Different market sectors offer unique opportunities and risk for investors, as well as ways to diversify a portfolio. These are the 11 key market sectors, and the pros and cons of each.

The US stock market is packed with different types of companies, focused on a massive range of products and services. This market is broken down into 11 sectors. This creates a lot of different options for investors in terms of which sectors and industries they want to get exposure to by buying shares.

Each sector has its own advantages and disadvantages. We’ll introduce each and then examine the pros and cons.

Why Invest in Different Sectors?

Investing in different sectors allows for portfolio diversification and can be a key element of wealth management. A diversified portfolio, with a variety of stocks, dividends, and ETFs, offers exposure to different parts of the market. This, in turn, exposes the portfolio to both the potential risks and returns of each sector. The key idea of diversification is that the risks associated with one sector are balanced by the returns of the other.

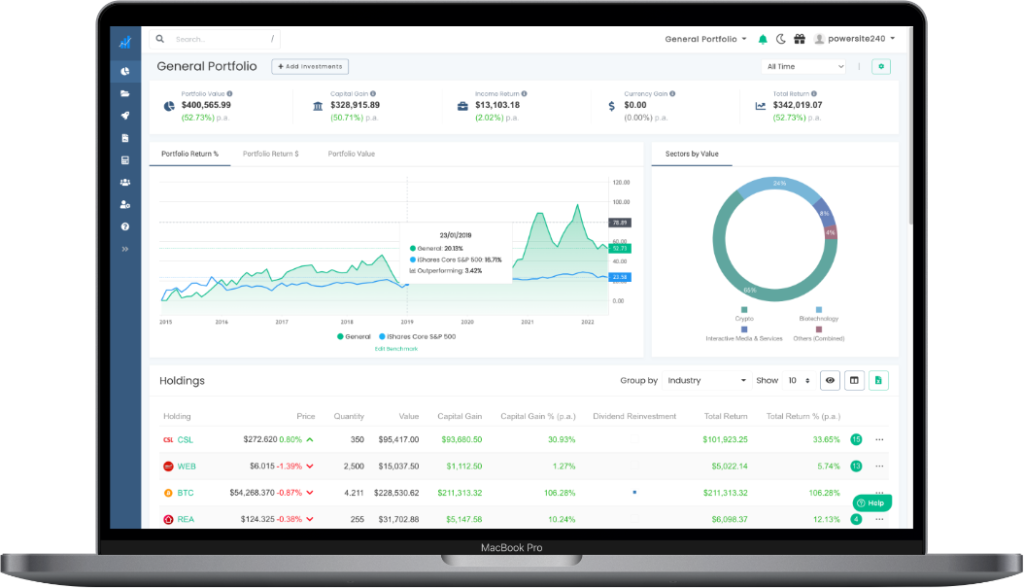

If you own or plan to own a diversified portfolio, Navexa can help you track it. Our platform helps you map your financial goals and automates tax reporting. You can start using it today for free, and upload your holdings in minutes.

What Is the GICS System and Why Is It Important?

The Global Industry Classification Standard (GICS) divides the investment market into 11 sectors further comprising24 industry groups, 69 industries, and 158 sub-industries. This is a common system that investors use to learn how companies are classified, and what ETFs and mutual funds consist of.

The GICS was created in 1999 by MSCI and Standard & Poor’s. This classification system includes the following groups:

- Sectors

- Industry groups

- Industries

- Sub-industries

It’s occasionally revised, following the growth and developments of certain industries. For example, the latest addition was the real estate sector. This sector was included in 2016, due to the increasing growth and importance of real estate and equity REITs.

This change had a powerful effect on the real estate sector. For example, it drove more money to real estate companies. Additionally, large fund companies had to purchase more real estate stocks to offer them in index funds. Adding the real estate sector to the GICS opened doors for other changes and introduced investors to new options.

However, the GICS is not the only method of classifying industries and sectors. The Industry Classification Benchmark (ICB) is one alternative. The ICB schema was developed in 2005 by Dow Jones and FTSE. It divides the market into 11 industries and 20 supersectors, which are further divided into sectors/sub-sectors. The ICB standard is used in many international markets, including NASDAQ and NYSE.

Today, we’ll focus on the Global Industry Classification Standard and its 11 stock market sectors.

Key Information on the 11 Sectors Plus Pros and Cons

These 11 stock market sectors represent 11 groups of public companies that share similar business activities, products, services, or features.

1. Energy: Exposure to Different Stocks

The energy sector includes companies that focus on the exploration and production of energy products. However, with COVID-19, there has been a change in how energy resources are seen and utilized. The pandemic increased interest in renewable energy sources due to the energy pressures it exacerbated. Renewable energy infrastructure has shown potential to address some of those pressures. Still, investments in the clean energy sector are generally not as stable as investments in oil and gas.

