Measuring portfolio performance can seem like a complex, dark art. We introduce eight powerful portfolio performance metrics for better understanding investments.

When it comes to investing, you want to make sure that you are keeping track of your portfolio’s performance.

This will help you stay on track and achieve your investment goals.

In this blog post, we will discuss the top eight portfolio performance metrics.

By tracking these metrics, you can make informed decisions about your portfolio performance and ensure your money is working hard.

What Are Portfolio Metrics?

A portfolio metric measures how well or poorly an investment or portfolio is performing. There are a variety of different portfolio metrics, each of which measures a particular aspect of investment performance. Tracking these metrics ensures that your portfolio is on track to reach your investment goals.

The 8 Best Portfolio Performance Metrics

We’ve compiled this short guide to eight of the most popular and respected investment performance metrics investors and analysts use to measure and judge stocks, funds, sectors and markets. From overall returns to different ‘delta’ measurements, all these metrics are useful and unique. Let’s dive in.

1.Compound Annual Return

The compound annual return, sometimes called compound annual growth rate, or CAGR, is the most common and most important metric for most investors.

Compound annual return is one of the most crucial portfolio performance metrics. It measures the percentage increase in your investment’s value each year, considering the reinvestment of dividends and capital gains.

This metric is essential for long-term investors as it can help measure the effectiveness of an investment strategy over time. By tracking compound annual returns, you track and analyze not just capital appreciation, but the impact of letting reinvested gains progressively fuel that growth.

2.Compound Annual Return vs. Benchmark

Comparing a compound annual return to a benchmark is a great way to measure a portfolio’s performance. A benchmark is a standard against which you can compare aninvestment’s performance. There are many different benchmarks you can use, depending on your investment goals.

For example, if you are trying to beat the US stock market, you can use the S&P 500 as your benchmark. If you are trying to achieve a specific rate of return, you can use your own benchmark based on that goal.

3. Sharpe Ratio

The challenge with the compound annual return is that it only focuses on return and says nothing about risk.

The Sharpe ratio is a measure of risk-adjusted return. This takes into account the volatility of your investment’s returns. This metric is vital for investors who are looking for a higher return potential but still want to keep their eye on risk.

The Sharpe ratio compares an investment’s potential return to its volatility. By tracking the Sharpe ratio, investors can make better informed decisions on a portfolio’s path, combine multiple diversified asset classes to smooth returns, or even lever investments to target a certain level or tolerance of risk.

4. Beta

But what about if your portfolio’s volatility is greater or less than the market as a whole? You would expect that investors taking on additional volatility must be compensated for the extra volatility risk.

Beta is a measure of how risky the overall stock market is. It’s like taking every stock in the market and combining it into one and calculating its volatility.

A beta of 1 means that the investment is just as volatile as the market, while a beta of 0.5 and 2 means that the investment is less and more volatile than the market, respectively.

Here’s an example of beta in action.

Say Walmart’s beta is roughly 0.5. This means that when the market goes up 2%, Walmart should go up 1%. The reverse is also true. If the market goes down 5%, you expect Walmart to only go down by 2.5%.

One important thing to understand is that stocks and other asset classes can have a negative beta. This means that when stocks go up, the negatively correlated asset will go down. And when stocks go down, this asset would go up.

This critical understanding enabled Ray Dalio to turn Bridgewater into a behemoth and is an asset allocation strategy shared by almost all of the best proprietary trading firms.

5. Jensen’s Alpha

If your performance beats beta, you get alpha.

Jensen’s alpha, also known as just alpha, is a measure of how much an investment outperforms or underperforms its expected return. If Walmart, with a beta of 0.5, matched the return of the market (beta of 1), you achieved alpha. You took less volatility risk than the market but matched the market’s return.

By tracking Jensen’s alpha, you can analyze which investments are outperforming or underperforming their benchmarks.

6. Treynor Ratio

While Jensen’s alpha focuses on excess return, the Treynor Ratio focuses on total risk-adjusted return.

This metric is helpful for investors who are looking to minimize their risk while still achieving a high return relative to the market.

The Treynor ratio can help determine whether an investment is worth the risk by comparing its potential return to its beta.

7. Sortino Ratio

How many investors would complain their portfolios are too risky after an 11% gain?

Likely not many.

The Sortino ratio is similar to the Sharpe ratio but only looks at downside volatility instead of total volatility.

This metric is essential for investors who are looking to minimize their losses and protect their principal investment.

The Sortino ratio can help determine whether an investment is worth the risk by comparing its potential return to its downside volatility.

By tracking the Sortino ratio, you can make judgments around downside risk. Combined with the Sharpe ratio, investors can use it to smooth their portfolio risk and expected returns.

8. Calmar Ratio

And while volatility to the downside is an essential proxy for risk, I think far more investors are concerned with the total permanent loss of capital.

The Calmar ratio is another measure of risk-adjusted return, which takes into account not the downside volatility but the maximum drawdown of your investment’s returns.

