Your guide to calculating capital gains tax in Australia in 2022. From tax rates, CGT events, taxable income and more. Plus, discover four key tax reporting strategies investors use to adjust and optimize their total taxable capital gain.

Paying tax is a part of investing. It has long been a fact of life that a significant portion of our earnings will always be earmarked for payment to the state. This includes capital gains.

Tax is applied to a wide range of earnings including wages, salaries, and investment income from property, shares, and cryptocurrency.

In Australia, the tax rate that is applied to your investment income is known as the Capital Gains Tax, or CGT.

Whether you’re a seasoned investor or just starting out, it’s important to be aware of how CGT works. This article will explain how the CGT works, and how to calculate and report your capital gains in Australia in 2022.

While you can’t avoid paying CGT on your investment income, there are some strategies you should be aware of for minimizing the impact of tax on your capital gains. This blog post examines some of these strategies and provides examples of how they might look.

The Australian tax year, or financial year, runs from July 1 to June 30. This is the period for which you will need to submit your tax assessment based on any income you received during the financial year. This period is known as ‘tax season’.

How Does CGT Work?

The Australian Tax Office (ATO) requires individuals to declare investment activity in their tax return and pay tax on all investment earnings, including capital gains and dividend income.

If you buy shares, invest in property, or hold other investments which you sell at a higher price than what you bought them for, you will have made a capital gain. This means you will be paying CGT.

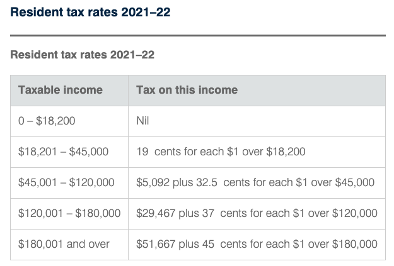

CGT is the tax rate that is applied to net capital gains (total gains minus total losses). It is not a set rate, but is calculated according to your marginal tax rate. This is the tax rate that you usually pay on your personal income, and will be the tax rate applied to your investment earnings.

Capital gains are taxed at an individual’s marginal tax rate

While CGT rates for individuals vary according to their marginal tax rate, flat rates apply for companies and self-managed funds.

Trading companies pay 26% if their annual turnover is less than $50 million, and if it exceeds $50 million, the CGT applied is 30%. Investment companies don’t qualify for the 26% rate and are taxed at 30%. Self-managed super funds are taxed at a lower rate of 15%.

If you sold any assets during a financial year, you will need to work out your capital gain or capital loss for each asset. CGT will need to be paid on your net capital gains.

To calculate your capital gains, you first need to know the ‘cost base’ or original purchase price of the asset. From there, you can work out how much profit you’ve made by subtracting the selling price from the cost base.

Depending on how long you’ve held the shares for, you may or may not qualify for Australia’s 50% CGT discount on investments held longer than 12 months.

The Navexa platform provides an automated solution for making these calculations — more on that later.

That’s how the CGT rate is determined. So, let’s take a closer look at which investments the CGT applies to.

What Does CGT Apply To In Australia?

CGT applies to a wide range of investment income in Australia, including earnings generated from real estate, shares, cryptocurrency, foreign exchange, and collectibles.

When you dispose of an asset for more than what you paid for it, you realize a capital gain which you will have to pay CGT on.

There are a range of other situations that will trigger the requirement to pay CGT. These are known as ‘CGT Events’. A CGT event occurs when an investor makes a capital gain or incur a capital loss on an asset.

Here’s a comprehensive list of what constitutes a CGT Event.

The Australian Tax Office (ATO) imposes CGT when you make a capital gain or loss

How Does CGT Apply To Shares?

When you sell shares for more than what you paid for them and realize a capital gain, you will have to pay CGT. When other CGT events occur, you will also have to pay CGT on your shares. Examples include switching shares in a managed fund between funds, or owning shares in a company that is subject to a takeover or merger.

It is important to keep good records of all your share transactions, including amounts and dates of purchase. When you file your tax return, CGT will need to be calculated for any profits you made from selling your shares.

Does CGT Apply To Dividend Pay-outs?

