In this post, we profile 16 of the best investing, personal finance blogs and podcasts (and YouTube channels) you’ll find on the web in 2022. Whether you’re new to personal finance and investing, or you’re looking for advanced economic analysis and trading content, these podcasts, blogs and channels will build your knowledge and financial literacy.

There’s never been more content about investing, personal finance, money management and financial independence than there is today.

As you’re reading this, thousands of content creators and journalists around the world are producing and publishing content aimed at helping you better understand personal finance, the markets and the deeper economic forces that drive them.

I’ve been in the financial research and publishing world for more than a decade. I’ve read, watched and listened to a lot of posts, videos and podcast episodes on investing, trading, personal finance and financial independence.

There are plenty of fantastic finance podcasts and blogs out there for those learning about everything from how to get started investing, or saving money, through to more advanced areas like options trading, portfolio management and macroeconomic theory.

But, as with most topics in this content-saturated era we’re living in, there’s also a lot of junk — clickbait content that promises fascination but turns out to not really say much at all.

That’s why I’ve put this post together. The 16 podcasts, blogs and channels I profile here are, in my and the Navexa team’s experience, some of the best investing and personal finance blogs and podcasts out there today. From deep economic analysis to business news, interviews with the world’s wealthiest investors and model portfolios designed to uncover once-in-a-lifetime investment ideas, these shows and websites span the spectrum of expertise.

Presented in no particular order.

#1: Chat With Traders — Pro Traders Share Their Stories

Professional trader Aaron Fifield launched the Chat With Traders podcast in 2015. Each podcast episode takes the form of a long conversation between the host and the guest — a billionaire fund manager, legendary options trader, a strategy specialist, or other industry expert.

These interviews are deep explorations that dive into what drives and motivates pro traders, what they’ve learned in their journey, and how they apply their knowledge to making money.

The CWT podcast is definitely not for beginners. While some of the ideas and principles you’ll learn in these episodes are universal and useful to investors of every level, you probably want to have a high degree of prior knowledge of trading (as opposed to investing) to get the most out of it.

I recommend podcast episode 214 with professional trader, James King, who shares four principles that drive elite performance.

#2 Equity Mates — An Aussie Investing Podcast Ecosystem

You can’t find an investing or finance podcast in Australia without stumbling upon Equity Mates. Founded in 2017, university mates Alec and Bryce created Equity Mates as a means to share their journey into investing and wealth building. They felt that ‘financial markets were seen as complex and inaccessible and financial media catered to the industry but not everyday Australians’.

The content you’ll find on the Equity Mates podcast and blog today is very much the opposite of industry-centric. Now spanning nine podcasts, online courses and even the FinFest live event, Equity Mates has expanded to cover a huge range of personal finance and investing content.

From the original Equity Mates Investing Podcast to Crypto Curious, Get Started Investing and more, there’s pretty much something for investors of almost every level to learn here. Thanks to their rise to prominence in Australia’s investing podcast world, Equity Mates now pulls some high-profile guests on its shows, too.

Check out this podcast episode, in which the Head of Research & Portfolio Management at InvestSmart, Nathan Bell, shares his 2, 4, 6 rule of portfolio construction.

#3 Equity ASA: Short & Sharp Podcast Episodes For Australian Investors

The Australian Shareholders Association has been around since 1960. It’s a membership-based association that represents retail shareholders. The ASA ‘safeguards shareholder interests in Australian equity capital markets, helps its members to improve investment knowledge and fosters a connected retail investor community’.

Navexa has worked with the ASA several times, presenting webinars on portfolio performance tracking and delivering a live presentation on financial democratization at the 2022 ASA conference in Melbourne.

A more recent part of the ASA’s offering is its podcast series presented by the brilliant Phil Muscatello. Phil has his own podcasts, which I’ll get to shortly, but he still finds the time to front the ASA’s Equity Podcast.

The podcast takes the form of brief, varied interviews with guests ranging from portfolio managers and financial research houses to algorithmic traders and precious metals experts.

Each podcast episode seeks to inform the listener about a different aspect of the financial industry, and grant access to some of the most influential and experienced people on behalf of ASA members.

#4: Shares For Beginners — The Jargon-Free Investing Podcast

Navexa featured on Phil Muscatello’s Shares For Beginners Podcast when I chatted with Phil about portfolio performance tracking and financial literacy in 2021.