This metric is vital for investors who are looking to minimize their losses and understand the worst-case scenario for their investment.

The challenge with the Calmar ratio is that there are not as many data points to make it as statistically significant as the other methods.

What Is the Best Portfolio Metric?

You’ve probably surmised that this is a trick question. While if I had to pick only one, I would crown the Calmar Ratio as king, you can get a much better view by understanding the above.

It’s worthwhile to understand multiple different portfolio performance metrics. Knowledge, as Benjamin Graham said, pays the best dividends.

By being familiar with compound annual growth, benchmarking, beta, alpha and the various ratios that measure risk and performance, investors give themselves more tools to understand and manage their investments.

The Best Way to Track Your Portfolio Performance Metrics

Renowned management expert, Peter Drucker, famously said ‘what can’t be measured, can’t be managed’. In other words, if you don’t know how an investment or portfolio is performing, you’re going to have a difficult time managing and improving its performance.

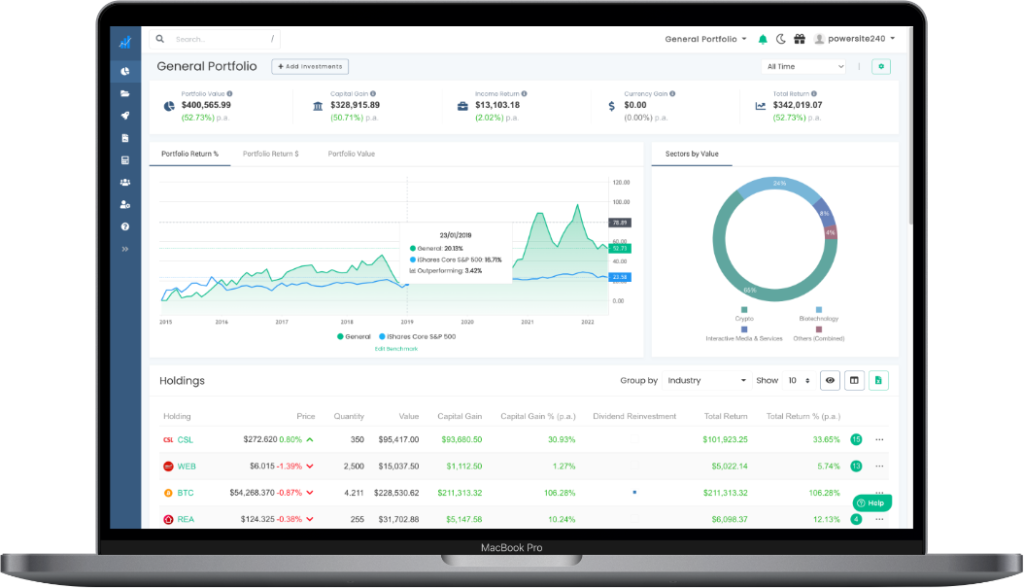

This is why it pays to understand eight performance metrics explained here. And, why we recommend investors use a portfolio tracking platform to help them measure, analyze and optimize their own performance.

Navexa is designed to help investors do exactly that. By bringing all stock, crypto, ETF, cash and other investments into a single unified tracking account, we help you measure every aspect and factor of portfolio performance so you can focus on making data-driven investment decisions.

Portfolio Performance Metrics FAQs

What is a good ROI?

A good ROI, or return on investment, is a measure of how much money you make on your investment compared to how much money you put in. This metric is important for investors who are looking to make a profit on their investment. While this varies for each investment class, it’s usually asked in the context of the stock market.

We also know that volatility is a critical component of understanding return. However, if you’re still interested, you can check out Professor Damodaran’s Equity Risk Premium for the month and multiply by your portfolio or stock’s beta.

What Is a good Sharpe ratio?

A good Sharpe ratio is between 1 and 2, and above 3 is considered excellent.

What is a good Jensen’s alpha?

Any positive value for Jensen’s alpha is excellent. It means the portfolio has beat the market with a superior selection of assets.

What is a good Treynor ratio?

A good treynor return is anything greater than the S&P500 minus the current risk-free rate.

What is a good Calmar ratio?

A Calmar ratio between 0.5 and 3.0 is considered Great. Anything above 3.0 is excellent.

How is annual compound return calculated?

The Navexa portfolio tracker uses an advanced portfolio performance calculation based on the Modified Dietz method to measure annualized, money-weighted performance. Navexa also calculates and displays CAGR performance.

How is the Sharpe ratio calculated?

The Sharpe ratio subtracts the risk-free rate from the investment’s return, then divides the result by the standard deviation of it’s excess return.

How is the Treynor ratio calculated?

The Treynor ratio divides the difference between average return and the average risk-free rate of return by the investment’s beta.

How is the Sortino ratio calculated?

The Sortino ratio divides the difference between an investment’s aggregated earnings and the risk-free rate of return by the standard deviation of negative earnings.