Many Australian investors enjoy investing in companies that pay out dividends (a percentage share of their profits) to their shareholders. But, like other forms of income, dividends are subject to taxation.

Dividends are paid from profits that have already been subjected to Australian company tax. Because the profits have already been taxed, shareholders won’t be taxed again when they receive the profits as dividends, provided that their marginal tax rate is lower than the tax rate paid by the company.

These dividends are described as being ‘franked’. A ‘franking credit’ is attached to the dividend and represents the tax that has already been paid by the company distributing the dividend. The shareholder who receives the dividend with an attached franking credit will either pay less than their usual tax rate, or receive a tax refund.

The general rule is that if your marginal tax rate is lower than the rate of tax paid by a company or fund, you might be entitled to claim a refund. However, if your marginal tax rate is higher than the tax already paid on the dividend, you may have to pay additional tax.

Does CGT Apply To Crypto?

If you were hoping to avoid paying CGT by investing in cryptocurrency, we have bad news for you. Cryptocurrency investment in Australia is also subject to taxation, in a similar way to other investment assets.

In recent years, the cryptocurrency market has grown rapidly, and the ATO has been quick to catch up.

Cryptocurrency markets have exploded in recent years and the ATO is all over it

As with other assets, CGT may apply in circumstances other than just selling your crypto. The ATO classifies four main CGT events for crypto activity:

You’ll be taxed when you:

- Sell crypto.

- Exchange one crypto for another.

- Convert crypto to a fiat currency like AUD.

- Pay for goods or services in crypto.

Just like when you pay CGT at your marginal tax rate when you sell shares, you pay this rate when you sell crypto.

Generally, you could apply the same tax rules to your crypto portfolio as you would for investment in stocks.

Remember, the ATO knows about your cryptocurrency.

What About CGT And Property?

You must pay CGT when you realize a capital gain from property. This could include selling an investment property for more than what you paid for it or selling a block of land that you created through a subdivision process.

Your main residence is generally excluded from CGT if you meet certain criteria specified by the ATO:

- You will need to have lived in the home for the whole period that you have owned it.

- The home can’t have been used to produce income or have been bought with the intention of renovating and selling it for a profit.

- It must be on land no greater than two hectares.

If you meet the criteria, you may be able to avoid paying CGT when you sell your house. If not, you may still qualify for a partial exemption. The ATO provides a property exemption tool on their website to help you make the calculations.

Capital Gains Tax (CGT) has to be paid on investment income from property

If you acquired property on or prior to 20 September 1985, CGT does not apply. But it will apply to certain capital improvements made after this date. It is also important to keep track of any rental income you receive from property and include it in your tax return. For more details on CGT and property, visit the ATO.

If You Are An Investor, It Pays To Know About CGT

As you can see, CGT applies to a wide range of investment income. When you prepare your tax return, you will need to provide the ATO with your assessable income and any capital gains or capital losses you made that year.

While this article isn’t financial advice, we do advise you to be well informed. The above is not an exhaustive list of what CGT applies to in Australia, so you should check with the ATO if you are unsure about what your tax obligations are.

You can’t escape having to file a tax return, but fortunately there are a few strategies you can use to reduce your tax burden, legally.

Let’s explore some of the strategies that investors use to minimize investment tax.

Effective Strategies To Minimize Tax Payments

There are several legal investment strategies investors employ to minimize tax bills and claim tax deduction. This goes for both gains and income.

Below you’ll find some of the ways Australian investors hold on to as much of their investment gains and income as possible.

The following is not investment advice. As with all the information on the Navexa blog, it’s general investment information our writers have collated from other sources. For any financial or investment decisions, you should always understand the risks, and seek professional advice if necessary.

Strategy 1: Hold Onto Your Investments For Longer Than 12 Months

Australian tax law makes a distinction between short and long term capital gains. A long term capital gain is when you make a profit on an investment that you’ve held for longer than 12 months. It’s a short term capital gain if you’ve held the asset for shorter than 12 months.

As an investor, this is important to understand because of something known as the ‘CGT discount’.

If you’ve held an asset for longer than 12 months before a given ‘CGT event’ occurs, you may be able to claim a CGT discount of 50%. Remember, a ‘CGT event’ is the point at which you make a capital gain or loss on an asset.

