November 25, 2024

Lord of the microprocessors

Dear Reader,

These days it feels like nobody can shut up about NVIDIA.

Especially this past week, when the current stock market darling announced its Q3 earnings — $30.8 billion in revenue, beating analysts’ expected $29 billion, and up 112% on Q3 2023.

The company’s winning streak, according to CEO Jensen Huang, comes amid ‘the age of AI’.

But let’s step back from the quarter timeframe, and consider the bigger picture.

Before the AI hype of the past few years, there was another wave of (possibly irrational) optimism that propelled NVIDIA towards its current towering heights.

And before that, yet another source of opportunity, capitalization and greed.

Here’s what came before, and what might come after, the hype that surrounds, drives and threatens the lord of the microprocessors, NVIDIA.

1990s: Birth of a GPU empire

NVIDIA started life in the Denny’s restaurant pictured above in San Jose, California, where three engineers agreed to form a new startup.

It was 1993, and the three co-founders — Jensen Huang, Chris Malachowsky and Curtis Priem — could see computing hitting the mainstream.

Specifically, they reasoned that graphics-based processing would become a huge market.

Thus began the first age of NVIDIA; a company that won business and renown for building the best graphics processing units for computer games.

They won contracts with companies like Sega and Microsoft, and replaced the outgoing Enron in the S&P 500 in 2001, as most other tech companies faded in the fallout of the dot-com bubble.

This, of course, was only the beginning.

2009-18: Shovels for the crypto gold rush

In 2009, Bitcoin launched.

While most people focus on crypto as an asset class or a financial story, it also represented a deep shift for the microprocessor market.

A new era of ‘digital prospecting’ began.

Bitcoin miners needed powerful computers to solve complex mathematical puzzles to earn their digital gold.

Suddenly, NVIDIA’s GPUs weren’t just useful for computer games — but for making money.

These graphics cards, with their ability to perform multiple calculations simultaneously, were perfect for the task.

So many crypto miners began buying up NVIDIA’s GPUs, that demand soared and even created supply shortages.

At the peak of the crypto mining boom in 2017-2018, NVIDIA’s GTX 1080 Ti was the crown jewel for miners.

NVIDIA’s stock price more than doubled in 2017, riding the wave of crypto enthusiasm, while GPU prices rose so much that this single component became worth more than what you used to pay for an entire computer.

Like in all gold rushes, though, the mines eventually ran dry.

By 2022, several factors had conspired to end NVIDIA’s crypto mining dominance:

Bitcoin mining shifted to specialized ASIC hardware, leaving GPUs behind.

Ethereum, the last bastion of GPU mining, moved to a Proof-of-Stake model, eliminating the need for energy-intensive mining.

China, once a crypto mining powerhouse, banned the practice outright.

It seemed the party was over for NVIDIA.

As you know, though, and can see from the chart above, the company was far from finished.

The age of AI = the age of NVIDIA

With crypto mining no longer the way forward for NVIDIA’s GPU development and sales, artificial intelligence appeared as if on cue.

The same parallel processing power that made NVIDIA’s chips great for crypto mining also made them ideal for training AI models.

In 2018, NVIDIA began integrating Tensor Cores with ‘custom matrix multiplication’ units into its GPUs, enhancing their AI capabilities.

The result? NVIDIA’s data center revenue, driven largely by AI applications, grew from $3 billion in fiscal year 2019 to $15 billion in fiscal year 2023.

And that was just the beginning.

In 2023, as generative AI tools like ChatGPT captured the world’s imagination, demand for NVIDIA’s AI chips went parabolic.

