Total Stock Return is an investment performance metric that measures capital gains & income together. Here’s how to calculate it, use it, pros & cons, and more.

It’s vital to understand how your investments are performing. This is especially true for stocks that provide a dividend, which can have a significant impact on value and performance.

This is why it’s useful to know how to calculate total stock return. Knowing this allows investors to determine the real value they receive from their stocks, and better plan their investment strategy.

The Total Return, or Total Shareholder Return (TSR), also called the Total Stock Return, is the number that shows the amount of value gained for an investment. TSR includes dividends, and capital gains.

Here are some of the ways to calculate total stock return, including using the Navexa portfolio tracker, and its Modified Dietz Method.

What Are Total Returns?

Stocks can give returns in a couple of ways:

- Through the increase of the stock price.

- Through dividends.

Total stock return reflects all returns from capital gains, dividends paid, plus any other gains.

It’s measured for a specific time period, and helps the investor see performance over that period. The metric can be expressed as a percentage, or a dollar amount.

The Importance of Total Return

There are several reasons investors should keep track of their total returns. Primarily, this number shows how well the investment performs. It’s also handy for comparing stock performance to each other, or the wider stock market.

Some investors tend to ignore the total returns of their holdings, and only focus on how the individual stocks move day to day, or week to week. This can create confusion about investment performance and strategy.

Since TSR accounts for the initial and ending stock price, plus dividends, it gives clarity over total investment performance.

Finally, knowing the total return helps with dealing with taxes and authorities, and possibly minimizing tax on investments.

Terms Investors Should Know

When dealing with the total stock return, investors should understand key investment terms, and concepts. Understanding the following ideas can help shareholders improve their financial literacy.

- Annualized return: Return on investment over a 12-month period.

- Simple returns: Returns that are based on the initial investment only.

- Compound return: Return that’s paid for the initial investment plus accumulated income.

- Compounding frequency: The rate at which an investment compounds — it could be annually, quarterly etc.

- Dividend reinvestment: Receiving dividends as additional shares instead of cash.

- Internal rate of return (IRR): Similar to total returns, only includes a future profitability metrics.

- Expected total return: Same as total return, but using future assumptions instead of actual earnings.

- Unrealized capital gains: Gains that are yet to be converted into cash by selling out of an investment.

- Realized capital gains: Financial gains after an investment is sold.

- Risk-adjusted return: Metric that includes investment risk levels while calculating returns.

How to Calculate the Total Return for a Stock?

There are several ways of calculating total stock return. The shareholder may use the formula below, an online calculator, or a next-generation tool like the Navexa portfolio tracker.

TSR Formula

There are a few steps to take before working with the TSR formula.

First, investors should calculate the capital gain on their investment since they purchased it.

For example, if the initial investment was at $100 a share, and the share is now trading at $150, capital gains are $50 per share.

Then, add all the dividends, and other earnings that the investment has paid during the entire holding period. This will show the total stock return, expressed in dollars.

The simple formula goes like this:

TSR = (capital gains + dividends) / purchase price

The purchase price is the amount of money the shareholder invested in the stock.

To get the TSR as a percentage, use the dollar amount of the total returns, divide it by the price paid for the investment, and multiply the result by 100.

TSR Annualized Formula

To annualize their total return, investors should:

- Take the percentage calculated in the previous step and add 1.

- Then raise that number to the power of 1 divided by the number of years they held the investment.

- And finally subtract 1.

This is a more complex formula, and it looks like this:

Annualized total return = (total return + 1) ^ 1/years – 1

Furthermore, this formula assumes annual compounding. Some shareholders may use monthly or continuous compounding, but this calculation should be enough.

TSR Calculated in Excel Sheet

Besides using the total return formula, some investors use Excel to get their numbers. The “Rate” formula can help out, but the shareholder still has to manually enter the details of their overall performance to get the correct data.

TSR Calculator

Those who want to calculate their total return can also use online TSR calculator forms. They can select their currency, fill in the starting and ending stock price, enter the total amount of dividends, and run the calculation.