Our podcast episode discusses the pros and cons of the modern, app-first investment world and, of course, goes into the reasons why we’ve developed a portfolio tracking platform that allows investors to track all their investment performance in a single account.

But more broadly, the Shares For Beginners podcast is what is says it is — a great place to get into the ideas and concepts around investing without a huge amount of prior knowledge.

Phil’s effortless, casual podcast presentation and interview style does away with jargon and industry-speak in favour of easy-to-digest conversations with guests from fintech startups (us) to hedge fund managers, private investors, psychologists, even the editor-in-chief of Investopedia.

The episodes and topics are wide ranging, and you can be sure to learn something from pretty much any of the short, sharp episodes you dive into.

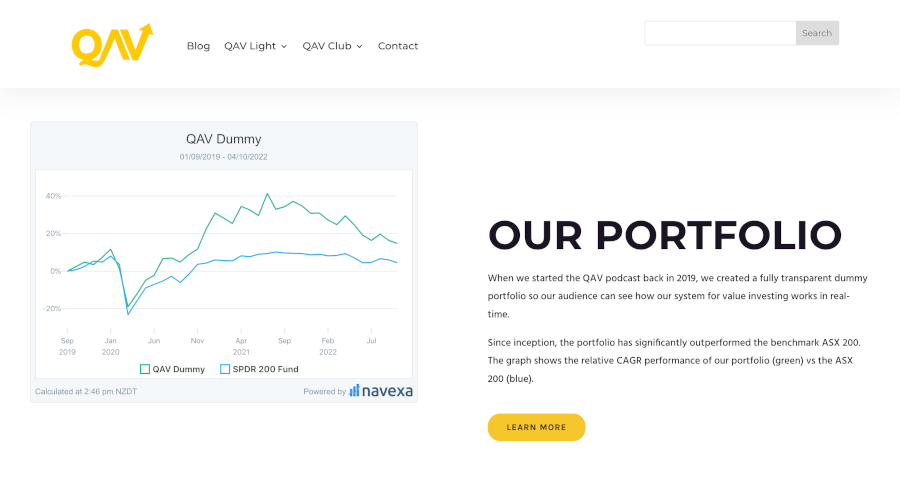

#5: QAV Podcast — Dedicated Value Investing Content

While I’m on the subject of finance podcasts we’ve appeared on, I should mention the small, but growing (and loved by its audience) Quality At Value Podcast.

Started by investors and friends Cameron Reilly and Tony Kynaston, QAV is a podcast, blog and membership club for value investors. The episodes and content centre on Tony’s impressive history as a long-term value investor.

Tony has achieved an annualized return of around 19.5% for the 30 years he’s been investing in the markets. That’s a seriously strong performance.

In the QAV podcast episodes and content, Tony and Cameron dive into all thing value investing. Specifically, they share Tony’s wealth of experience and the specific rules he’s created to spot winning stocks over his impressive 30-year run in the markets.

Navexa provides the QAV team with performance tracking for their model portfolio — which at the time of writing is outperforming the SPDR 200 benchmark by more than 10%.

Check out Navexa’s conversation with Cameron and Tony on S04E20 of the podcast.

#6: New Money — Top Quality Investing YouTube Channel

You shouldn’t, in my opinion, restrict your personal finance and financial education content consumption purely to podcasts. In the past few years, YouTube has produced a new generation of content creators spanning personal finance, investing, financial freedom, financial independence and so on.

Search ‘invest like the best’ or ‘financial freedom’ on YouTube and you’ll find hundreds of videos on everything from opening a crypto exchange account, to real estate investing, personal finance and beyond.

Of course, not all of it is great personal finance content. There’s no shortage of clickbait videos by blinged-out teenagers promising to reveal the secret to owning three Teslas before you have a driver’s license.

But dig a little deeper, and you will find some truly top-notch channels, like New Money, an investing and markets-focused show led by Australian Brandon Van Der Kolk. Brandon’s videos are about 10-20 minutes long.

They focus on topics like what stocks Warren Buffet and Berkshire Hathaway are buying and selling, how to understand key economic indicators and predictions, and — my personal favourite — deep dives into Dr. Michael Burry’s enigmatic tweets.

There’s a lot to learn here. The content is entertaining, easy to understand, and useful for investors whether they’re new to the markets or already years into their investing journey.

#7: We Study Billionaires — Wealth Hacking The World’s Best

So far I’ve kept the list local to Australia. But of course, you can’t dive into the world of investing — or investing and personal finance podcasts — without looking to the biggest market in the world, the US.