Let’s say you made $30,000 profit from investments that you’d held for less than 12 months, and your marginal tax rate was 37%. You’d have a $11,100 tax liability.

However, if you’d held the asset for longer than 12 months before you sold, the CGT discount would mean your tax liability was just $5,500! That’s a significant amount saved on your tax bill.

Capital Gains Tax discount applies to a wide range of investment income, including shares, property, and cryptocurrency.

As you can see, holding onto your investments for longer than 12 months to take advantage of this discount can be much more tax effective than disposing of them quickly.

Remember, you must be an Australian resident for tax purposes to take advantage of the CGT discount. There are also some other situations where the CGT discount does not apply.

For example, the discount is not available if the asset is your home and you started using it as a rental property or business less than 12 months before disposing of it.

A CGT discount of 50% is available to Australian trusts, and complying super funds can receive a discount of 33.33%. However, companies can not take advantage of the CGT discount.

When you file your tax return, you must subtract any capital losses that you may have from your capital gains before applying the CGT discount. In most cases you will be eligible for the discount if the asset has been held for longer than 12 months.

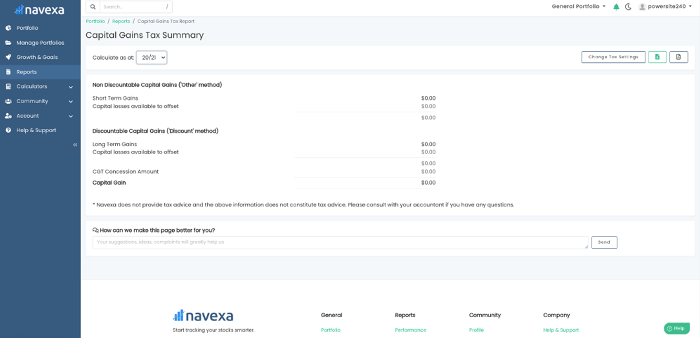

Navexa provides a platform where you can easily track your portfolio performance and calculate both your taxable capital gains and taxable income. Our CGT Reporting Tool gives a detailed breakdown of which assets are ‘non-discountable’ from a CGT perspective (those which have been held for less than the required 12 months to qualify), reducing the amount of tedious leg-work at tax time.

Navexa’s tax reporting tools remove the need to manually calculate your portfolio’s tax obligations and show you the most tax effective way to prepare a tax return.

Provided the portfolio data in your account is correct and up-to-date, you can run an automated tax report in just a few seconds.

What you see above is Navexa’s CGT Report.

Navexa calculates your taxable gains and displays a detailed breakdown. Capital gains are displayed according to Short or Long Term status alongside your Capital Losses Available to Offset. The report also calculates your CGT Concession Amount and finally, your total Capital Gain.

Navexa’s CGT Reporting Tool makes it easy to categorize your investments for your tax return.

Find out more about how Navexa can help you manage your tax obligations.

Strategy 2: Offset Your Capital Gains With Capital Losses

Another useful strategy at tax time is using capital losses to offset your capital gains. While it would be nice if your assets always made gains and never losses, most of us who invest know that this isn’t the case. Thankfully, the silver lining here is that your capital losses can be used to reduce the tax you pay on your capital gains.

You will have made a capital loss when you sell an asset for less than what you paid for it. This loss can be deducted from capital gains that you made from other sources, to reduce the tax you pay. If you don’t have any capital gains to deduct from, the capital loss can generally be carried forward to future financial years. If you make capital gains in future years, the capital losses are still up your sleeve to deduct from any gains and reduce tax.

While there is no time limit on how long you can carry the losses forward if you don’t make any gains, the ATO does require that capital losses are used at the first available opportunity. This means when you have a capital gain to declare and capital losses available to offset, you must do so. They also require the earliest losses to be used first.

For example, if an investor owed $5,000 in CGT for their investments in a financial year, but had declared losses of $1,500 the previous financial year, they could carry these losses over to offset their capital gain, resulting in a reduced tax bill of $3,500.

