The discounted cash flow (DCF) method can help you calculate the current value of an investment. DCF can be used to value companies, stocks, and bonds. Keep reading to learn how to use it.

Determining the current value of a stock is a key part of investment research. One method for doing this is the discounted cash flow (DCF) method, which values a stock — or any other investment — based on predicted future cash flows.

The DCF model involves several steps, each calculating different data, to estimate the present value of stocks, bonds, or businesses.

The DCF model relies on the weighted average cost of capital as the hurdle rate. However, you’ll also likely have to calculate a terminal value, intrinsic value, free cash flow (FCF), and a few other metrics before employing the DCF formula. Here’s what you need to know.

How do Investors Determine the Value of a Business?

Investors generally evaluate a business before they invest in it. Luckily, there are several methods to determine whether an investment’s current price represents fair value or not.

They may use comparable financials to identify similar companies in an industry or sector. They may access databases which provide financial information and a value range for companies.

The discounted cash flow method is one of the best ways of evaluating established companies with a good track record of revenue and costs.

However, the discounted cash flow model is quite complex to work with. It involves multiple calculations related to cash flows, rate of return (RoR), equity, and so forth. The discounted cash flow calculation can be used for stocks, businesses, bonds, and other business projects.

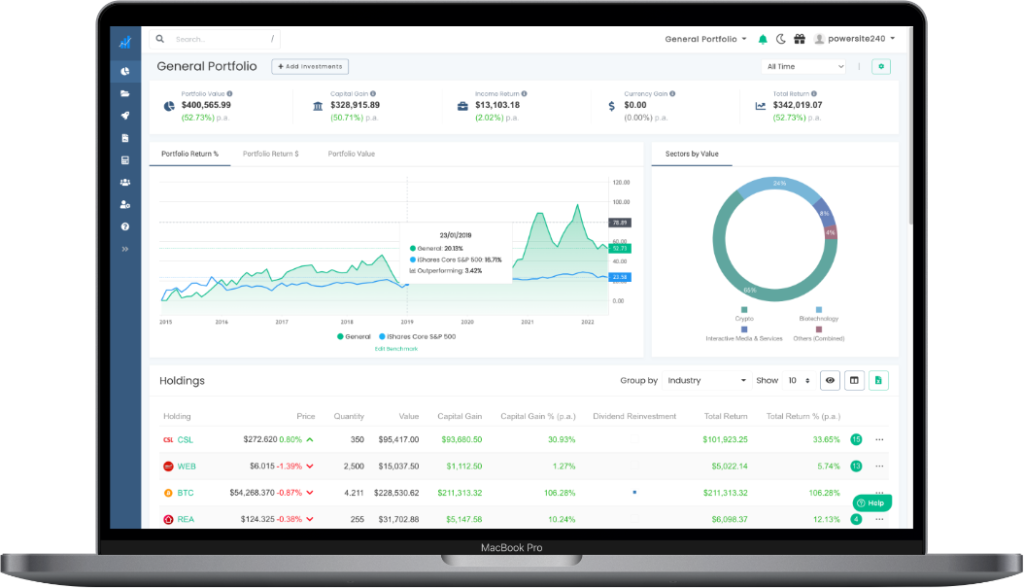

Navexa provides a powerful discounted cash flow calculator. You can use this to estimate a stock’s value by inputting key financial metrics — a handy addition to Navexa’s automated portfolio tracking and tax reporting tools for stock and crypto investors.

Introduction to the Discounted Cash Flow Model

The discounted cash flow model is helpful in determining a company’s ‘intrinsic’ value. It’s used to determine the value of an investment based on estimated future cash flows. The DCF method is the standard in evaluating privately-held companies, although it could be used for publicly-traded stocks, too.

For many, DCF is a complex mathematical and financial equation, most commonly used by Wall Street experts. However, anyone who understands the basics of DCF can use it to evaluate a business.

The first thing to look into is the weighted average cost of capital (WACC). The WACC represents the hurdle rate for this model, and it’s the minimum RoR required for the project or the investment. Riskier projects have a higher hurdle rate, and vice versa.

Related Terms

These are some of the related terms you should know about if for DCF:

- Time value of money — a core principle in finance. This refers to the fact that a sum of money is worth more now than in the future due to its earning potential.

- Discount rate — in terms of DCF, discount rate refers to the interest rate used to showcase the current value.

- The risk-free rate of return — a theoretical term that refers to interest received from a risk-free investment.