We Study Billionaires is a podcast on The Investor’s Podcast Network. Hosted by Danish investor, author and former professor Stig Brodersen and veteran CEO Trey Lockerbie, this show does what it says in the title.

The duo study, discuss and interview some of the wealthiest and most influential investors and businesspeople on the planet to learn the key factors and lessons in their success.

We Study Billionaires podcast features Warren Buffett, Howard Marks, Bill Gates and plenty of other high-calibre guests. There’s fresh episodes every week, plus the brilliant starter packs you can use to get up to speed on key topics fast.

#8: Motley Fool Money — Daily Business News & Financial Coverage

While you’re looking at US-based podcasts, you’ll likely find financial research publisher The Motley Fool’s show, Motley Fool Money. These short and sweet daily episodes don’t necessarily follow a strict theme, like We Study Billionaires or QAV.

Host Chris Hill and a revolving cast of the firm’s analysts cover daily business and market headlines and break down implications for stocks and investors.

On the weekends, they run investing class-style episodes that teach financial and investing literacy from ‘special guests helping to shape the future’.

One notable feature of Motley Fool Money is the show’s episode notes, which break down key talking points with timestamps, and list the ticker symbols of any stocks discussed in that episode. Great for browsing and finding episodes on companies you hold or want to know more about!

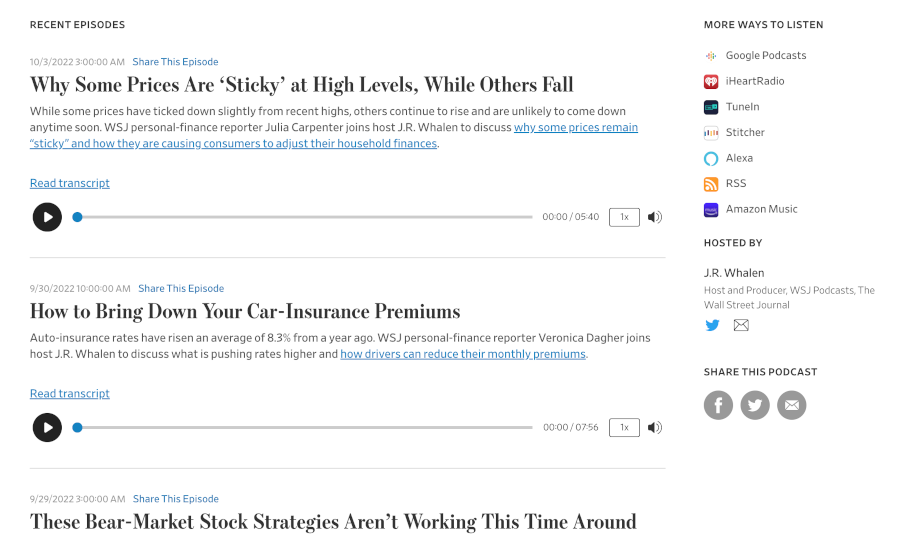

#9: WSJ Your Money Briefing — Financial Literacy With Wall Street’s Leading Journalists

While we’re talking big American personal finance podcast players, I should mention the Wall Street Journal‘s Your Money Briefing. Billed as a ‘personal finance and career checklist’, Your Money Briefing is another show that seeks to interpret mainstream financial and economic news and translate that into actionable personal finance ideas for the listener.

Whether it’s spending and saving habits, predictions on energy prices or trends in the corporate workforce, the show is broader than just stock market commentary.

The Wall Street Journal is one of the premier business publications on the planet, and their reporters and analysts are among the best in the business.

One interesting piece of trivia about Your Money Briefing is that the host, J.R. Whalen, was in a past role responsible for assigning dollar values to each question on the show Who Wants To Be A Millionaire. If that’s not a sign that this show’s host understands the value of information, I don’t know what is.

Your Money Briefing runs daily Monday to Friday, and joins nine other high quality podcasts in the WSJ stable — one of which I cover below.

#10: WSJ The Future Of Everything — Covering Big, World-Shaping Trends

The WSJ’s future focused podcast aims to answer a big question — what will the future look like? By projecting the trends we’re seeing in the world today into the decades ahead, The Future Of Everything brings a unique macro view to any investor’s podcast library.

You can expect plenty of science and tech — obviously — and you’ll find a nice balance between both challenges facing civilization and the breakthroughs that could overcome them.