Some of the top categories in this sector are:

- Oil and natural gas stocks

- Pipeline and refining stocks

- Mining stocks

- Renewable energy stocks

Companies in the energy sector aren’t limited to just one category. Instead, they’re often focused on several operations around one energy product.

Additionally, the energy sector is vast. It accounts for trillions of dollars annually, and will always be in demand. Companies that increase the prices of their services tend to have more money to set aside for dividend payments. This sector also offers a variety of investment opportunities, from ‘traditional’ like oil and gas, to solar and wind energy stocks.

However, there are certain risks involved in investing in this sector:

- Can be a highly volatile market

- Companies involved in this sector often need to make huge investments into research and development and might lose money

- There’s a chance of regulatory risk regarding limitations on the production of some energy sources

- New technology may reduce long-term demand

2. Materials: Performs Well When the Economy Grows

The materials sector refers to companies that take raw materials or natural resources and turn those into useful products. Companies that produce chemicals, paper, glass, metals, packaging, construction materials, and so on.

This sector usually does well when the economy is growing and there’s a high demand for certain products. However, many things affect this sector, such as:

- Changes in the supply chain

- Cyclical demand for materials

- Changes in the economy that affect companies

- Legislation

- Inflation

3. Industrials: Essential for the US Economy

The industrial sector is one of the essential sectors of the US economy. It performs three functions:

- Producing and distributing capital goods

- Offering commercial services

- Providing transportation services

The companies operating in these sectors are often related to aerospace, construction, transportation, waste management, and similar.

As with any other investment, recognizing the best company in the market is challenging. Investors often check whether the company has diversified operations, low operating costs, and solid credit ratings.

The industrial sector has a cyclical nature. Thus, it’s more suited for risk-tolerant investors. The sector is strong during economic growth. However, economic downturns directly reduce the demand for industrial goods and services, which may cause stock prices to drop.

4. Consumer Discretionary: Another Cyclical Sector

This sector deals with goods and services that aren’t considered essential for people. Usually, these include items and offers people can purchase if they have enough income. For example:

- Cars

- Durable goods

- Leisure equipment

- Household items

- Media production

- Apparel

- Services like hotels and restaurants

This sector is the most sensitive to economic cycles. The companies that offer consumer discretionary products will grow quickly in a good economy, but slow down when the economy contracts.

Gross domestic product (GDP) is one metric to consider when investing in this sector. If GDP is on the rise, people are more likely to afford these items and services and the demand will increase.

5. Consumer Staples: Low Stock Decline During Bear Markets

In contrast to the consumer discretionary sector, the consumer staples sector includes companies involved in the production of foods, drinks, tobacco, and non-durable household items. The consumer staples sector tends to generate consistent revenue even during recession periods. Companies involved in the consumer staples sector may face lower stock declines during bear markets.

What’s more, it might happen that the demand for consumer staples increases during economic downturns. Those who invest in this sector usually benefit from dividend income, depending on their investment decisions.

The volatility in consumer staples is generally lower. This industry matures with modest growth.

6. Healthcare: Essential for Aging Demographics

This sector includes companies that provide healthcare services and manufacture healthcare equipment and technology. These companies are present at all stages of pharmaceutical and biotech research, including development and production.

This is a highly interesting sector, with quickly growing companies and overall above-trend growth. Companies in the healthcare sector are often considered a hedge against market downturn.

These are the common healthcare stocks:

- Drug stocks

- Medical device stocks

- Payer stocks (like insurers)

- Healthcare provider stocks

There are several things to consider when looking into healthcare sector companies:

- The company’s growth data

- Growth strategies

- Potential mergers and acquisitions

- Financial statements

- Valuation

- Dividends

When it comes to risks, the primary issue is competition. A competitor discovering better products and services may drive another company down. The healthcare sector is also highly regulated, but any new regulation and/or FDA decision can drastically affect the company and its stock.

Additionally, drug companies are exposed to litigation risks.

Still, aging demographics and technological advancements should, generally speaking, positively affect the healthcare sector long-term.

7. Financials: Banking, Insurance, Finance

The financial sector includes companies involved in providing products and services around mortgages, banking, consumer finance, insurance and similar. This is one of the most important market sectors for the economy.

Types of financial sector stocks include:

- Bank stocks

- Insurance

- Stocks from companies involved in other financial services

- Mortgage REITs

- Blockchain and cryptocurrencies

- SPACs

The financial sector dictates how the economy functions, since it ensures the free flow of capital and liquidity in the marketplace. When the financial sector is strong, many other market sectors follow suit. Generally, this sector has shown robust growth and profitability. Still, it can be affected by changes in interest rates and other economic factors.

