An introduction to some of the (legal) ways to optimize investment taxes in Australia.

Paying tax is part of investing. While you can’t avoid paying tax (at least, not legally), there are several ways in which you can reduce the impact of tax on your investment earnings.

This post explains the tax system in Australia as it relates to investment income, and introduces some strategies Australians use to minimize their investment taxes.

Tax And Investing In Australia

The Australian Tax Office (ATO) requires individuals to declare investment activity in their tax return and pay tax on all investment earnings, including capital gains and dividend income.

If you buy shares, invest in property, or hold other investments and then sell them at a higher price, you will have made a capital gain.

The Capital Gains Tax (CGT) is the tax rate that is applied to net capital gains (total gains minus total losses).

How Does the Capital Gains Tax (CGT) Work?

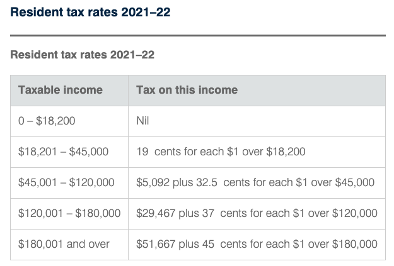

The capital gains tax is not a set rate but is calculated according to an individual’s marginal tax rate. This is the tax rate for personal income, and will be the tax rate applied to investment earnings.

Unlike CGT rates for individuals, flat CGT rates apply for companies and self-managed funds. Trading companies pay 26% if their annual turnover is less than $50 million. If it exceeds $50 million, the CGT applied is 30%. Investment companies don’t qualify for the 26% rate and are taxed at 30%. Self-managed super funds are taxed at a lower rate of 15%.

Getting back to individual taxation, if you sold any investments during a financial year, including shares, you will need to work out your capital gain or loss for each asset. CGT will need to be paid on your net capital gains. The Navexa platform provides a straightforward solution for making these calculations — more on that later.

Which Investments Does The CGT Apply To?

CGT applies to a wide range of investments, including property, shares, and cryptocurrency. When you sell an asset and realize a gain from that sale, you will be charged CGT.

In addition to owing CGT when you sell an asset, the tax also applies in other investment situations, or ‘CGT events’. A CGT event occurs when you make a capital gain or incur a capital loss.

Examples of other CGT events include switching shares in a managed fund between funds or owning shares in a company that is subject to a takeover or merger.

Here’s a comprehensive list of when the CGT may apply.

Tax And Investment Income

Like capital gains, dividends are subject to taxation.

Dividends are paid from profits which have already been subjected to Australian company tax. As mentioned earlier, this is 30%, or 26% for smaller companies (reducing to 25% for the 2022 year onwards). Because the profits have already been taxed, shareholders won’t be taxed again when they receive the profits as dividends.

The ATO considers these dividends ‘franked’. A ‘franking credit’ is attached to the dividend and represents the tax that has already been paid by the company distributing the dividend. The shareholder who receives the dividend with an attached franking credit will either owe less than their usual tax rate, or receive a tax refund.

Tax And Cryptocurrency

Cryptocurrency investment is also subject to taxation in Australia. Cryptocurrency is taxed in a similar way to other investment assets.

The ATO classifies four main CGT events for crypto activity.

You’ll be taxed when you:

- Sell cryptocurrency.

- Exchange one crypto for another.

- Convery crypto to fiat currency like AUD.

- Pay for goods or services in crypto.

Just like when you pay CGT at your marginal tax rate when you sell shares, you owe this rate when you sell crypto.

Remember, the ATO knows about your cryptocurrency.

Now that we’ve discussed the basics of tax for Australian investors, let’s explore some of the strategies that investors use to minimize investment tax.

Effective Strategies to Minimize Tax Payments

There are several legal investment strategies investors employ to minimize tax bills and claim tax deduction. This goes for both gains and income.

Below you’ll find some of the ways Australian investors hold on to as much of their investment gains and income as possible.

The following is not investment advice. As with all the information on the Navexa blog, it’s general investment information our writers have collated from other sources. For any financial or investment decisions, you should always understand the risks and seek professional advice if necessary.

Strategy 1: Hold Onto Your Investments For Longer Than 12 Months

Australian tax law makes a distinction between short and long term capital gains. A long term capital gain is when you make a profit on an investment that you’ve held for longer than 12 months.It’s ashort term capital gain if you’ve held the asset for less than 12 months.

As an investor, this is important to understand, because of something known as the ‘CGT discount’.

If you’ve held an asset for longer than 12 months before a given ‘CGT event’ occurs, you may be able to claim a CGT discount of 50%. Remember, a ‘CGT event’ is the point at which you make a capital gain or loss on an asset.

Fifty percent is a significant discount. If you made $40,000 profit from investments that you’d held for less than 12 months, and your marginal tax rate was 37%, you’d have a $14,800 tax liability.