Episodes tackle big topics like how best to decide which species to save and whether genetically modified crops are the future of food.

Hosted by Danny Lewis and Alex Ossola, The Future Of Everything comes out about every fortnight. Each episode runs for around 20 minutes.

#11: Money For The Rest Of Us — Former Pro Investor Helps Everyday People Build Wealth

Former financial advisor and money management expert Bret Stein quit his professional investing career after 20 years and started the Money For The Rest Of Us Podcast.

The big idea is that Bret now shows listeners how to apply the principles and investment philosophies he developed at $15 billion asset management firm FED Investment Advisors in their retail investing and personal finance journeys.

Money For The Rest Of Us is less about financial news and economic coverage than is is about how those things impact personal finance, investment strategy and retirement planning for everyday investors.

According to Bret, ‘Money For the Rest of Us is for people like you and me who aren’t relying on someone else to make sure we have enough to retire. We’ve taken control of our financial future’.

With close to 20 million downloads, this personal finance podcast is among the most popular of its kind. And it goes beyond just the weekly personal finance podcast episodes, which run for around 30 minutes.

Money For The Rest Of Us also offers free reports, an email newsletter, a members-only education platform (which teaches students to manage their personal finance like a professional) and Bret’s book, Money for the Rest of Us – 10 Questions to Master Successful Investing.

#12: Contrarian Edge — Great Content On Investing & Life

Vitaliy Katsenelson is a deep thinker whose curiosity about the world of finance extends beyond just the markets and investing. A professional investor, educator and writer, Vitaly’s Contrarian Edge blog is packed with deeply researched and brilliantly-written content.

The prolific Vitaliy shares opinions and analysis on a wide range of subjects related to investing. From macroeconomic and geopolitical coverage through to single stock analysis, personal finance and more philosophical pieces on the qualities and principles one need cultivate for a fulfilling investment journey, Contrarian Edge is as informative as it is entertaining.

Vitaly has published two books to date, Active Value Investing and The Little Book of Sideways Markets, with a third title on the way at the time of writing.

While Contrarian Edge is a blog, you’ll also find podcast episodes on the site — a mix between Vitaliy’s guest appearances on podcasts and audio versions of his blog posts.

#13: Value Investing with Sven Carlin, Ph.D. — The Dedicated Value Investing YouTube Channel

You won’t find many people with a doctorate in investing. But Dr, Sven Carlin is one such man. Having developed a Real Value Risk Model for emerging market stocks during his studies, Sven has worked for Bloomberg in London and taught finance and account at The Amsterdam School of International Business.

Today, he runs the 200k-plus subscriber YouTube channel, Value Investing with Sven Carlin, Ph.D. The channel is packed with video content on everything from individual stock analysis and commentary, commodities, tips for beginner investors, investing book reviews, and Sven’s YouTube model portfolio, which he launched in 2022.

The model portfolio is an interesting differentiator here. Not many other YouTube investing content creators go beyond the tried and true (and, once you’ve watched a few of them, tedious) ‘how to open a brokerage account’ and ‘3 most popular ETFs’ formats.

Sven’s plan with his YouTube portfolio is to build a $1 million paper portfolio and run it for several decades, with regular videos explaining trades, trends, and the reasoning behind investing decisions.

Sven’s inspiration for his YouTube portfolio is one of the all-time value investing greats.

Munger’s 50-Year Journey To Find a Single Worthwhile Investing Idea

Berkshire Hathaway’s Charlie Munger is infamous for his contributions to the firm’s world-beating investment performance.

One of his stories illustrates how discerning the man is with investment ideas. Barron’s, a sister publication to the Wall Street Journal, has been around more than a century. Munger read the magazine for half a century before he found an investment idea in it that he thought worth following.

According to Munger: ‘In 50 years I found one investment opportunity in Barron’s out of which I made about $80 million with almost no risk. I took the $80 million and gave it to Li Lu who turned it into $400 or $500 million. So I have made $400 or $500 million reading Barron’s for 50 years and following one idea.’

This is what Sven Carlin is trying to emulate with his YouTube portfolio; a long-term investment idea generator which perhaps uncovers one big winner, and which teaches much along the way.

#14: The Acquirer’s Podcast — Making Complex Financial Analysis Casual & Entertaining

Here’s another podcast that’s also a blog and, in this case, an investment fund. Tobias Carlisle is a professional investor, author, and lawyer. He runs The Acquirer’s Multiple, where he shares his wisdom from a career spent managing merger and acquisition transactions, and his own deep value investing.