There are some capital losses that can’t be deducted, so be aware of these. These include personal use assets such as boats or furniture, or collectables below a certain value. The ATO also won’t allow capital losses to be deducted from collectables unless they are deducted from capital gains from collectables.

Capital losses can also be deducted from your cryptocurrency assets, too. Let’s say you bought $5,000 worth of Ethereum because it had been surging in price and you were experiencing crypto-FOMO. You buy near the peak and in subsequent weeks the price crashes heavily, after a large nation announces that it won’t endorse cryptocurrency in their economy. Despite this disappointment, don’t forget that if you sell the asset and realize a capital loss, it could be a handy tool to offset other capital gains in your portfolio.

Despite a few exclusions, however, most capital losses from your investments can be deducted from capital gains you have made from other assets. If you are unsure about whether you can deduct a particular capital loss, check with the ATO.

Strategy 3: Invest In Companies That Pay High Dividends And Franking Credits

We’ve already looked at how the ATO taxes dividends, so what does this mean for minimizing your income tax obligations? Again, this is not financial advice.

Remember that companies must pay the Australian Companies Tax on their profits. If an investor receiving a dividend has a tax rate greater than the company tax rate that has already been applied to the company’s profits, they will receive a franking credit.

Let’s look at an example. Say an investor with a 32.5% tax rate receives a $1,750 dividend with a $750 franking credit attached. The franking credit takes the taxable income to $2,500, with gross tax of $812.50 payable. The franking credit rebate of $750 is deducted from the gross tax and the investor is left to pay a reduced tax amount of $62.50, leaving them with $1,687.50 after tax income. As you can see, the impact of the franking credit rebate is significant. For a full breakdown of this and other franked dividend scenarios, click here.

The investor in the above situation manages to retain most of their dividend income. Because the franking credit offsets their CGT so significantly, the amount of tax the individual pays is greatly minimized. Obviously, if your marginal tax rate is lower than 32.5% you will pay less tax and receive a larger chunk of the dividend. If you’re in a higher tax bracket than this, you will receive less.

Regardless of your marginal tax rate, franked dividends are a useful tool to reduce your tax obligations. Choosing to invest in companies that pay dividends, especially fully or highly franked dividends, is a popular strategy for minimizing tax paid on investment returns.

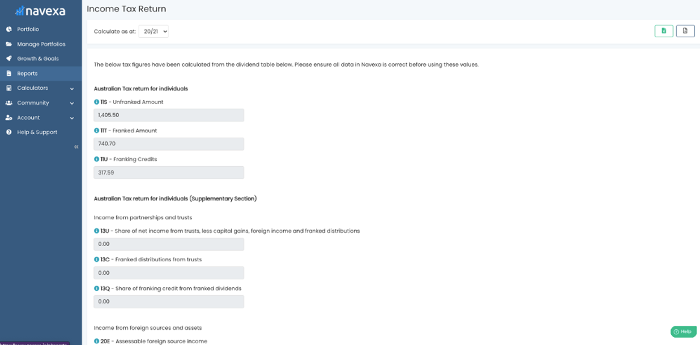

Navexa’s Taxable Income Reporting Tool

Navexa can help you accelerate the process of determining your taxable income. When you automate your portfolio tracking in Navexa, the Taxable Investment Income Report provides you with everything you need to know to prepare your tax return.

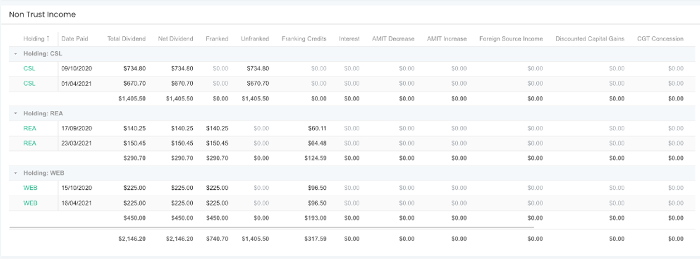

As you can see above, the Taxable Income Tool displays the Unfranked Amount and the Franked Amount for your dividends, as well as the total franking credits attached to them.