However, if you’d held for longer than 12 months, the CGT discount rules would mean your tax liability was just $7,400 — a much more ‘tax effective’ amount.

The CGT discount applies to crypto investments, too.

As you can see, holding onto your investments for longer than 12 months to take advantage of this tax discount can be much more tax effective.

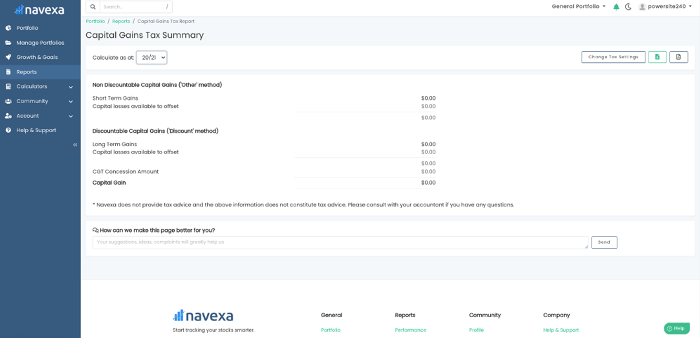

Navexa provides a platform where you can easily track your asset performance and calculate your taxable gains. The CGT Reporting Tool gives a detailed breakdown of which assets are ‘non-discountable’ from a CGT perspective and reduces the amount of tedious leg-work at tax time.

Navexa’s tax reporting tools remove the need to manually calculate their portfolio tax obligations or the most tax effective way to prepare a tax return.

Provided the portfolio data in your account is correct and up-to-date, you can run an automated tax report in just a few seconds.

Navexa’s Capital Gains Tax Tool

What you see above is Navexa’s CGT Report.

Navexa calculates your taxable gains and displays a detailed breakdown. Capital gains are displayed according to Short or Long Term status alongside your Capital Losses Available to Offset. The report also calculates your CGT Concession Amount and finally, your total Capital Gain.

Navexa’s CGT Reporting Tool makes it easy to categorize your investments for your tax return, while the Unrealized Capital Gains report can help show the most tax efficient way to dispose of investments.

Find out more about how Navexa can help you manage your tax obligations.

Strategy 2: Lower Capital Gains With Capital Losses

Another useful tool for investors at tax time is their capital losses.

You make a capital loss when you sell an asset for less than what you paid for it. This loss can be deducted from your capital gains (from other sources) to reduce the amount of tax. If you don’t have any capital gains to deduct from, the capital loss can generally be carried forward to future financial years. If you make capital gains in future years, the capital losses are still up your sleeve to deduct from any gains and reduce tax.

For example, if an investor owed $4,000 in CGT for their investments in a financial year, but had declared losses of $1,500 the previous financial year, they could carry these losses over to offset their capital gain, resulting in a reduced tax bill of $2,500.

Strategy 3: Invest In Companies That Pay High Dividends And Franking Credits

We’ve already looked at how the ATO taxes dividends, so what does this mean for minimizing your income tax obligations?

For example, an investor with a 32.5% tax rate receives a $1,750 dividend with a $750 franking credit attached. The franking credit takes the taxable income to $2,500, with gross tax of $812.50 payable. The franking credit rebate of $750 is deducted from the gross tax and the investor is left to pay only $62.50 in tax, leaving them with $1,687.50 after tax income. For a full breakdown of this and other franked dividend scenarios, click here.

As you can see, the investor in the above situation manages to retain most of dividend income. Because the franking credit offsets their CGT so significantly, the amount of income tax the individual pays is greatly minimized.

Choosing to invest in companies that pay dividends, especially fully or highly franked dividends, is a popular strategy for minimizing tax paid on investment returns. Fully franked dividends are effectively tax free income.

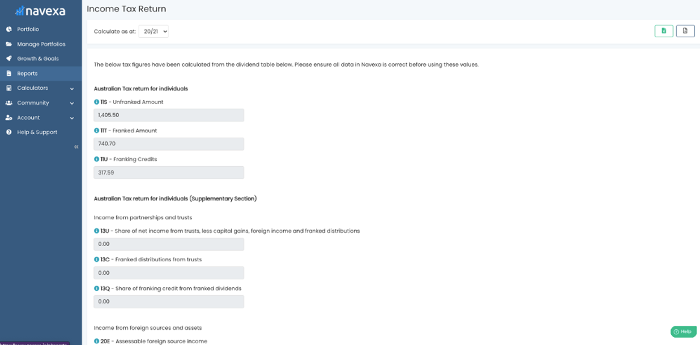

Navexa can also help you accelerate the process of determining your taxable income. When you automate your portfolio tracking in Navexa, the Taxable Investment Income tool provides you with everything you need to know to prepare your tax return.