Tobias has published four value investing books. Most recently, The Acquirer’s Multiple: How The Billionaire Contrarians of Deep Value Beat The Market was the #1 new business and finance book on Amazon. Over on his website, The Acquirer’s Multiple, you’ll find The Acquirer’s Podcast, along with the ‘absurdly simple, ridiculously powerful’ stock screener which is available on a subscription basis.

The podcast itself is super high quality. It leans more towards to expert end of the finance podcast spectrum. It’s long-format and doesn’t dumb anything down. The episodes I’ve listened to are packed with interesting information, but they don’t put you to sleep like some of the other expert-level shows you might stumble upon.

If you’ve seen The Big Short (which I list below, for reasons I’ll explain), you’ll have enjoyed that rare balance of dense finance topics with light, accessible explanation. Or, you will have become dizzy with all the Wall Street jargon, slam zooms and quick cuts.

I mention this, because tuning into The Acquirer’s Podcast feels sort of similar to watching this film. You’re in the room with veteran professional investors whose careers and lives have been shaped by the markets. They speak the language of Wall Street, but they let you in on what it means.

This recent episode features Tobias and his two regular guests discussing the complexities of defining a bear market. It’s a great example of the sort of content you’ll get from the podcast — market and economics analysis discussed by professional traders as though they’re enjoying a post-work debrief at a bar.

#15: The Big Short — The Feature-Length Adaptation Of The 2008 Subprime Crisis

I know. It’s not a personal finance podcast or YouTube channel. But hear me out. Because while there’s plenty of shows and channels out there for market and economics commentary and education, there are relatively few that take you behind the scenes of the upper echelons of the financial markets.

Adam McKay’s The Big Short is, in my opinion, a must-watch for anyone investing in the markets. Why? Because in just over two hours, the film explains the 2008 global credit crisis with both massive scope and detailed depth.

The cast of characters includes Christian Bale’s memorable performance as Dr. Michael Burry, the hedge fund manager who predicted and led the betting against the crash. It pulls together top-tier dramatic talent like Ryan Gosling, Steve Carrell and Jeremy Strong with celebrity cameos from Margot Robbie and the late Anthony Bourdain, all in service of explaining and illustrating the economic, market and cultural circumstances that set up the biggest crash (so far) of the 21st century.

The film goes deep into the psychology of the people who contributed to, predicted and profited from the ’08 subprime crash. More than any other film about the financial markets — which tend to get lost in portraying the luxury lives of the ultra-wealthy — The Big Short illustrates the disconnect between Wall Street and Main Street in early-2000s America.

To go even deeper into this fascinating episode of financial history, check out the Michael Lewis book, The Big Short: Inside The Doomsday Machine, on which McKay based his film.

#16: A Wealth Of Common Sense — Pro Institutional Investor Making the Complex Simple

While we’re looking at content that helps you navigate the complex world of finance and economics, I should mention A Wealth Of Common Sense. This blog, written by Ben Carlson (Director of Institutional Asset Management at Ritholz Wealth Management) is another example of a professional investor breaking down market news and analysis for everyday readers.

Huge institutions turn to Ben for investment advice and portfolio guidance. Having managed people’s money his whole career, he has broad and deep knowledge of the markets, money and financial advice. But his ethos on the blog — and the accompanying podcast, Animal Spirits — is to keep it simple.

According to Ben: ‘Both the economy and the financial markets are complex adaptive systems, but I’ve never found complex problems require complex solutions. Common sense and self-awareness are extremely underrated attributes in the world of finance.’

This post on surviving bear markets at different stages of life is a brilliant example of the quality and readability of Ben’s writing. And this episode of Animal Spirits shows you the type of in-depth analysis and commentary you’ll find on the show’s weekly, roughly hour-long episodes.

How To Make The Most Of Financial Independence & Personal Finance Podcasts

So there you have it. My 16 best personal finance and investing podcasts and blogs from across the web. From advanced, pro trader-level podcasts to more everyday content aimed at helping ‘normal’ people invest, save money and build their financial independence.

The shows and sites (and the feature film) I’ve featured here give, IMHO, a wide range of content that I hope result in you discovering at least one new resource on your own financial journey.

Of course, I have included two finance podcasts that we’ve appeared on ourselves here at Navexa. That’s because we’ve created a platform to help investors make the best possible financial decisions for their investment portfolio.

