Common stock versus preferred stock — not sure where to start? In this post, we explain these different types of stocks, what they mean for shareholders, and the key qualities of common stock as opposed to preferred stock, and vice versa.

Not all stocks are created equal. And we don’t just mean that some stocks perform better than other stocks.

Rather, there’s two distinct types trading on the open market: Common and preferred.

The first you’re probably already familiar with. The second, maybe not so much.

Common and preferred stock offer shareholders very different things — from their pricing and dividend payments, through to the privileges you’re entitled to as a shareholder of each.

Below, we explain common vs preferred stock, which is better, which is safer and more.

Common: The Stocks Most Shareholders Buy

If you’ve bought shares before, chances are you probably bought common stock. Most of the time, common stock is what we talk about investing in. Most of the world’s major markets consist of common stock, as opposed to preferred.

The definition of a stock is this: A security representing a share of ownership in a company.

When you own common shares, you own a percentage of the company or fund’s assets and profits. This is the idea upon which most stock trading rests — that buying shares in the right companies exposes your money to their success.

By owning common stock, shareholders are aiming for one — or both — of two things. First, they’re looking to increase the value of their shares via gains to the stock’s share price. If a stock rises 100%, for example, shareholders who bought before that gain could double their money.

Second, investors can benefit from holding common stock through dividends the company pays to its shareholders. In other words, you can get paid to own common stock shares — if the company’s board of directors chooses to pay a dividend.

Dividend income is one of the key differences between common vs preferred stock.

There’s another crucial benefit to owning common shares: Voting rights. As a shareholder in a company, you get voting rights on some of that company’s corporate decisions. Preferred shares do not confer the shareholder these same voting rights.

Preferred Shares: More Like Owning A Bond Than Shares

Preferred shares, while they might sound similar to common shares, are actually a very different form of investment.

They function more like a bond.

A bond is a fixed income instrument. When you buy a bond, you’re essentially making a loan to a government or company, who use them to raise money.

An investor buys a bond because it entitles them to receive a fixed income for an agreed period, at the end of which the issuer will buy it back.

Preferred shares functions in a similar way. You buy a ‘preferreds’ not to profit from a company’s rising share price (or have any voting rights as a shareholder), but to receive a fixed income for an agreed period. Some preferreds don’t ever expire — you can buy them, collect the income and never have to re-sell them to the issuer.

So, it’s a significantly different form of investment. Why do we refer to it as preferred? The answer relates to the income you collect. Preferred stockholders are entitled to collect any income the company decides to distribute before common stockholders.

When it comes to dividend distributions, there’s a hierarchy. Bonds are first in line to receive income, then preferred shareholders, then common shareholders. While owning common shares exposes you to a company’s capital gains, it doesn’t guarantee that you’ll receive a dividend — or that each dividend you receive will be the same amount.

Owning preferreds doesn’t expose you to the company’s capital gains, but it does ensure that you’ll receive a share of the profits as a dividend before common stockholders (but after bond holders).

And, you don’t receive voting rights. While owners of common stocks get voting rights in certain situations, preferred stocks do not offer this benefit.

Which Is Better, Common Or Preferred Shares?

Like many questions about investing, whether common or preferred is ‘better’ depends largely on the individual investor’s objectives and preferences.

Consider the key differences.

Common Stock vs Preferred Stock: Key Differences

- Preferreds grant shareholders the right to receive dividend income from the company before common shareholders.

- Common shares grant shareholders the right to vote on matters like who joins the board of directors, operational and structural changes and issues affecting the shareholders themselves like mergers, acquisitions and stock splits. Preferred shareholders do not gain any such voting privileges.

- If a company is forced to close and liquidate its assets, preferred stockholders are entitled to payment before common stockholders.

So in assessing which is ‘better’, you should consider what your priorities and preferences dictate. If you’re looking to invest in a company you whose share price you think could rise 10-fold in the next five years, you might prefer to go for common shares, since this will allow you to capture your share of any capital gain.

But, if you’re looking to buy a stock and collect income from it over several decades, you might consider buying preferred stock (if, of course, the company offers preferred stock — many do not).

Common Stock vs Preferred Stock: Which Is Safer?

While preferred shares are similar in ways to a bond, they’re still shares. This means that its value — and the dividends it might generate — can fluctuate.

According to this professional advisor, ‘nothing is guaranteed with preferred stocks’.

While you are entitled to receive dividends before common shareholders when you own preferreds, this doesn’t mean you’re guaranteed to receive them.

It’s possible that a company will choose not to pay a dividend to common stockholders but still pay one to preferred stockholders. So in that sense, preferreds could give you a better chance of collecting income from your investment.

