A lot of people talk about buying index tracking ETFs.

Finfluencers.

Gurus.

Friends.

Even Warren Buffett has promoted index tracking ETFs.

The idea behind this is that you get decent diversification relatively easily.

As we learn early in our investing careers, diversification is a good thing, right?

Right?

Well, it depends on how you define diversification.

Is it owning multiple stocks?

Is it owning multiple stocks across different industries?

Do these stocks need to be of equal value in your portfolio?

Do these stocks need to be from different countries?

There are many different ways to diversify.

Note: Absolutely none of what follows should be considered financial advice — merely a personal investigation into the numbers behind diversification.

Don’t Underestimate Big Companies’ Dominance

The ASX200 index covers the top 200 companies listed on the ASX.

And there are many ETFs out there that track this index.

Buying into one of these would give you broad diversification in terms of number of companies.

But how diverse is the ASX200 really?

With a little bit of digging, you will find that the top 10 stocks in the ASX200 makeup more than 50% of the index’s total market capitalization.

In other words, the ASX200 is very top heavy.

BHP is the number one stock in the index, with a market cap of ~$200 billion.

Compare that to the 200th stock in the index, with a market cap of $1 billion.

This means if BHP has a bad year, it can significantly impact the whole index.

So what does this look like in a real portfolio?

Meet The ASX10 Big Heavyweights

Let’s take a look at a theoretical portfolio made up of the top 10 ASX stocks in 2018.

Let’s call it the ASX10.

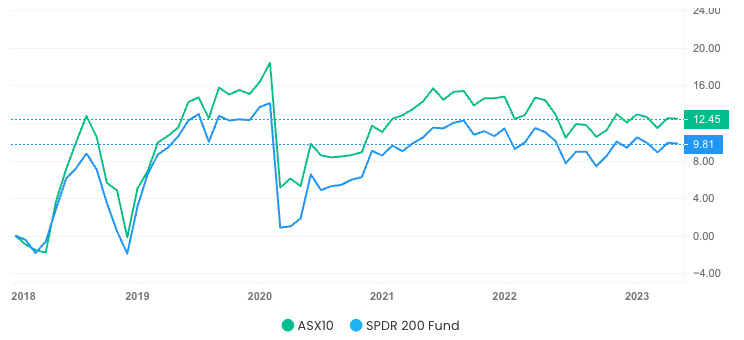

In the past five years, the ASX10 has outperformed the ASX200 index.

With capital gains and dividends included, the ASX10 achieved a return of 12.45% p.a. — outperforming the ASX200’s return of 9.81% p.a.

You can see from the chart that the movements were almost identical the whole way through.

But the ASX200 had 190 other companies influencing its overall performance.

So while you get diversification from an ASX200 index fund, is it the kind of diversification you want?

It Pays To Know What Comprises Index ETFs

To be clear, I’m not saying investors shouldn’t buy index funds.

If it’s between doing nothing with their money or investing at all, then index funds might be a great idea.

They do, after all, track the performance of an index — most of which, over the long term, tend to go up.

But for those of us who pay closer attention to what we’re investing our money in…

And those — like me — who unashamedly ‘nerd out’ on every detail of our investments…

It’s worth noting that there can sometimes be hidden costs — or rather opportunity costs — to simply buying an index fund versus investing in a particular cohort of companies.

Diversity has become one of those pieces of financial jargon people perhaps automatically presume to be admirable.

But, as I like to say, the numbers never lie.

Always do your own research — this is not advice and always remember that past returns are never a guide for future performance.

Knowledge pays the best interest,

Navarre

The Data-Driven Investor