The Navexa Portfolio Tracker: Optimize Your Investment Journey

Whatever your financial goals, or which industry experts you might listen to for tips on money matters and financial topics, one thing we all need on our personal financial journey is a reliable tool for tracking our performance and returns.

As you’ll hear on our episode of the QAV Podcast with Cameron and Tony, our founder Navarre is a long-term, buy-and-hold investor to whom strong, annualized returns matter more than eye-grabbing one-off gains.

He’s been learning about investing for a long time. Everything he’s learned has proved it’s far better to work with hard data than skewed or incomplete information about a portfolio.

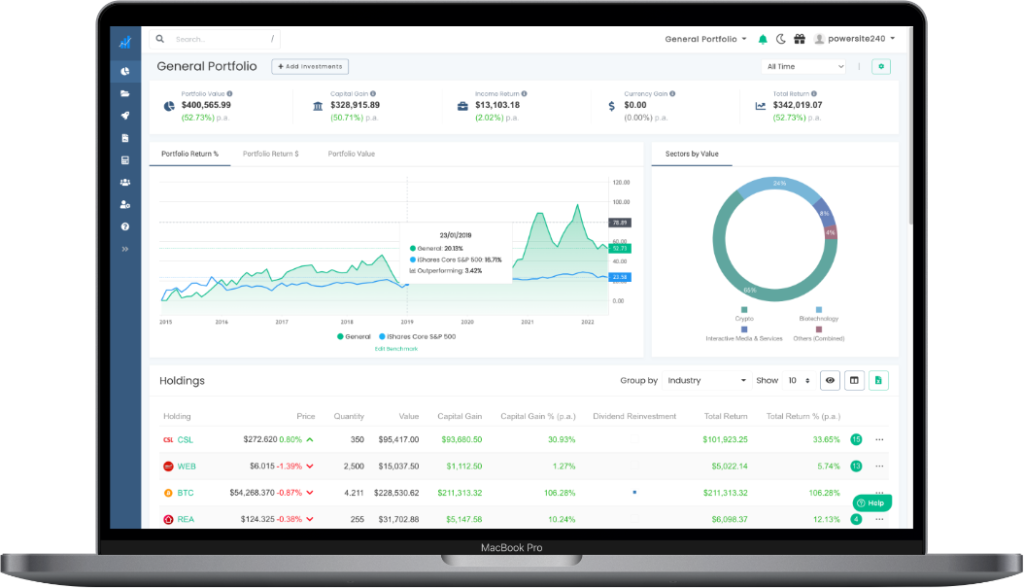

This is why the Navexa Portfolio Tracker, today, is one of the leading portfolio tracking platforms. It allows you to add portfolio data from stock brokers, crypto exchanges, cash accounts and even unlisted investments like property.

This means you can track all your investments in one place. Which, in turn, means you can look at your overall portfolio performance, measured together using the same industry-standard performance calculation.

Once you load your portfolio into Navexa, you can see true performance over the long term. You can see at a glance your capital gains, currency gains, investment income — all net of your trading fees.

You can run comprehensive tax reports with a couple of clicks. You can track & analyze more than 8,000 ASX & US-listed stocks and ETFs, plus cryptos, cash accounts and unlisted investments (like property).

And, you can go even deeper, running reports like Portfolio Contributions, which shows you in chart form which of your investments are boosting (and which are dragging down) your overall performance.

Invest In Knowledge While You Invest in The Markets

We’ve developed Navexa so that you can spend more time learning about the financial and economic forces driving the markets, the strategies that some of the world’s best investors use to outperform the rest of the market, and the investing and personal financial principles that underpin strong long-term investment strategies.

How? Because once you start tracking your portfolio performance in Navexa, you’ll no longer need to spend time manually tracking, calculating and reporting your investment performance — especially at tax time, when the government requires you provide accurate, comprehensive records of every trade and transaction you’ve made in a given financial year.

Not that podcasts or blogs were around in his time, but Benjamin Franklin famously (among many other things) said, ‘an investment in knowledge pays the best interest’. By which he meant that taking the time to learn about how money and the markets work can be more valuable than buying and selling investments themselves.

Between the 16 investing and personal finance podcasts and blogs I’ve detailed here, and the powerful portfolio performance tracking tool we provide here at Navexa, I hope you’re now better equipped to learn about investing and to build your financial literacy!