One thing to note is that some preferred stocks are classified ‘cumulative’ preferred. This means that if a company misses a dividend payment, it’s obliged to pay the arrears in the future — before paying dividends to common stockholders.

Preferred stocks, like common stocks, are liable to rise and fall. See the chart below showing a preferred stock ETF (in blue) relative to a common stocks fund over five years.

If the company goes out of business, preferred stockholders will receive payment before common stockholders, but after creditors and bond holders.

So by some measure, preferreds could be regarded as relatively more safe compared with common shares. But all investments, of course, carry risk. You should always do your own research and seek a professional opinion before risking your money.

Why Would A Company Issue Preferred Stock Vs Common Stock?

Preferred stock offerings are relatively rare in the stock market. There’s two main types of organizations that tend to offer them; Financial companies like banks, and real estate investment trusts, or REITs.

Businesses liked these might choose to issue preferred stock because it counts not as a liability on their balance sheet, but equity instead. That lets the business raise funds without increasing its debt-to-equity ratio.

Preferred stock also grants less control of a company to outside investors — something a business may prefer than offering common stock.

What Is The Downside Of Preferred Stock?

If the benefits of owning preferred stock as a shareholder are better privileges when it comes to dividend income and payment in the event of bankruptcy or liquidation, then the downsides are these:

1. You don’t get any say in corporate decisions like you could get by owning common stock. This means you’re more of a passenger on the company’s journey than an active shareholder who can influence its direction or strategy.

2. You don’t get any exposure to the stock’s potential capital gains. If your own preferred stock in a bank that produces a 100% price gain, you won’t benefit as a preferred stockholder. Although, you may indirectly enjoy a share of those profits in the form of an increased dividend payment.

Common Stockholders vs Preferred Stockholders

The differences between common stock and preferred stock are simple.

Common stock — which accounts for the majority of stock available on the market — gives you the standard exposure and rights you’re probably used to as a shareholder. You can grow (or lose) your capital and collect dividend income by owning common stock.

Common stockholders are investors who have the right to profit from rising stock prices, collect income and have a say in corporate decisions. But, they are the last in line for dividends and bankruptcy payouts.

Preferred stock is far more rare than common stock. Only certain companies — generally financials and REITs — offer this bond-like type of stock.

Preferred stockholders don’t get exposure to capital appreciation. Rather, they are ahead of common stockholders in the income and bankruptcy payout hierachy.

Earning Dividends From Common Stock Or Preferred Stock? You Must Do This.

Now you know the main differences between common stock and preferred stock.

But, did you know that many investors fail to properly track and account for their dividend income? They look at their capital gains and treat their portfolio’s income separately. But, the fact is, your dividend income has a potentially huge impact on your overall returns and performance.

With the Navexa portfolio tracker, you can easily track your dividend income.

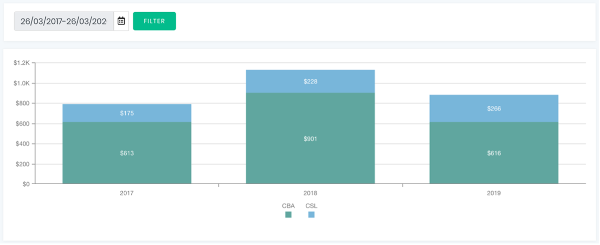

Here’s an example of our dividends reporting, showing you how different holdings generate income year to year:

Whether you’re collecting income from common stock or preferred stock — in fact, especially if you’re a preferred stockholder — you need to be able to report correctly on that income at tax time.

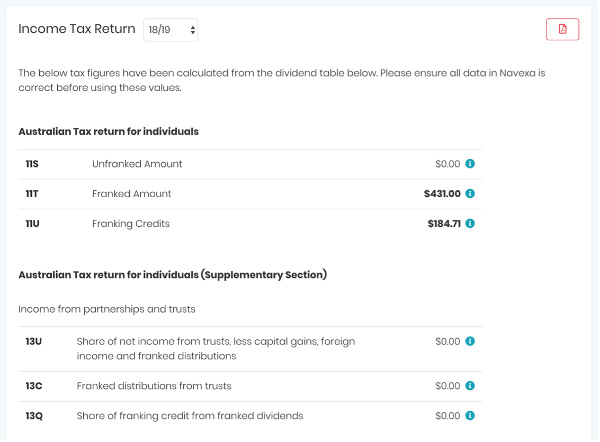

That’s why we’ve created an automated portfolio income tax report in Navexa:

If you want to improve your dividend income tracking and reporting, take a free trial of Navexa today.