8. Information Technology: Offers Four Mega Sectors

The information technology sector involves companies that produce software and IT products and services. This includes the manufacturing of hardware, mobile phones, computers, and similar. Therefore, some experts divide this sector further, into four ‘mega sectors’:

- Semiconductors

- Software

- Networking and internet

- Hardware

The information technology sector is also widely used by many other industries. It’s one of the fastest growing stock market sectors in the last decade and contains some of the largest companies in the market (think Microsoft, Adobe, Oracle Corp, and so on).

Still, many new companies in this sector don’t produce cash flow right away. Competition is fierce in the space, and investors often use guesswork instead of calculated valuation to invest in a company.

9. Communication Services: New vs. Old

The communication services sector includes companies involved in everything from traditional media to the internet. This also includes entertainment-oriented companies, products like interactive games, communications services and so on.

The usual methods of analyzing communications stocks are:

- Comparing companies that operate in the same industries

- Comparing companies that are at similar stages of growth

- Analyzing user base size and engagement trends

- Paying attention to the company’s expenses

The communications sector offers growth opportunities for companies that focus on online services. On the other hand, companies that work with traditional communication services and products may face challenges as the industry evolves rapidly.

10. Utilities: Attractive Even in a Bad Economy

This is one of the stock market sectors that’s also essential for the economy. Companies in this sector provide electricity, gas, and water to commercial and retail users. Generally, this sector offers steady performance.

The utilities sector usually offers dividends to the company’s shareholders. Additionally, economic downturns can make utilities attractive for long-term investing. This sector generally has lower volatility.

On the other hand, the utilities sector is intensely regulated. Regulatory change can negatively impact these businesses. Organizations in this sector may also have to invest in expensive infrastructure to provide their services. This can place them in debt, which in turn can be sensitive to interest rate changes.

11. Real Estate: Great for Portfolio Diversification

The real estate sector includes several indirect investment opportunities:

- Companies that work in real estate services

- Real estate developers

- Equity REITs

Besides purchasing stocks from companies involved in this sector, investors also make money by renting and flipping properties (direct investing). This sector generally has steady growth. Depending on the type of investment, it can offer quick returns (flipping) or steady income (renting).

Investing in the real estate sector is a popular way to diversify one’s portfolio. This sector is not closely correlated to stocks, bonds, or commodities. Still, there are some limitations of directly investing in this sector:

- Managing tenants

- Potential property damage

- Reduced income from vacancies

- Requires deep market knowledge

When purchasing real estate stocks, investors should be careful about:

- Management costs

- REIT’s low growth

- Interest rate changes

- Possible market downturns

The 11 Stock Market Sectors and Ways to Invest

There are many different ways to invest in each of these market sectors. Some of the most common ones include ETFs, investment trusts, and index funds. Here’s how investors usually get in:

- Energy sector: The easiest way to get into the energy sector is via mutual or index funds. There are many funds to choose from, and each is managed according to a strategy or energy index.

- Materials, industrials, consumer discretionary, and consumer staples sectors: These sectors usually offers dividends, so buying individual stocks is one way to go. Some ETFs invest in companies in this sector as well.

- Healthcare sector: Utilizing ETFs and healthcare mutual funds is the popular way to enter this market.

- Financials, communication services sector and information technology and utilities: The most common way to get involved with these is through individual stocks.

- The real estate sector: This market comes with several investment opportunities beyond property itself, such as REITs, real estate stocks (via a brokerage account or a tax-qualified retirement account), ETFs, index funds, and Real Estate Investment Groups (REIGs).

These 11 Sectors Offer Unique Market Exposure And Diversification Opportunities

These market sectors are key to portfolio diversification. From products and services essential to everyday life, through to more speculative technology projects, diversifying across these sectors can expose a portfolio to a variety of potential risks and rewards..

For example, the materials sector, utilities sector, and services sector are key components of the economy, regardless of whether it’s growing fast or slow. Still, companies in these stock market sectors are often affected by market downturns, interest rates, and economic changes — some more than others.

However you invest or diversify, whether you’re into high-growth tech stocks, or slower, steadier opportunities like consumer staples and real estate, you must always track your trades, transactions and investment performance.

Why? Because it’s essential to both optimizing your investment journey through data-driven decision making, and meeting reporting requirements at tax time.

Navexa helps you do all of this in an easy-to-use, accurate portfolio tracker currently being used by thousands of investors around the world. With detailed performance analytics and reporting on diversification, portfolio contributions, income and more, Navexa gives investors actionable insights on their portfolio.

Create an account free today and see your portfolio like you’ve never seen it before.