Tracking a cryptocurrency portfolio might be challenging. Here’s what experienced inventors use to understand their crypto ROI.

Investing in cryptocurrencies can be challenging, especially for investors who are used to dealing with traditional assets. These investors often see the crypto market as highly volatile.

In addition, there’s a lot of market manipulation, which often causes drastic price movements.

However, most people get attracted to crypto investment and jump into a digital asset because of the possibility of a high return on investment.

Even the experienced trader who deals with gold might test out the waters and get into crypto, ready to take the risks.

Here’s how they calculate the ROI, rate of return, and their net profit.

Briefly on Cryptocurrencies

There’s a lot that can be said about cryptocurrencies, but new investors should know that it all started with Bitcoin (BTC) in 2009. It was the first-ever digital currency that introduced a peer-to-peer electronic cash system.

Once the first cryptocurrency started getting traction, others followed. Soon, a whole new market was born, and ever since, the financial industry hasn’t been the same. Cryptocurrency opened up many doors to investors who can now invest in these assets in several ways, such as:

- Purchasing coins or tokens directly on the exchange

- Investing in an Initial Coin Offering (ICO)

- Investing via Initial Exchange Offering (IEO)

- Getting into Crypto Exchange Traded Fund (ETF)

Some of the new options for investing in crypto include purchasing non-fungible tokens (NFTs) and lending money via some of the Decentralized Finance (DeFi) platforms.

Dangers of Investing in Cryptocurrency

Even though there are many ways to get introduced to crypto investments, novice investors often worry about the limitations regarding current and future regulations.

Many investors don’t consider the value, efficiency, or use case of the cryptocurrency they invest in. Some also completely ignore the technology behind the project and only follow a hyped community and current market sentiment.

This often results in a poor, emotion-driven investment decision, which brings a negative return on investment (ROI).

On the other hand, some investors are fortunate, and hit the nail on the head by getting into tokens which prove to be successful projects, bringing high ROI.

Still, those who purchased crypto and learned to manage the risks claim there’s a potential for a decent return on investment (ROI).

However, ROI depends on the current price of the asset and market fluctuations, which can be shaken with just one negative headline.

This is why calculating the rate of return and ROI can be tricky.

What Is Return on Investment (ROI)?

Return on investment, or ROI, is defined as the percentage growth or loss of investment, divided by the initial cost of an investment, multiplied by 100. ROI calculation measures the profitability of an investment.

On the other hand, the rate of return, or IRR, is the rate of all future expected cash flows of an investment. IRR measures the estimated return.

Both are used to measure the performance of investments, with ROI being used by individual investors or institutions and IRR being used by financial analysts.

Positive ROI and Negative ROI

The difference between a positive ROI and a negative ROI is simple. A positive return on investment means that net returns are greater than any investment costs.

The negative ROI percentage shows the net returns are poor, meaning the total costs are greater than returns.

The Importance of the ROI Metric

ROI is the key performance indicator that shows how successful an investment might be. ROI calculation can be handled in two different ways:

- By using the standard ROI formula: subtracting the initial value of the investment from the final value of investment, and then dividing the number by the cost of investment x 100

- By using the alternative ROI formula: dividing net return on investment with the cost of investment x 100

Still, investors should be mindful that the annualized return formula often ignores the compounding that’s added to the initial value, which is why it might give incorrect results.

Tools Investors Use to Calculate ROI

There are many tools to calculate ROI, and experienced investors often don’t even have to use a formula to get the numbers right.

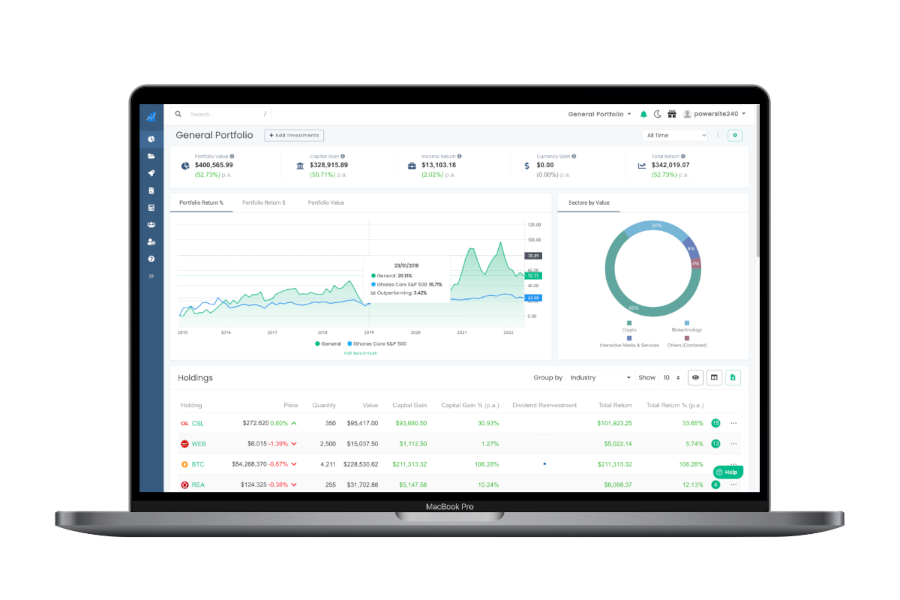

For example, Navexa is one of the best ROI and portfolio trackers people can use to keep track of the money they invested.

