August 26, 2024

The early Brit catches the US tech boom

Dear Reader,

Stock pickers tend to get screwed.

The S&P Scorecard makes it clear: 79% of active management large cap funds lagged the S&P 500 over the past five years.

Over the longer term, the numbers get worse — only about 12% of them beat the market over the past 15.

What about small-cap funds? Nope — about 90% lag the market’s performance.

Value stock funds? Even worse — 94% of them can’t beat the market.

You get the picture.

It’s statistically highly unlikely that you can earn better returns by selecting stocks than if you just bought an index fund.

Passive, long-term investing, which relies on the market’s 10.64% annualized return to slowly, but surely, lift all boats over time, has more evidence going for it than ever.

Seldom do modern investors aspire to strike it rich discovering the next big thing before everybody else.

Which is why you need to know about reclusive fund manager, Nicholas Sleep.

This mysterious investor did something few big players dare in today’s market — particularly those managing other people’s money.

And particularly, those from his side of the Atlantic.

Regulation hell vs. innovation heaven

This explanation gives you a pretty good idea of the difference between Europe’s and the United States’ markets:

Increased regulatory burden has hampered Europe’s competitive position, hindered innovation and is particularly burdensome for small and medium sized companies.

The root cause is hard to identify. There are, of course, cultural differences between Europe and the US, but Europe also has more complexity with regulation, from both individual countries and the single market.

The formation and growth of Silicon Valley firms through the 2000s to the rapid growth we are seeing from AI firms today is evidence that the US has created an environment that fosters innovation.

While countless hours are being spent by software engineers in the US trying to outcompete each other for the next AI breakthrough, European law makers are apparently burning the midnight oil to prepare the first AI Act!

See how European stocks rebounded after the 2020 pandemic compared to US stocks:

You get the picture.

Innovation and growth happens faster in the US than it does on the continent.

It’s no coincidence most of the great investors and fund managers of our time all come from the same country.

Bogle, Buffett, Dalio, Graham, Lynch, Munger. All Americans.

So how on earth did a British fund manager manage to spot one of the highest-performing investment opportunities of the past two decades, before US investors cottoned on?

Here, Reader, you enter the myth of Nick Sleep.

Betting big in the early tech wilderness

Nick Sleep first worked as a fund manager at Marathon Asset Management. In 2006 he set up his own fund, Nomad, with partner Qais Zakaria.

Eight years later, they’d made a sufficiently gargantuan enough return for their investors that they closed the fund, returned the money to their clients, and disappeared.

How much money are we talking?

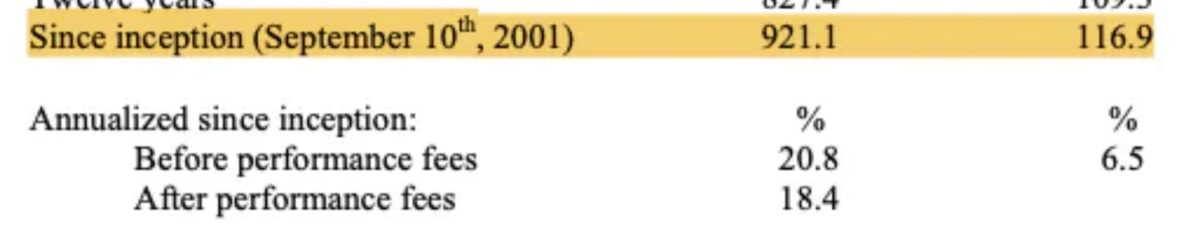

Here’s a snapshot of Nomad’s performance in 2013, a year before they shut up shop:

Before performance fees, they were outperforming the great Warren Buffet’s annualized 19.8% return.

As in, beating the greatest investor of the past 100 years, by picking stocks.

They did this, in large part, thanks to Nick Sleep’s visionary approach.

He pioneered something called ‘scale economics shared‘.

His thesis was basically that large internet businesses would use their rapidly growing revenue to make their services progressively cheaper for their customers — as opposed to simply paying it out to investors, or reinvesting it into their business (read more here).

But in the post-Dot Com bubble world of the early 2000s, Nick Sleep saw a way for the next generation of internet businesses to achieve massive growth by returning their profits to their customers in the form of ultra-competitive prices.

The early days.

Fund manager mic drop

At the time, this view was far from popular. It was too new, too unfamiliar — even to the historically visionary investors in the very country where such businesses were taking root.

But Nick Sleep saw the game evolving, and made his play.

Nomad bet big on a company called Amazon, while the rubble of the 2000 tech collapse still smouldered around him, buying in at less than $30 a share.

By 2007, the fund owned $55 million in Amazon stock.

By the time Sleep and Zakaria closed Nomad, that position was worth $1.2 billion.

At the time of writing, Amazon shares trade for $178 — nearly six times the price at the time Nick Sleep started betting big on his scale economics shared thesis.

Stock picking might be out of fashion, and notoriously difficult. But this story shows you that it’s not impossible — not even for a British fund manager, let alone a Wall Street heavyweight.

Nick Sleep virtually disappeared after Nomad closed in 2014.

His annual Nomad investor letters have become legendary among those who know about them (read all of them here).

Here’s 15 highlights:

Compounding Quality

@QCompounding

Nick Sleep is one of the greatest investors of all time.

People who invested with him achieved a yearly return of 20.8% (!).

Here are 15 things I learned from reading his annual letters:

8:48 PM • Aug 8, 2024

10

Retweets

70

Likes

Read 7 replies

Here’s one of my personal favourites, addressed to some guy named Warren upon Nomad’s closure:

New video reveals how to never worry

about ETF AMIT statements again

While you’re here, if you’re investing in ETFs in Australia, you’ll want to watch this new video.

He walks you through the ‘extremely important’ numbers you get with your annual AMIT statement from your ETFs — and the simple way to deal with them without having to stress at tax time.

Click the preview to play:

That’s it for The Benchmark this week.

Forward this to someone who’d enjoy reading.

If one of our dear readers forwarded this to you, welcome.

Until next week!

Invest in knowledge,

Thom

Editor, The Benchmark

Track & report on your portfolio like a pro

Unsubscribe · Preferences

All information contained in The Benchmark and on navexa.io is for education and informational purposes only. It is not intended as a substitute for professional financial or tax advice. The Benchmark and any contributors to The Benchmark are not financial professionals, and are not aware of your personal financial circumstances.