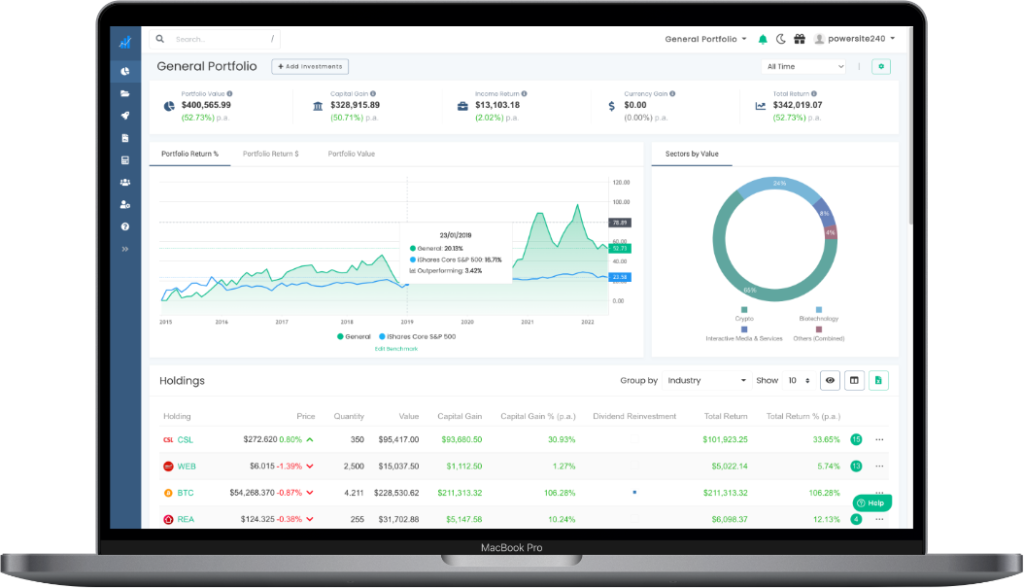

TSR Calculated in Navexa Portfolio Tracker

Investors can use Navexa to get deeper insights into their holding and portfolio performance.

The method behind Navexa’s calculation is called the Modified Dietz Method. It provides a dollar-weighted analysis of the returns. It’s known as one of the most accurate methods to calculate investment performance, and gives investors a detailed view of their total stock returns.

Plus, our tracker accounts for the frequency, and size of cash flows, providing a complete picture of performance.

Total Shareholder Return Example

Here’s a simple example of TSR:

Let’s say an investor purchased 100 shares, each of them for a price of $10. This makes their total investment $1,000.

The shareholder decided to hold this number of shares for a certain period of time. During this time, the company paid a $2 per share dividend, while the share price hit $12.

The TSR for the time period equals ($12 – $10) +$2 / $10 = 0.4

To get the percentage, the investor should multiply this number by 100, which equals 40%.

Advantages and Disadvantages of Total Shareholder Return

There are many benefits of using Total Shareholder Return:

- It’s a solid tool for performance analysis.

- TSR is highly valued as a performance metric because of its simplicity.

- The calculation offers a clear idea of an investment’s overall performance.

On the other hand, TSR is not a perfect methodology. Some of its disadvantages include:

- It’s limited to the past performance of the stock and dividends paid per share.

- Any market volatility, and market fluctuations will affect TSR numbers.

- It only evaluates performance for a single period.

Total Return With Reinvested Dividends

For shareholders who reinvest their dividends, calculating total return is a bit more complicated. This is because each of the reinvestments, including the capital gains, can easily become its own TSR calculation.

The formula we mentioned won’t work with this type of investment, as the new shares accumulate at the current trading price. This causes investors to end up with more shares than when they received the dividend. Plus, those shares will also start paying dividends on their own, and the numbers will start piling up.

The best solution to this issue is to simplify the approach — observe the overall investment, instead of looking at it on a per-dividend basis.

Using Navexa is an ideal way of keeping tabs on real returns and investment performance. The platform supports tracking for cryptocurrency ROI, so investors can view all their investments’ performance in a single account.

How to Use the TSR Formula in Investing?

There are many uses of TSR in investing. As we stated above, it’s a great way of comparing the total performance of different investments over time.

This is especially true for shareholders who would like to know which of their stocks (that pay dividends) are performing the best. With TSR, investors get a metric that tells them the past performance of an investment.

TSR can also help in improving investment strategy.

Benefits of TSR in Investment Strategy

When it comes to stocks and investments, knowing the total and expected returns is crucial for making the right decisions.

The total return formula helps people who want to understand how their investments are performing. The calculation accounts for all gains, dividends, and other earnings This gives investors a clear picture of how their investment strategy has been performing.

A Useful — But Not Perfect — Investment Performance Metric

Being actively invested in the stock market means one should be keeping track of every share and dividend in one’s portfolio.

One of the easiest ways to do this is with the Total Stock Return formula. The TSR calculation includes all gains, and dividends earned per share received over a given period.

However, this calculation is limited to the past value of the dividend, and stocks. Plus, it can be affected by market volatility.

Still, it’s a great way of evaluating investment performance.

For a fuller, clearer picture of investment and portfolio performance, try Navexa. We’ve developed an all-in-one portfolio tracking platform that shows the true performance of stocks, crypto and unlisted investments.

Navexa’s advanced performance calculation accounts for capital gains, dividend income (including reinvested dividends), currency gain and other key factors that impact true performance.