It’s a smart portfolio tracker tool, developed to pull data from all sorts of platforms, including crypto exchanges.

Navexa helps traders and investors see their annualized ROI with ease — bypassing the need to use any manual calculation.

What is Crypto ROI?

Crypto ROI helps investors calculate the performance and efficiency of their crypto investment.

By calculating crypto ROI, traders and investors also compare how different crypto investments perform against one another, and which asset has the highest potential of bringing more money.

What’s more, crypto ROI is a key metric in determining the performance of an asset compared to its initial price.

Calculating crypto ROI has become a popular indicator for Bitcoin, Ethereum, and altcoin traders and investors.

Crypto ROI is observed in the same manner as traditional investments ROI — if an ROI is positive, that means the investment is performing well — the price is increasing over a certain period.

On the other hand, if the value of ROI is negative, that means the asset has lost value.

When it comes to crypto, it might be tricky to know whether a crypto investment will bring ROI.

Digital assets often look quite appealing, especially to new investors, but the market is very volatile and high ROI often depends on multiple factors.

Why do Investors Measure Investment ROI in Crypto?

The most common reason investors measure crypto return on investment ROI is to see whether the initial value of the investment has increased.

Calculating crypto ROI gives the general idea of how profitable an investment is.

It also shows how the investor’s portfolio performance compares to the initial investment.

How to Calculate ROI in Cryptocurrencies?

Investors usually calculate crypto ROI by subtracting the original cost of investment from the current value and then dividing it by the original cost.

Just like with traditional investment assets and markets, ROI calculation shows whether an investment strategy is working or not.

Is ROI an Ideal Metric?

While ROI is a powerful metric that shows the success or failure of the investment strategy, it has some flaws. For example, ROI doesn’t usually account for the time someone spent investing. This is why analysts often calculate annualized ROI, which shows the progress of profit or loss for a given timeframe.

ROI doesn’t explain the asset’s environment, market risk, and liquidity changes. This is why investors often rely on a few other metrics, and not just the ROI.

Those crypto investors who prefer trading to holding should also account for other factors and costs, such as trading fees, wallet fees for sending the coins, and any other metric related to their expenses.

They should also account for the dates when they bought and sold an asset.

The ROI metric doesn’t reflect the risk associated with purchasing, trading, and holding crypto, which is why investors must rely on additional data.

Crypto ROI Calculator

There are many crypto investment ROI calculators out there and most are super easy to use to calculate profit on crypto investments.

Navexa is one of the top crypto ROI calculator tools investors use to get the percentage of their ROI.

The Navexa portfolio tracker calculates performance for stock and cryptocurrency holdings, including capital gains, currency gain tracking, income tracking and more. Navexa is easy to use and free to start with, so both novice and experienced investors can test out its features.

Example: Calculating the ROI of a Bitcoin Investment

Bitcoin is likely the first asset investors get into when they start investing in crypto. Here’s a simple example of how people calculate the ROI of BTC.

Let’s say someone invested $2,000 into BTC. After a while, their $2,000 grew to $6,500.

They would calculate the BTC ROI following the standard formula:

($6,500 – $2,000) / $2,000 = 2.25 x 100 = 225% ROI

Return on Investment for Different Digital Assets

With so many different assets on the crypto market, each asset may have a different ROI. Those projects that have a more active community, and a better use case for their tokens may provide higher ROI to early investors. However, that’s not always the case and this post should not be considered financial advice!

Bitcoin is already a somewhat established asset, and its ROI has historically been the highest compared to other assets. On the other hand, Ethereum is the second-largest cryptocurrency after Bitcoin, but it just recently provided a higher ROI for some investors.

Some of the best performing assets currently include The Sandbox, Terra, Decentraland, and other assets that are related to the metaverse, play-to-earn gaming models, NFTs, and a few other new technologies in the crypto space.

However, experienced investors know that the crypto market is unstable and that ROI on most crypto assets can become negative if the coins face a massive sellout.

Final Word on Calculating Crypto ROI

One of the reasons people get into crypto is the promise of a potentially high ROI. However, getting great returns with crypto can be challenging. Still, measuring ROI can help investors make more rational decisions. ROI metric also helps people allocate the money in their portfolio in the right way so that they’re more profitable in the long run.

On the other hand, calculating ROI on a crypto investment could be tricky, as investors often forget to account for their trading fees and other expenses they managed.

However, with Navexa, getting a clear ROI metric is easy 🙂