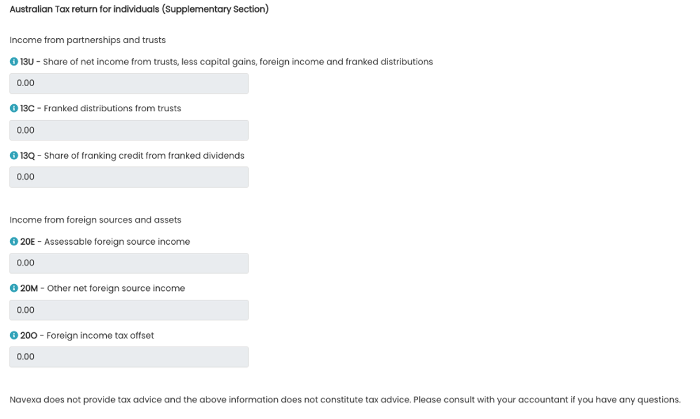

And in the below image, you can see the additional fields in the ‘Supplementary’ section. These display further tax-relevant information such as the amount of Franked Distributions From Trusts, the amount of Assessable Foreign Source Income, and your Foreign Income Tax Offset.

A foreign income tax offset is when you may have already paid tax on something in another country. This might be employment income or capital gains. In some instances, you may be able to claim a foreign tax offset as part of your tax return. Navexa’s Taxable Investment Income Tool will calculate and display these details for you.

Below these fields, you’ll be provided with a holding by holding breakdown of your taxable investment income, like this:

This shows you subtotals for payments from each holding, with grand totals for each column at the bottom. Assets are organized by the dates at which you acquired them, which has important tax implications.

At the top right of the report, you’ll find buttons for exporting the report as both an XLS and a PDF file.

This helps you accelerate the process of preparing your investment income for assessment.

Let’s take a look now at how different investors might choose to dispose of their assets.

Different Tax Strategies For Disposing Of Investments

When the time comes that you want to sell, it can be easy to get excited about the potential gains you are about to realize. This excitement can be dampened, however, when you are faced with the reality of your tax bill.

Choosing a particular method to dispose of your assets can have a major impact on the profits you generate and the tax you pay on them.

Please remember that this does not constitute financial advice. Our writers have collated a wide range of information relating to investment tax that we think is useful for you to consider. As always, we recommend you do your own research before making any investment decisions — tax or otherwise

Strategy 1: First-In-First-Out (FIFO)

The first-in-first-out (FIFO) approach is a common method used by investors when they sell holdings. When you purchase a group of shares at a given price, they will constitute a ‘parcel’.

You may acquire shares in the same company in several different transactions over a period of time. Each transaction forms its own parcel of shares.

The concept of FIFO relates to the disposal of investments. When you are ready to sell shares, you can choose which parcels — sometimes called ‘lots’ — of shares you would like to sell.

Using the FIFO method, you would sell the parcels that have been held for the longest period. Provided that the share price has risen since the time of purchase, the FIFO method will ensure the greatest capital gain from the sale of a parcel of shares. Obviously, this won’t always be the case, and adopting a FIFO approach might not result in the greatest capital gain.

For example, if an investor purchased 100 shares in a company at $20 per share three years ago, and another 100 shares at $40 two years ago, they might choose to use the FIFO method when they choose to sell some of those shares.

Let’s say the company’s share price has now risen to $50. The investor sells using the FIFO method, disposing of the first 100 shares that were purchased at $20. Because the share price has grown $30 since they purchased them, they realize a gross profit of $3,000. However, if they had chosen to sell the more newly acquired shares parcel, they would only realize a gross profit of $1,000.

As mentioned, FIFO will only result in the largest capital gain if the share price has risen consistently over time. If share prices have dropped since you bought them, the FIFO approach might not result in the greatest capital gain — but it could lower your tax burden.

Strategy 2: Last-In-First-Out

In the above example, the investor opted to sell their more recently acquired shares because they wanted to maximise their capital gains. Because the share price rose over time, the FIFO approach achieved this goal.

LIFO works in the opposite manner to FIFO — your newest shares are sold first. The LIFO method ‘typically results in the lowest tax burden when stock prices have increased, because your newer shares had a higher cost and therefore, your taxable gains are less’.