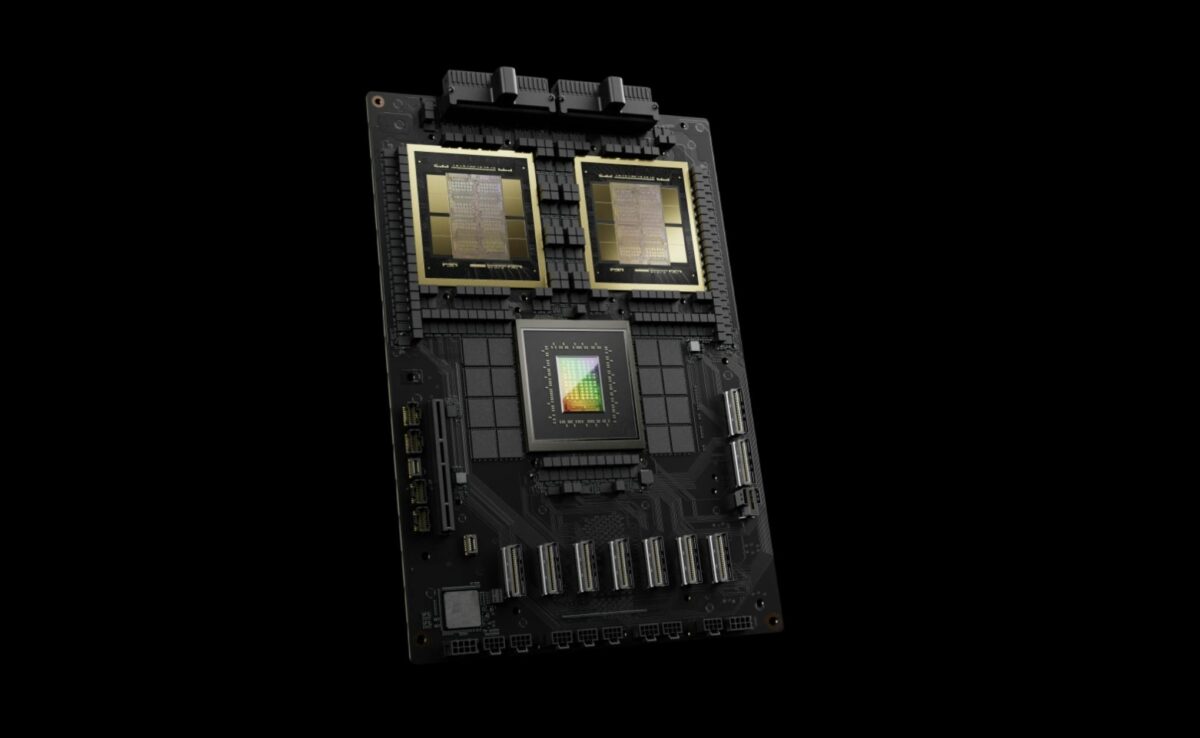

NVIDIA’s H100 GPU became the gold standard for AI training, with some calling it ‘the most valuable chip in the world’.

Companies scrambled to get their hands on these chips, leading to waitlists and supply shortages.

You can see how much this demand now accounts for the company’s revenue (see ‘data center’):

The company’s stock price is up 1,146% since its October, 2022 low, and is now the world’s largest publicly-traded company by market cap.

Too big to fail succeed?

One problem with being on top, writes Dan Gallagher in the Wall Street Journal, is there is often nowhere to go but down.

NVIDIA’s exceptional growth over the past couple of years has created optimism and pessimism in equal measure.

The bulls feel this is the company to own in the still-nascent age of AI.

The bears feel that the stock’s run up is too much, too fast, and must come with a corresponding downside.

Because with growth comes complexity, and complexity can create risk.

Hence headlines like these:

One of the red flags bears see with NVIDIA is the hype which now surrounds the company.

Jensen Huang now commands a comparable level of attention and anticipation as Steve Jobs did when Apple was launching its early iPhones.

Surely, the reasoning goes, this signals the kind of irrational exuberance that precedes a plummeting stock price.

I try not to be biased in The Benchmark.

My mission here is simply to introduce you to interesting, and hopefully useful, ideas about investing and wealth creation.

And maybe this is a biased note on which to end this email.

But, here’s Apple’s stock price chart, on which you can see the day they launched the first iPhone:

There were those who doubted the iPhone would make an impact.

Even those who thought it signalled a wrong turn, and the beginning of a decline, for Apple.

NVIDIA has its doubters, absolutely. And the past is never a guide to future performance.

Still, PwC forecasts the technology could contribute up to $15.7 trillion to the global economy in 2030, up from $757 billion in 2025.

This would be a nearly 2,000% increase.

Quote of the Week

‘Software is eating the world, but AI is going to eat software.’

— Jensen Huang, NVIDIA CEO

That’s it for The Benchmark this week.

Forward this to someone you know who’d enjoy reading.

And if one of our dear readers forwarded this to you, welcome.

Invest in knowledge,

Thom

Editor, The Benchmark

Unsubscribe · Preferences

All information contained in The Benchmark and on navexa.io is for education and informational purposes only. It is not intended as a substitute for professional financial or tax advice. The Benchmark and any contributors to The Benchmark are not financial professionals, and are not aware of your personal financial circumstances.