- Terminal value — the value of the asset/business/project that goes beyond the forecast period. It assumes the business will have a set growth rate forever. It’s used as an indicator of future cash flows.

- Earnings per share — shows the amount of money a company earns for each share. It’s often used for determining the value of a business.

- The intrinsic value of a business — observes the value of a business on its own. Represents the present value of all expected future cash flows with an appropriate discount rate.

- Internal rate of return (IRR) — a discount rate used to estimate the profitability of an investment.

- Net present value of a company — a method of calculating your ROI.

- EBIDTA — earnings before interest, taxes, depreciation, and amortization; represents a measure of a company’s overall financial performance.

Formulas You Might Need

There are several formulas you might need to perform a DCF calculation.

Time value of money

PV = FV / (1 + r)

Where:

PV is the present value

FV is the future value

r is the rate of interest

Besides the formula, you can use an online calculator to get these numbers if necessary.

Terminal value

(FCF x (1 + g)) / (d – g)

Where:

FCF represents free cash flow for the last forecast period

g is the terminal growth rate

d is the discount rate (usually the weighted average cost of capital)

Earnings per shares outstanding

EPS = net income of company – preferred dividends / common shares outstanding

Free cash flow FCF

FCFt = OCBt- It

Where:

FCFt is a Free Cash Flow

OCBt is Net Operating Profit After Taxes

It is an investment during the period

The discounted cash flow formula

DCF = CF1 / (1+r)^1 + CF2 / (1+r)^2 + CFn / (1+r)^n

Where:

CF1 is the cash flow for year 1

CF2 the cash flow for year 2

CFn the cash flow for additional years

r is the discount rate

If the results are above the current cost of the investment, the opportunity will likely result in a positive ROI.

What Can Discounted Cash Flow Tell You?

DCF helps calculate how much money one could receive from the investment if they invested in it today. It’s adjusted for the time value of money, which further helps determine whether future cash flows will be equal to or higher than the value of your investment.

Furthermore, DCF can be used for calculating:

- The cost of purchasing an investment

- Rental income

- Expenses like mortgage, utility bills, cost of debt

- Estimated sales proceeds

Where to Find the Necessary Data?

In order to successfully do the DCF valuation, you’ll need to find specific rates. These are:

- The growth rate of the cash flows.

- The discount rate that you’ll use to discount future cash flows.

- Terminal rate to determine the final value of the DCF.

Growth Rate for Cash Flows

Since the DCF calculation is highly sensitive to the data you enter, it’s best to start within a reasonable range. Check the company’s balance sheet for past growth rates and use those to predict future cash flows. Remember that any number you choose is an estimate, and will affect your final result.

To calculate the growth rate, subtract year 1 cash flows from year 2 cash flows. Then divide the result by year 1 cash flows.

Discount Rate of Return

Next, you should find the discount rate of return for cash flows. To do this, use the WACC method. As we said before, the WACC is fundamental for discounted cash flow calculation.

To get WACC numbers, you should find the cost of debt and cost of equity first. Then, you should calculate the weights of both.

The formula for the weight of debt is:

WD = Total debt / (Market cap + total debt)

The formula for the weight of the equity is:

WE = Market cap / (Market cap + total debt)

Then, you calculate the WACC. The formula goes as follows:

WACC = (E / V x Re) + [D/V x Rd x (1 – Tc)].

Where:

E is the market value of the firm’s equity

D is the market value of the firm’s debt

V is E + D

Re is the cost of equity

Rd is the cost of debt and

Tc is the corporate tax rate.

Lower WACC is considered better than higher WACC.

Terminal Rate

The terminal rate is also one of the key inputs of the DCF calculation. It influences the value you’ll calculate for the future.

If you’re hoping to stay consistent in calculations, you should use the same rate you used for calculating the discount rate, WACC, or the rate at which the company grows.

Now that you have these numbers, it’s time to move on to the DCF calculations.

Value Investments Using the DCF Method: Companies, Stocks, and Bonds

The DCF model is great for evaluating different kinds of investments, including bonds and stocks. Here’s how you can use it to see whether a certain investment is worth its current price.

How to Use DCF to Value a Company?

There are certain steps to make to successfully calculate discounted cash flow for companies:

- Analyze the income

- Determine terminal value

- Calculate enterprise value

- Include additional assets

- Subtract all debt and non-equity claims

Since the DCF model reflects the value of a company’s future cash flows, the first step is to understand and analyze the income of the organization. There are two common methods for this:

- Unlevered DCF approach — forecast and discount entire operating cash flows, then add non-operating assets and subtract liabilities.