Navexa’s Taxable Income Tool

As you can see above, the Taxable Income Tool displays the Unfranked Amount and the Franked Amount for your dividends, as well as the total Franking Credits attached to them.

And in the below image, you can see the additional fields in the ‘Supplementary’ section. These display further tax-relevant information such as the amount of Franked Distributions From Trusts, the amount of Assessable Foreign Source Income, and your Foreign Income Tax Offset.

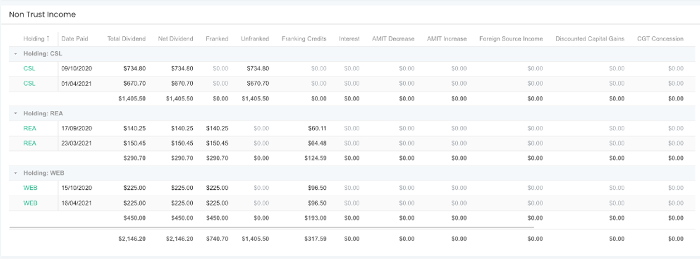

Below these fields, you’ll also be provided with a holding by holding breakdown of your taxable investment income, like this:

This shows you subtotals for payments from each holding, and grand totals for each column at the bottom.

At the top right of the report, you’ll find buttons for exporting the report as both an XLS and PDF file.

This helps you accelerate the process of preparing your investment income for assessment.

Dispose Of Your Investments In A Tax-Efficient Way

When the time comes that you want to sell it can be easy to get excited about the potential gains you are about to realize. This excitement can be dampened, however, when you are faced with the reality of your tax bill.

Choosing a particular method to dispose of your investments can have a major impact on the profits you generate and the tax you pay on them.

First-In-First-Out (FIFO)

The first-in-first-out (FIFO) approach is a common method used by investors when they sell holdings. When you purchase a group of shares at a given price, they will constitute a ‘parcel’.

You may acquire shares in the same company in several different. Each transaction will form its own parcel of shares.

The concept of FIFO relates to the disposal of investments. When you are ready to sell shares, you can choose which parcels — sometimes called ‘lots’ — of shares you would like to sell. The FIFO method involves disposing of the parcels that have been held for the longest period. Provided that the share price has risen since the time of purchase, the FIFO method will ensure the greatest capital gain from the sale of a selection of shares.

For example, if an investor purchased 100 shares at $20 in a company three years ago, and another 100 shares at $40 in the company two years ago, they might choose to use the FIFO method when they choose to sell some of those shares.

Let’s say the company’s share price has now risen to $50. The investor opts to sell using the FIFO method, disposing of the first 100 shares which were purchased at $20. Because the share price has grown $30 since they purchased them, they realize a gross profit of $3,000. However, if they had chosen to sell the more newly acquired shares parcel, they would only realize a gross profit of $1,000. The FIFO method is therefore popular with investors looking to maximise capital gains when they sell. But what about tax?

Last-In-First-Out (LIFO)

In the above example, the investor opted not to sell their more recently acquired shares because they wanted to maximise their capital gains. But if you are looking to minimize the impact of tax, adopting the LIFO approach could be advantageous.

LIFO works in the opposite manner to FIFO — your newest shares are sold first. The LIFO method ‘typically results in the lowest tax burden when stock prices have increased, because your newer shares had a higher cost and therefore, your taxable gains are less’.

Because the investor has chosen to dispose of shares that were bought at a higher price, they realize a smaller capital gain — and subsequently pay a lower tax bill.

However, don’t forget that you can only qualify for the CGT discount if you’ve held the shares that you sell for over a year.

The FIFO and LIFO approaches discussed above assume that the share prices involved have risen over time. This won’t always be the case. If the price of an asset drops over time, a smaller capital gain may be realized by selling the newly acquired shares. Smaller capital gain = less tax.

In some instances, investors might choose to dispose of a particular lot or parcel that cost more than the current share price so they can realize a capital loss. This capital loss could be used to offset other capital gains.

Regardless of the approach you choose, it is important to keep good records and understand the tax implications of disposing of the various share parcels in your portfolio.

Try Navexa’s Powerful Automated Investment Tax Tools

We hope you’ve enjoyed this quick guide to investment tax and some of the strategies investors use to help minimize their tax bill in Australia.

Navexa doesn’t offer tax advice, and we always encourage you consult your accountant or seek other professional advice when it comes to investments and taxes.

Navexa is a platform where you can easily track your investment portfolio and display detailed information that will help you at tax time.

Navexa empowers investors to build brighter financial futures with simple, but powerful, automated investment analytics and reporting tools.

Features such as the CGT Reporting Tool and the Taxable Investment Income Tool can help you determine your obligations and opportunities when the time comes to pay the tax man.