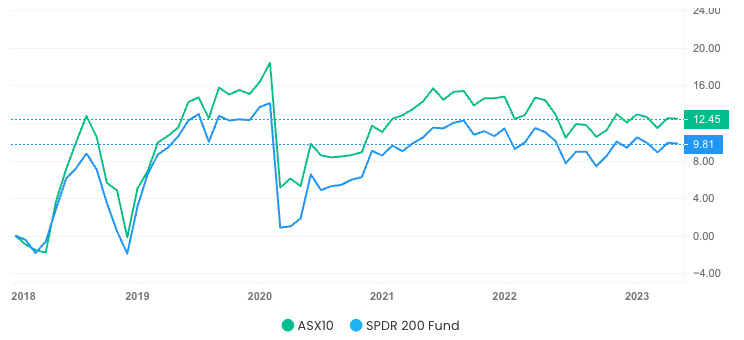

Navexa Portfolio Tracker: Automatically Track All Investments & Sort Your Tax Reporting In Minutes

You don’t need to worry about manually tracking your investment’s gains, income, and long-term returns.

The Navexa Portfolio Tracker automatically handles performance tracking and tax reporting for Australian investors.

Take a free 14-day trial and see for yourself why thousands of investors trust Navexa to track their portfolio and sort their investment taxes the easy way.