- Levered DCF approach — forecast and discount cash flows that remain available to shareholders after non-equity claims have been deducted.

At a certain point, you’ll stop calculating unlevered free cash flows and move to determine the lump sum or terminal value. The terminal value represents the value of a company beyond the final explicit forecast period. For this, you’ll usually use the estimate numbers.

The next step is to determine the enterprise value. This number represents the value of a company’s operations to all stakeholders.

If a company has any money sitting around, you should include that money into the present value of unlevered free cash flow.

The final step is to subtract all debt and non-equity claims to calculate what’s left for the equity owners.

How to Use DCF to Value Stocks

The DCF method is also handy for evaluating stocks. Here’s how:

- Take the average last three years of the company’s cash flow.

- Multiply the FCF with the expected growth rate to get the FCF for the future.

- Calculate the value of that cash flow by dividing it by the discount factor.

- Repeat the process for the next X amount of years to get the net present value (NPV) of the FCF.

- Calculate the terminal value of the stock by multiplying the final year FCF with a terminal multiple factor.

- Add the values from steps 4 and 5 and adjust the total cash and debt (find these in the company’s balance sheet) — this gives you the market value of a company.

- Divide the market value of a company by the shares outstanding to find the intrinsic value per share.

How to Price Bonds with DCF?

Finally, you can use DCF to value bonds, as their price is based on a model close to the DCF one. Typically, determining the fair value of the bond will involve calculating the bond’s cash flow (current value of a bond’s future interest payments) and its face value (the value of a mature bond).

Both these values are fixed, which helps you determine the bond’s RoR.

Here’s what to look at:

- Maturity date: Short or long-term, when reached, the bond’s issuer must repay the bondholder the full bond value.

- Discount rate: Interest payments that go to the bondholder, usually a fixed percentage of the face value.

- Current price: Bond’s current value, dependent on several factors such as market condition.

Pricing a bond is relatively simple, and can be done in the following way:

Calculate face value, annual discount rate, and maturity date

Collect the basic information about the bond; face value, on-par value, and the bond’s annual coupon rate. Also, note the maturity date. You’ll need these numbers to continue the DCF valuation method.

Calculate expected cash flows with the formula:

Cash Flow = annual coupon rate x face value

Discount the expected cash flows to the present

Cash Flow ÷ (1+r)^t

Where:

r is the interest rate

t the number of years for each cash flow

Value individual cash flows

To calculate the cash flows, use the following formula for each year:

Cash Flow Value = Cash Flow / (1+r) ^ 1 + 30 / (1+r) ^ 2… + 30 / (1 + r) ^ 30

Calculate the final face value that you’ll receive at the bond’s maturity date

Final Face Value Payment = Face Value / (1+r) ^ t

Add the cash flow value and the final face value and you’ll get the value of the bond.

Benefits of Discounted Cash Flow

The main pros of DCF:

- Highly detailed

- Includes all major assumptions about the company/project

- Determines the intrinsic value of a business

- Includes all future expectations about the business

- Suitable for analyzing mergers and acquisition

- Can be used to calculate IRR

Limitations of the DCF Model

The main cons of this model:

- Involves a large number of assumptions

- Prone to errors

- Too complex for novice investors

- Sensitive to changes in assumptions

- Isolates the company’s value

- Doesn’t include competitor’s value

- Terminal value TV is hard to estimate

- WACC is hard to estimate

Is DCF the Same as Net Present Value?

Even though these two methods are related, the DCF is not the same as net present value (NPV). NPV is actually the fourth step in calculating the DCF. It’s used to deduct the upfront costs of the investment from the investment’s DCF.

Final Word On The Discounted Cash Flow Model

The discounted cash flow valuation method projects a series of future cash flows and earnings, which it discounts with the time value of money. It’s one of the best ways to assess the present value of stocks, bonds, or businesses.

The DCF method is most suitable for experienced investors since it’s complex.

So, now you know how to analyze a potential investment’s value using the discounted cash flow method. And, since you’ve landed here on the Navexa blog, we have good news:

You can skip the complex calculations by using the automated discounted cash flow valuation calculator we’ve built into Navexa.

Navexa is a portfolio performance tracking and tax reporting platform that allows you to track your stocks and cryptos together.

Sign up to Navexa free today, and run value calculations on as many stocks as you like!