If we continue to assume a consistent growth in share price, LIFO would be a useful strategy to dispose of assets and realize less capital gain from the disposal — and subsequently pay less tax.

However, don’t forget that you can only qualify for the CGT discount if you’ve held shares for longer than 12 months.

FIFO and LIFO are based on shares being organized by time

The FIFO and LIFO approaches above assume that share prices have risen over time. When the opposite is the case, a smaller capital gain may be realized by selling the newly acquired shares or vice versa. The degree to which FIFO or LIFO suits your goals will depend on how the share price has behaved since you acquired the asset.

Some investors might opt for a more precise method of disposal such as maximum or minimum gain, to ensure that they dispose of the parcels which will return the greatest capital gain or result in the lowest tax burden.

Strategy 3: Maximum Gain

The FIFO and LIFO methods are based on selling assets based on the time at which you acquired them. One alternative approach is maximum gain, which is focused on the price at which shares were bought, rather than the time they were bought.

The suitability of FIFO or LIFO will depend on what has happened with the share price since you bought, and what your goal is. Maximum gain focuses on disposing of the assets that were acquired for the lowest price, rather than those which were acquired first or last. This approach is suitable for those looking to ensure maximum capital gains when they sell.

An example of the maximum gain approach: A prospective home buyer has found their dream home and needs to prove to their bank that they can service a large mortgage. They carefully select the shares that were bought at the lowest price in their portfolio to sell, so they can realize the maximum possible capital gain from the sale. While they will pay the most tax using this method, the capital gain will be the largest, and this will help paint a healthy financial picture to the bank.

But, you may want to minimize your CGT obligations.

Strategy 4: Minimum Gain

The minimum gain approach works in the opposite way to maximum gain — you select the parcels of shares in your portfolio that you acquired for the most expensive price and sell these first. By choosing to sell the tax lots with the highest cost base, you will minimize your gain.

This strategy is generally used by investors who want to minimize their CGT obligations. As we know, less capital gain = less tax paid.

Minimum and Maximum gain, as well as FIFO and LIFO approaches, will suit different investors depending on their requirements.

Regardless of what your aspirations are, and which approach you choose, it is important to make sure that your investment portfolio is kept in good order.

Record keeping is paramount in both portfolio management and personal finance — particularly as it concerns reporting your investment activity to the tax authorities.

The above strategies are probably best deployed when you have a clear understanding of your portfolio’s performance. It is important to keep an accurate record of your transaction history, including the dates and prices at which you bought particular shares. This knowledge is vital if you wish to select the most tax-efficient disposal strategy that you can. Or in some instances, simply if you want to maximise your capital gains.

The Navexa Portfolio Tracker automates this entire process, from tracking trades and transactions to optimizing how you report CGT on a portfolio.

Remember, Navexa doesn’t offer tax advice. We always encourage you to consult your accountant or seek other professional advice when it comes to investments and taxes.

Automate Your Portfolio Tax Reporting & Optimization With Navexa

Navexa is a platform for tracking your investment portfolio and displaying detailed information that will help you better understand your performance — and better handle investment tax reporting.

When it is time to prepare your tax return, you should have a clear vision of what you want to achieve. Whether you are looking to maximise your capital gains or minimize the impact of CGT, Navexa makes the process fast and stress-free.

Our CGT and the Taxable Income tools can help you determine your obligations and options when it is time to file your tax return.

Join thousands of Australian investors already using Navexa to manage their investment portfolios.

With Navexa you can:

- Track your stocks and crypto investments together in one account.

- Automatically track capital gains, portfolio income, currency gains and losses and trading fees.

- Benchmark your long-term portfolio performance against any index you choose.

- Automatically track your dividend and distribution income from stocks, ETFs, LICs and Mutual/Managed Funds

- Use the Dividend Reinvestment Plan (DRPs/DRIPs) feature to track the impact of DRP transactions on your performance (and tax)

- See the complete picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Navexa’s annualized performance calculation methodology

- Run powerful tax reports to calculate your dividend income with the Taxable Income Report

- Calculate your CGT obligations with our Australian Capital Gains Tax Report and the Unrealised Capital Gains Tax Report